Most of us hold in our hearts the dream of someday spending our time doing things that bring only fulfillment to our lives and shrugging the requirements outlined by the careers we have chosen. This dream is better known as retirement. Unfortunately, there is a growing trend among Americans—the propensity to “do it tomorrow.”

It is hard to imagine that we unwittingly defeat our own dreams. Here are some insights and a few disturbing facts on how that happens.

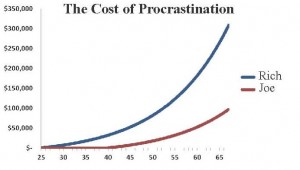

The cost of procrastination

Every year that we fail to put money aside for the future has an impact on our future dreams. For example, let’s say Rich is 25 years old and saves $100 each month for retirement. By the time he is 67 he will have saved over $307,000 (assuming a 7 percent rate of return). Contrast that with Joe who saves the same amount each month and the same growth rate, but waits to start his plan until he is 40. When Joe reaches age 67, he will have saved just over $97,000. That’s a $200,000 difference.

In order for Joe to catch up to Rich by age 67, he would have to save $317 per month. The difference becomes even greater if Rich and Joe contribute to a 401(k) plan where the company matches contributions.

Every year that we delay saving for the future has a significant impact on our ability to reach our financial dream. This is true whether we are 25, 45, or 65. Lack of action thwarts any financial goals.

The result of procrastination

Among U.S. workers, 57 percent said that they have less than $25,000 in total household savings

and investments, excluding the value of their home, according to the Employee Benefit Research Institute.

and investments, excluding the value of their home, according to the Employee Benefit Research Institute.

Since 1973, we have watched the savings rate in the United States drop steadily from its high of 11 percent. In February 2013, the personal saving rate was a paltry 2.6 percent. At this rate it’s no wonder that 28 percent of Americans said they are “not at all confident” that they have saved enough for retirement.

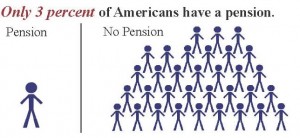

The decline in savings couldn’t come at a worse time. Today’s retirees are faced with longer life spans and higher retirement costs. All of this at a time when only 3 percent of us have a defined benefit plan (pension) through our employers. In addition, we face changes to Social Security benefits. The old three-legged-stool approach to saving for retirement is no longer a viable analogy. The stool has now changed to a pogo stick and we are at the center. The burden to plan and prepare for retirement has been shifted almost entirely to us.

With everyone sounding the alarm, why are we not heeding the call? Simply said, it’s our financial behaviors. Goals are not physically impossible to reach; we simply lack the self-discipline to stick to them.

The battle within

On a daily basis everyone faces the battle between our present self and our future self. We paint a picture of what we want the future to look like, whether it’s retirement, moving to a new home, or building a nest egg. We have a good feeling about the future we’ve projected. But to get to that future point we have to overcome our present self.

Our present self is in power today while our future self is nowhere to be seen. Sure, we want to be happy in retirement, but in order to make that happen we have to feel pain right now. There is only so much money in each paycheck. Saving will require us to give up something we want right now. There’s the pain! We see saving for the future as an immediate loss. It forces us to deviate from our desired lifestyle. We may have to give up something we want now—a bigger home, a new car, or a vacation—to have the lifestyle we want later. We are constantly forced to make decisions that deny us of immediate gratification and quite frankly, it’s hard.

The commitment device

Sticking to our goals first requires us to set goals. We are not generally driven or motivated by facts and figures. Decisions are strongly driven by our emotions.

How do we feel about the outcome of a decision? Incorporating the emotional side of planning with the facts, will help us to create a commitment device. The value of a commitment device is that we can attach a feeling, present and future, to the decisions we make.

What is most important to us today? How do we want the future to look? What lifestyle do we want to live during retirement? These are just a few of the ideas that must be considered when designing our future dreams. Our answers help direct us in creating a template that can be used in our financial plan.

In creating financial and retirement plans for our clients we begin with their personal values and goals. This helps us to match the present self with the future self in mapping out a plan to help reach those goals. By meeting with our clients regularly we help keep them focused on the end result.

The three legged stool approach to retirement savings is no longer a viable analogy.

Maybe it’s time for you to create a plan. Maybe it’s time for an update or review. Or perhaps you know someone else who could benefit from having a plan. Contact one of our wealth management consultants and find out how we can help. Your success is our goal.

Research by Smedley Financial Services, Inc.® For illustrative purposes only. Not intended as an actual situation or as a recommendation. Sources: Employee Benefit Research Institute and U.S. Department of Commerce.