Since 1944, the United States dollar has officially been the world’s reserve currency. With the recent weaponization of the dollar, the rise of inflation, and our government’s ever-growing national debt, some believe the world economy will crown a new global currency. Is de-dollarization indeed a threat, or is it merely fear-driven speculation?

What is a reserve currency?

Every country has its own currency, and the values of these currencies fluctuate relative to each other. If a company in South Korea wishes to import widgets from the U.K., they would otherwise negotiate a price in pounds sterling. From the time negotiations settle to when the invoice is paid, the exchange rate of the S.K. won may drop compared to the U.K. pound. This would result in the S.K. company paying more for the widgets than expected. This is called exchange rate risk.

The easiest way to reduce exchange rate risk is for governments and institutions to agree to trade in one currency. Hence, a global reserve currency. Central banks and financial institutions throughout the world hold large amounts of the reserve currency to help facilitate international transactions, including investments and debt obligations.

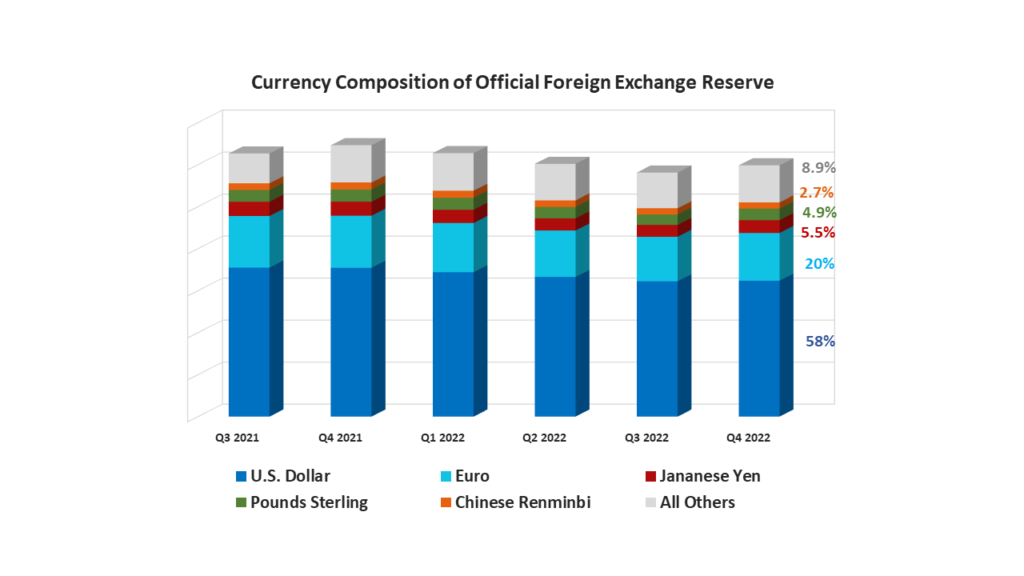

As of September 2022, about half of all international trade was invoiced in dollars, and about half of all international loans and global debt securities were denominated in dollars. In foreign exchange markets, dollars were involved in nearly 90% of all transactions. Central banks currently hold 59% of foreign currencies in U.S. dollars—a healthy percentage.

Advantages of the reserve currency

Currencies trade on the open market like other assets. The global reserve currency has a significantly higher demand than other currencies, which creates many advantages.

(1) The larger the demand for a currency, the lower the borrowing costs for the issuer of that currency. If the issuing country can borrow money at a lower interest rate, that country will have more capital and can pay a lower amount of interest on that debt.

(2) Businesses and citizens of that country will also have greater access to cheaper money.

(3) Taxes are often lower as government debt is less expensive, and demand is increased as there is more cash in the system.

(4) All of this stimulates growth, creates wealth, and stabilizes the economy during times of crisis.

(5) There is also political power in having reserve currency status. Because international trade uses the reserve currency, all countries rely on the financial system of the issuing country. The U.S. has leveraged this to enforce rule-based international order, establish justice, punish fraud, and ensure the world’s security. The dollar’s status has given Washington leverage over its political adversaries.

Disadvantages of the reserve currency

A strong currency is expensive, creating a paradox for the issuing country.

On the one hand, the country enjoys low-interest loans and the ability to raise capital quickly through issuing reserve currency-denominated bonds. On the other hand, the country wants to use capital and monetary policy to ensure that domestic industries are competitive in the world market and that the domestic economy is healthy and not running large trade deficits.

At times, these objectives can be mutually exclusive. This is called the Triffin Dilemma, and Americans have experienced it for decades, first with Japan and then with China.

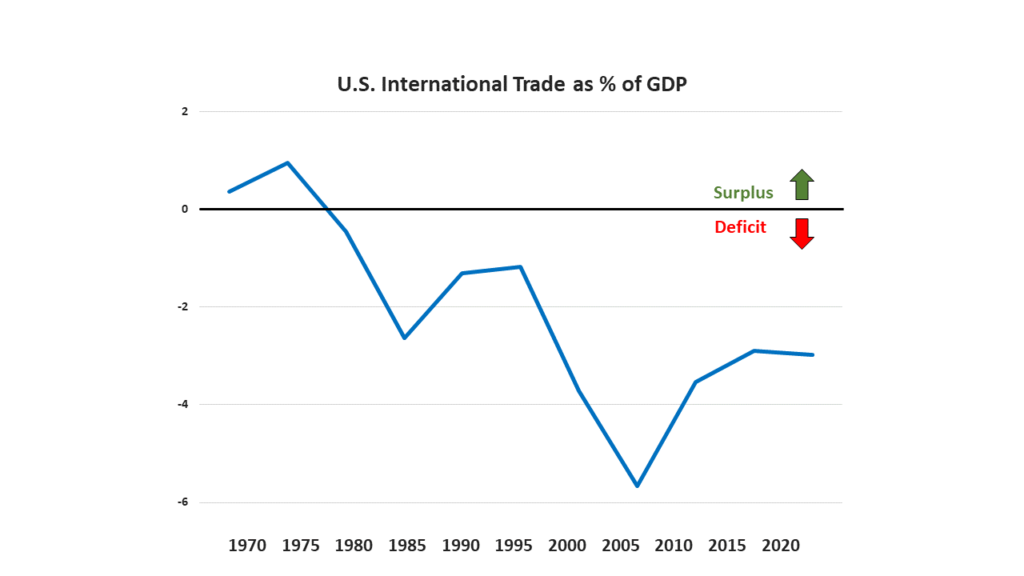

Because the reserve currency status increases the demand for dollars, the price of the dollar is increased compared to other currencies. This results in U.S. exports becoming more expensive, reducing demand for U.S. goods.

A more expensive dollar also makes foreign goods less expensive. This leads to greater imports and larger trade deficits. As foreign demand for the dollar pushes its value higher, reduced demand for U.S. goods can result in fewer jobs and higher unemployment. The only way for the U.S. to remedy this is to expand borrowing and increase debt.

Issuing the reserve currency makes monetary policy an international issue as opposed to strictly a domestic one. The government must balance the desire to keep unemployment low and economic growth steady with its responsibility to make monetary decisions that will benefit other countries. In this way, issuing the reserve currency can become a threat to national sovereignty.

Do trade deficits harm the economy?

A trade deficit occurs when a country imports more goods than it exports, thus transferring cash out of the country in exchange for goods into the country. On the surface, this sounds negative; however, the intricacies of economic trade are nuanced. Balanced international trade often results in a win-win scenario for the citizens of the two countries.

America loves to consume. Because foreign products are often cheaper, importing leads to more consumption. If U.S. trade deficits do not reach excessive levels, a deficit is not harmful to the U.S. economy. The United States has run a trade deficit nearly every year since the end of WWII and has remained the strongest economy in the world. Other countries have had continuous trade surpluses, and their economies have seen little growth.

However, large deficits are dangerous. Cash flowing out of the country strengthens the economies of those who receive it. Those countries often reinvest those dollars in the U.S. government by purchasing treasuries—increasing U.S. debt and leading to foreign nations subsidizing American consumption. As dividends and interest are paid on debt and American investments, more cash flows out of the U.S. and into foreign nations. In this way, being the reserve currency is itself a threat to maintaining the reserve currency. Having reserve currency status can ultimately lead to a weaker economy and stronger foreign nations. The question becomes, how much of a deficit can the U.S. economy handle?

Please look for part 2 and a continuation of this discussion here.

Listen to a deep dive into the reserve currency on the Power Up Wealth podcast.

3 Comments