You have control over the most important factors that determine successful retirement savings in your 401(k). You control the contributions, investments, and withdrawals. You are the riskiest part of your 401(k)!

Inherent risk does not exist in a 401(k). Why? A 401(k), 403(b), IRA, or Roth IRA is not an actual investment. These are merely vehicles or accounts that allow us to save money for the future in a tax-preferred environment.

The risks come in other areas, most of which we have the ability to control. This article will discuss four of the most misunderstood risks: investment risk, active user risk, savings rate risk, and self-plundering risk. Investment Risk

Investment Risk

Within the 401(k) or qualified retirement account, there is generally a wide variety of investment options. These include different sectors of the market and ranges of risk, as measured by volatility. These options can be conservative, aggressive, or anywhere in between.

We cannot control what the world stock and bond markets do, but we do have some control over how our money is invested and how much risk we are going to take. As participants, we choose which of the investment options we will use. This requires us to know which mix of the options will meet our investment risk tolerance, emotional needs, and time-frame.

Active User Risk

We drive the level of risk. If we choose investment options that are too aggressive, we increase our risk. If we do not diversify among the options, we increase our risk. If we change investment options in response to information we hear or read, we may increase our risk.

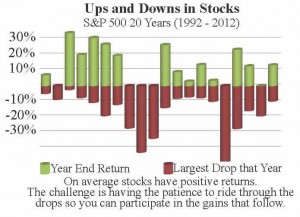

The chart to the left shows how volatility in the market changes from year to year. Investors evaluate each year based on the ending market price. Was it positive or negative? Participants tend to forget that even though a year may have ended positive, we could have experienced significant volatility mid-term. Take for instance 2009. The market ended up 23.5 percent by year end. Looking back, it’s easy to forget that during that year the market was down 27.6 percent.

These periods of volatility can cause investors to get sidetracked. They forget their long-term plans. They try to outguess the market by moving in and out. These decisions are often based on emotion, and it is generally to their financial detriment.

On the flip side, some participants remember the volatility and become risk averse. They forget that over time they have experienced more positive years than negative. They forget their long-term objectives and become too conservative.

Savings Rate Risk

We have seen a significant decline in the personal saving rate among Americans. While a 401(k) allows contributions up to $17,500 each year ($23,000 for those 50 and older), many make minimal contributions. Just like investing too conservatively, saving too little will leave many far short of living a desired lifestyle at retirement.

One of the benefits of a 401(k) is that you can make systematic investments directly from your paycheck. You don’t have to sit down and write a check each month. It happens automatically. Not only that, the company may offer a matching contribution. That’s free money! Our clients experience greater success when their savings plan is set on autopilot.

At any time, investors have the ability to increase their investment amount. Unfortunately, as raises and bonuses come, rather than increase their contributions, investors often allow the raise or bonus to be absorbed into their cash flow.

Self-plundering Risk

Participants who view their 401(k) as a savings account or emergency fund fall prey to this particular risk. They access their money by taking loans or withdrawals, diminishing the opportunity for long-term growth. Even if a participant takes a loan and pays it back, they will experience opportunity loss. This is the difference between the interest rate they paid themselves through the loan and the market returns they missed out on. The difference becomes more significant when you compound the missed opportunities over their working years and throughout retirement. Taking early withdrawals is even more damaging. Participants not only miss out on long-term savings and compounding returns, but they will also pay taxes and penalties. The taxes are based on marginal tax rates, but the 10 percent early withdrawal penalty is exact.

For example, say that a participant has a 25 percent federal tax rate and a 5 percent state tax rate. If they were to take a $20,000 withdrawal from their 401(k), they would lose $8,000 (40 percent) to taxes and penalties, netting a meager $12,000. Suddenly that withdrawal doesn’t sound so enticing.

There are many misconceptions regarding risk when it comes to 401(k)s. We want to make sure you are well informed about the benefits and risks in these accounts.

As we see it, a 401(k) is an ideal vehicle that provides us with a tax-preferred way to save for the future. Will a 401(k) be enough to support someone in retirement? Probably not. While most companies offer a company-match to 401(k) participants, many no longer offer pension plans. This makes it paramount that we save more on our own for retirement.

Our investment decisions, savings habits, and our willingness to stick to a plan can prevent us from increasing our risks. Working with one of our wealth consultants can help you make the most of your 401(k) opportunities and avoid some of these risks. Having a plan and making educated choices is just the beginning.