Since 1944, the United States dollar has officially been the world’s reserve currency. With the recent weaponization of the dollar, the rise of inflation, and our government’s ever-growing national debt, some believe the world economy will crown a new global currency. Is de-dollarization truly a threat, or is it merely fear-driven speculation?

What qualifications must the issuer of the global reserve currency have?

It is not easy to become the issuer of the world’s reserve currency. Although many countries are fighting for the opportunity, most of them fail to meet the lowest possible standards to even be mentioned in a superficial conversation on the subject.

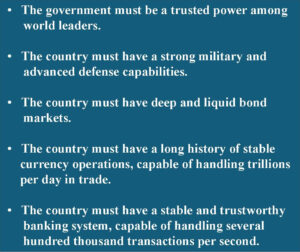

A reserve currency is crowned collectively by the governments of the world. Because the issuer of the global currency plays an enormous part in global economics, reserve currency status is taken very seriously. Characteristics required to hold reserve currency status include:

The countries of the world that check all these boxes can be counted on one hand. China, Russia, and every country in the Middle East are not among them.

Economic Sanctions and Dollar Weaponization

In an effort to coerce a change of behavior, an economic power can levy sanctions against the government, citizens, or businesses of another country. Sanctions come in a variety of forms and can include things like freezing financial assets, preventing international trade, and restricting access to central banks.

Countries opposed to the United States often find themselves between a rock and a hard spot. If they wish to have access to the global reserve currency, they must abide by the international laws imposed by the West.

This method of control is viewed unfavorably by the enemies of the Western world. They would love to create a system that allows them to act without economic consequences. However, that is not a system that world governments will support.

The United States, Europe, and other G7 allies have recently issued crippling sanctions against Russia due to their invasion of Ukraine. This has severely impacted the Russian economy and has forced them to find ways to trade in a currency other than the U.S. dollar.

The BRICS Alliance

Brazil, Russia, India, China, and South Africa are an informal group of emerging markets that are seeking to establish greater ties between their nations to stimulate economic expansion and increase trade. Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates have all recently been invited to join the alliance.

Some have speculated that the BRICS countries are moving to replace the dollar. With Russia’s current inability to use the dollar, their motivations are clear and pressing. Other BRICS countries would love to replace America as the global financial powerhouse, but none of these countries meet the qualifications to issue the reserve currency.

Leslie Maasdorp, the vice president and CFO of the New Development Bank, a financial institution created by BRICS, recently stated that “there are no current plans to create a common currency.”

Currently, the BRICS only account for 16% of all global trade, with over half of their trade reliant on the U.S. dollar.

Digital Currency Takeover

There is a tremendous amount of false information and speculation regarding digital currencies. This bad information drives two extremes: fear and high-risk investment. Although both government and private sectors are researching the possibilities and benefits of digital currencies, there are no plans to replace banknotes. The need for physical currency remains high.

Much of our financial system is already digital. However, some of the underlying technology is pre-1950. The use of newer technologies, including a digital currency, could improve efficiency and reduce transaction costs. The government is not trying to take over the banking system or control private assets. It is attempting to develop technologies that will run alongside our physical currency to improve our financial system. Cash will not be eliminated anytime soon.

Conclusion

All current data points to a strong U.S. dollar in the global economy. In addition, there are no viable reserve-currency alternatives. Fluctuations in the dollar’s strength are normal, but de-dollarization is not a major concern. The dollar will eventually be replaced, but for now, it is the uncontested king and will rule for many years to come.

Part 1 is found here. Part 2 is found here. For a deep dive into the future of the Reserve Currency, Part 3 on the Power Up Wealth podcast can be found here.