In 1979, global oil production dropped roughly 4%, primarily due to the revolution in Iran. This triggered panic among Americans who still remembered the shortages of 1973. The price of oil doubled in 12 months as lines started to build at gas stations, sending prices for all kinds of goods through the roof.

Since World War II ended, U.S. inflation has averaged 3.9%. In the decade prior to 1979, prices averaged a 6.6% increase per year. America had not seen back-to-back double-digit inflation since 1920, but in 1980, prices rose another 13.5%, then 10.3% in 1981. We have not seen anything like this since.

Inflation has been incredibly low over the last 40 years, thanks to technology, globalization, demographics, and the Federal Reserve. During this time, inflation has averaged just 2.7%.

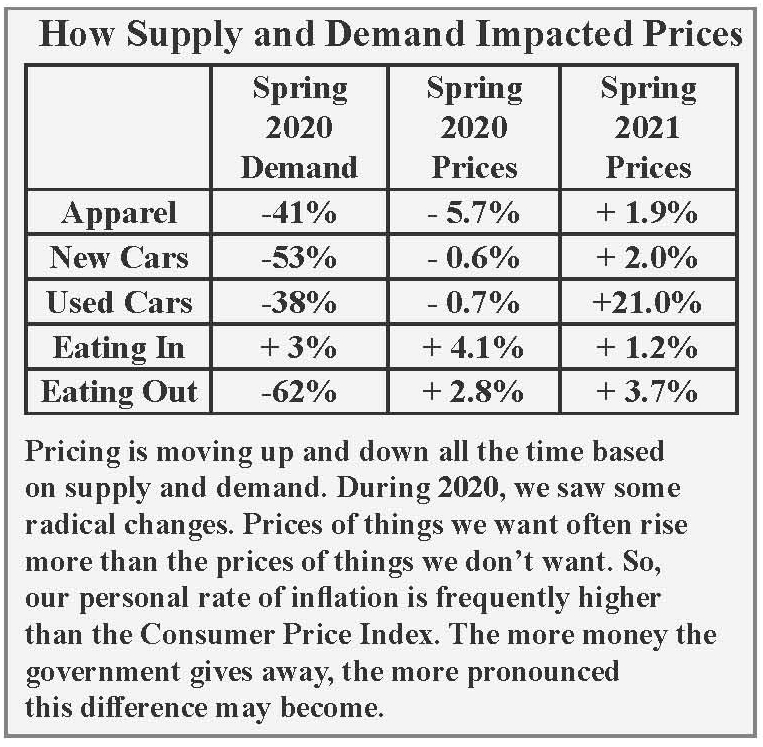

Demand and supply of goods are the basics of economic pricing. If either one rises or falls without the other, prices move. When panic demand for supplies hit in the spring of 2020, we did not see huge changes.

We did see a lot of changes in other areas. Oil demand fell around 10%, and the price of oil at one point went negative. On April 20, 2020, the prices of West Texas Intermediate oil fell to -$40 per barrel. Unbelievable! Companies could not give it away. Gas prices stayed positive (around $1.50 per gallon in Utah).

The U.S. government slammed on the economic brakes and then created around $12 trillion to keep things going. That is in an economy that produces less than $22 trillion in a year. It was massive, and it appears to have worked. Now, the government seems to have the economic tiger by the tail. It is hard to say what will happen if it lets go.

As stimulus efforts continue, prices will probably continue to rise. Official inflation came out on May 13, 2021, at 4.2%. That is a long way from 1979 levels, but it is the biggest number in decades. Many of these numbers are being compared to unusually low prices from a year ago. The Fed refers to this as a base effect.

Fed Chair Jerome Powell insists that these significant increases are temporary. If Powell is correct, then I expect we will begin to see price changes calm down by the end of summer. That does not mean prices will fall; it means they should stop rising so quickly. There is also a reasonable chance the Fed is wrong, so I will be keeping an eye on inflation.

*Research by SFS. Data from the Federal Reserve Bank of Minneapolis and the U.S. Bureau of Labor Statistics. Investing involves risk, including the potential loss of principal. The S&P 500 index is widely considered to represent the overall U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive results. Past performance does not guarantee future results. The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based upon changing conditions. This is not a recommendation to purchase any type of investment.

One Comment