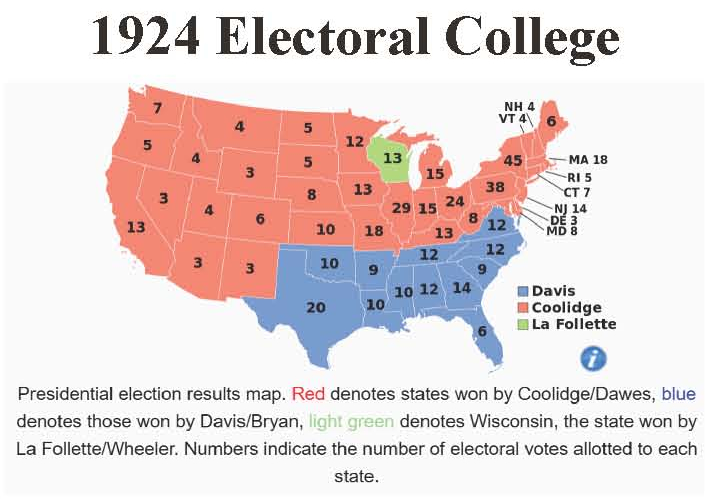

Calvin Coolidge became the president of the United States in 1923 after Warren G. Harding unexpectedly died. He ran a campaign as the incumbent just one year later. There were three major candidates that year. Coolidge won in a landslide, receiving 72% of the electoral college votes. Coolidge was a beneficiary of the economic boom known as the Roaring 20s.

The stock market is one measurement of how well the economy is perceived to be doing. Over the last 100 years, it has averaged about 8% per year. In 1924, it made approximately twice that amount, something that I am sure President Coolidge and his team were well aware of.

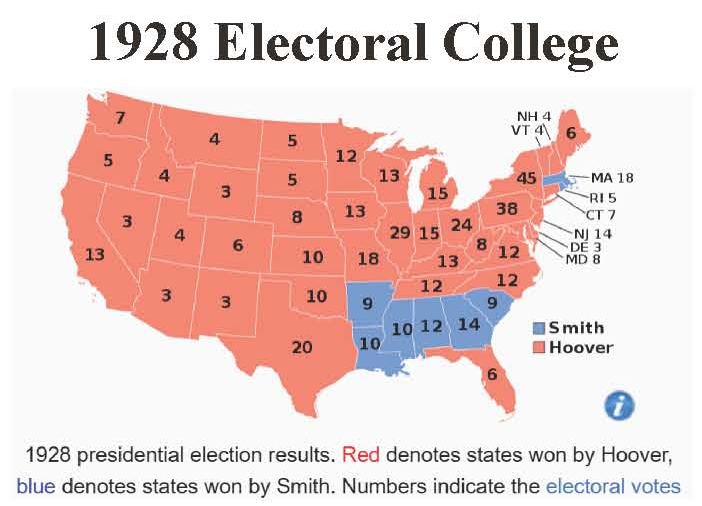

The stock market rose every year from the election of 1924 to the next election in 1928. It gained 38% in 1928 alone. The political party of the incumbent president was wildly popular. President Coolidge did not run again. So, Herbert Hoover received 84% of the electoral college votes.

Election years tend to be good for stocks. The theory is that the presidents pump up the economy and the market. History raises doubts. Not every election year is a double-digit home run like 1924, perhaps because there is only so much a president can do.

The election may have some impact on the markets, but the reality is markets have a huge impact on the election.

*Stock market data from TradingView. Election information from Wikipedia. Investing involves risk, including the potential loss of principal. The S&P 500 index is widely considered to represent the overall U.S. stock market. One cannot invest directly in an index. Past performance does not guarantee future results. The opinions and forecasts expressed are those of the author and may not actually come to pass. Diversification does not guarantee results, nor does active trading. This is not a recommendation to purchase any type of investment.