The clock is ticking down to December 31, 2025. We have less than two years to take advantage of low tax rates before scheduled tax rate increases take effect. In 2017, the Tax Cuts and Jobs Act (TCJA) introduced substantial changes to the tax code, which included adjustments to tax brackets, deductions, and credits. The law was enacted with a countdown clock. At expiration, if Congress does not extend TCJA provisions or pass new laws, several provisions will expire, reverting to the 2017 tax code.

Here’s what could change:

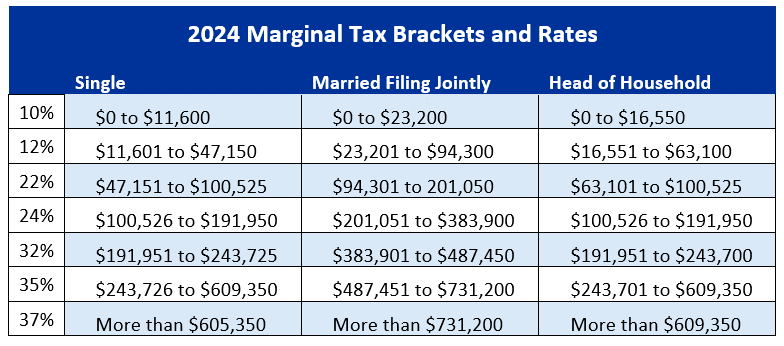

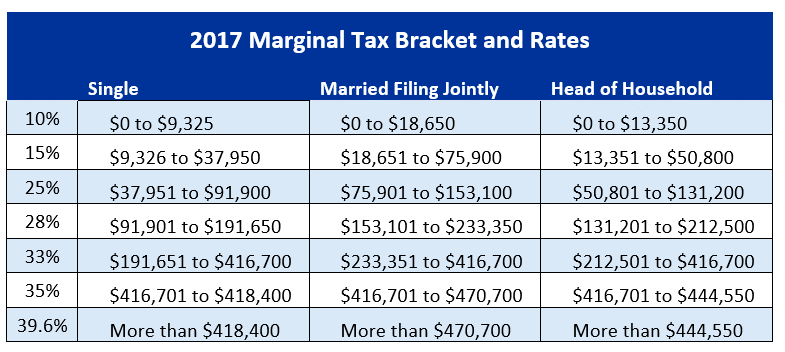

TCJA changed marginal tax brackets and reduced tax rates. This has been beneficial, especially to higher-income earners. For example, a married couple filing jointly with a taxable income of $160,000 in 2024 will fall into the 22% tax bracket. The same taxable income in 2017 would have landed in the 28% tax bracket. That’s a significant difference. Compare the marginal tax brackets in the 2024 and 2017 Marginal Tax Bracket and Rates tables below.

Historically, the highest marginal tax bracket has been north of 90%, and in the past 50 years, it’s been as high as 70% – unbelievable! For the next two years, taxes will be among the lowest during our lifetime. Taxes are literally on sale!

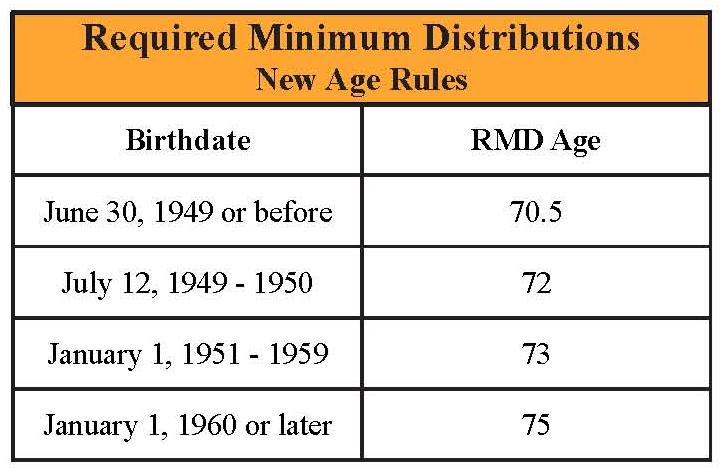

Higher tax brackets have another impact, one that is easily overlooked. Traditional IRAs and 401(k)s, known as qualified accounts, have been used to defer taxes to a future date, providing an immediate tax break by reducing earned income. These accounts have grown over the years, becoming a sizable percentage of wealth for pre-retirees and retirees. Unfortunately, when accounting for the growth of tax-deferred assets, the tax liability may cost more than you expected. Why? Required Minimum Distributions (RMD).

Required Minimum Distributions force you to take money out of your qualified tax-deferred accounts over time based on your age. In 2024, someone age 73 with $1,000,000 in qualified deferred assets will be required to take a distribution of $37,736. The older the age, the greater the required distribution. Each year, the amount is recalculated based on the account balance on December 31st of the prior year and divided by a factor determined by your age at the end of December in the current year.

The good news is that you can take control of your future tax liability by managing distributions from your tax-deferred accounts. This can be done by converting a portion of your Traditional IRA or 401(k) to a Roth IRA over time based on your tax situation each year. You choose how much and when you pay taxes. This strategy allows you to use a marginal tax bracket to your advantage. Even better, the amount you convert is not limited, and you do not need to have earned income to make a conversion. Starting this process early will give you more time to convert assets and manage the impact of taxes.

If you are making contributions to a 401(k) or IRA, consider changing the contributions to Roth 401(k) or Roth IRA. This allows you to maximize a lower tax bracket now.

Roth 401(k)s and Roth IRAs have no required distribution dates. The money in these accounts can continue to grow tax-free until you need or want to use it. Whatever remains in your account when you pass away can be transferred to your beneficiaries tax-free.

If your beneficiary is your spouse, they can continue to hold the account, growing it tax-free until they need or want to access the money.

A smart way to get money out of your qualified account tax-free is by making a Qualified Charitable Distribution (QCD). This strategy allows you to donate money to a qualified charity without paying taxes or reporting the distribution as income.

You must have turned age 70 1/2 to make a QCD, and it can count as your RMD for the year.

The wealth management team at Smedley Financial can help you create a plan that incorporates valuable strategies to help you prepare for a brighter future.