Since 1944, the United States dollar has become the world’s reserve currency. With the recent weaponization of the dollar, the rise of inflation, and our government’s ever-growing national debt, some believe the world economy will crown a new global currency. Is de-dollarization indeed a threat, or is it merely fear-driven speculation?

What is the gold standard?

The gold standard is a monetary system that links the currency of a country directly to the gold it possesses. Countries hold precious metals in central banks and print paper currency for trade in the marketplace. Central banks agree to buy and sell gold to anyone at a fixed price. This provides the credibility required for paper money to function as a basis of trade. Under the gold standard, governments are unable to print money without first obtaining the gold to back it.

Although there are pros to the gold standard, it can create deflation and significantly prevent economic growth. As an economy grows, the money supply should grow with it. Where there are more goods and services, there needs to be more money for those goods and services. Think of the gold standard as training wheels on a bike – they can provide safety and security, but no one will ever win the Tour de France with training wheels.

The global economy has become so large that there is not enough gold in the world to back any one currency, making the gold standard impractical today.

Who held the reserve currency before the United States, and how did they lose it?

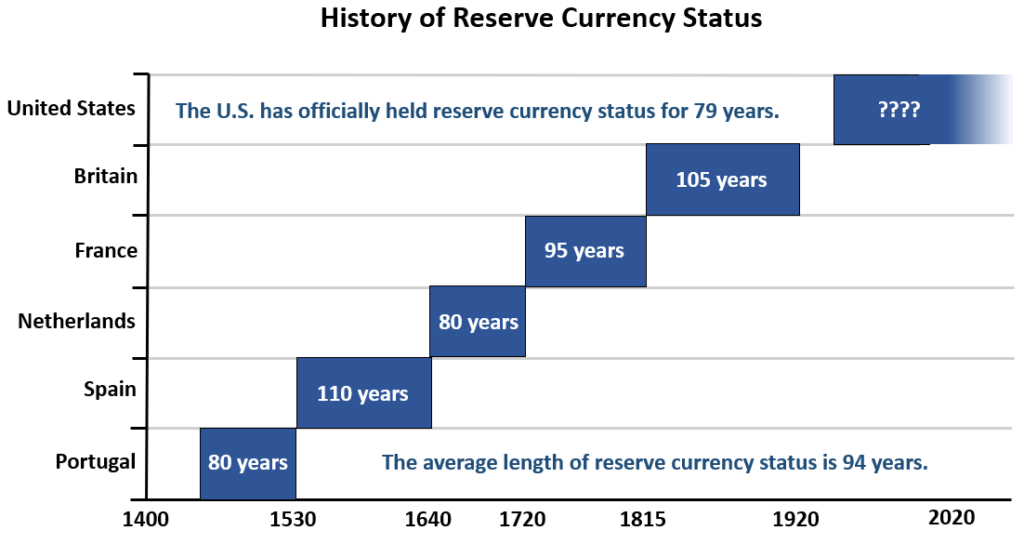

Since 1450 AD, there have been six world currencies. Great Britain was the last country to lose reserve currency status. In the 19th and early 20th centuries, most international trade was denominated in pounds sterling under the gold standard.

As we entered the First World War, Britain faced a struggling economy. Because of the fixed exchange rate of the gold standard, Britain was hamstrung and couldn’t engage in expansionary policies to provide stability during this economic crisis. In 1914, Britain had no choice but to break from the gold standard and increase the money supply to stimulate its economy. This caused a severe weakening of the pound. By 1920, the pound had dropped by 35%.

At the same time, the United States was exporting large amounts of weapons to ally nations in exchange for gold. This allowed the US to stay on the gold standard, strengthening the dollar. By 1947, the United States owned 70% of the world’s gold supply.

In 1925, Britain returned to the gold standard in hopes of solidifying the pound as the world currency. But its economic struggles only continued, and countries began trading outside of Britain in larger quantities. Britain was again forced to abandon the gold standard in 1931, never to return.

The Bretton Woods Agreement

Because the United States had accumulated so much of the world’s gold by the end of World War II, many foreign governments lacked the gold necessary to back their currencies. This created currency risk and trade problems. The world needed a new economic order.

In 1944, 44 countries agreed to peg their currency to the value of the U.S. dollar. The dollar was pegged to gold, thus indirectly backing the other currencies with gold. Although unavailable to common citizens, the U.S. granted any foreign nation the ability to exchange dollars for gold. This is known as the Bretton Woods Agreement, which officially crowned the U.S. dollar as the world’s currency.

The Nixon Shock

In the 1960s, the U.S. government’s finances came under stress as the government increased spending to fund the Vietnam War and social programs. The Federal Reserve printed money without increasing the gold supply in order to cover deficits. With more dollars in the world, the international market began to worry the U.S. lacked the gold required to back its currency. Countries began to exchange their dollar reserves for gold.

President Richard Nixon feared a global run on U.S. gold. In 1971, Nixon suspended the convertibility of the dollar into gold in hopes of keeping the Bretton Wood system alive and eventually eliminated the gold standard entirely. This fueled international fears, and the dollar declined in value. Countries unpegged their currencies from the dollar in favor of floating exchange rates, and the Bretton Woods system fully collapsed in 1973.

Many expected these events would end the dollar as the world currency. They could not have been more wrong. The U.S. financial markets continued growing to become the largest in the world, and the economic gap between the United States and other advanced economies widened significantly.

Part 1 is found here.

Please look for part 3 and the conclusion of this discussion soon.

One Comment