In what area of your life is it okay to shoot for average? In your financial life! In all other areas we strive to be above average. Pushing for higher achievement makes sense when it comes to career opportunities, participating in sports, or setting goals. When it comes to investing, however, reaching for above-average returns can be financial madness.

Striving to get the highest return possible at any risk can be devastating to investment portfolios. It encourages investors to take on too much risk without properly assessing the downside possibilities. It emboldens investors to believe they can predict a future outcome when in reality no one can accurately or consistently predict future market movements.

When analyzing portfolio returns, investors often use market indexes as the benchmark by which they measure their personal investment performance. If they outperform the chosen index they feel empowered. In contrast, if they underperform that index, they feel they are failing financially. Standards for measuring long-term portfolio returns are much more complex. Investors may be well served when they embrace average.

Emotional impact to market volatility varies widely and can be as diverse and unique as we are as individuals. Having said that, similarities exist in the ways investors react.

Throwing in the towel

Volatility tempts even experienced investors to give in at the wrong time. Take for instance an investor who was spooked by the bear market of 2008. Many investors fled the market for good, seeking fixed, low-yielding options for their money. During that bear market period, from October 9, 2007, through March 9, 2009, the S&P 500 lost 56.78 percent. Hypothetically, if after suffering this large loss, the investor moved to an investment growing at 3 percent, it would take more than 28 years to

break even.

Concentrating investment focus

Investing in one area of the market that represents the same sector does not reduce risk. Concentrated sector allocations may cause investors to fall behind when the market heads down. For instance, the S&P 500 represents 500 American large capitalization stocks. Even though there are 500 stocks, they are all part of the same market sector.

A portfolio concentrated in one sector results in greater risk. When that sector of the market heads south, you may quickly forget how great it was on the upside. You have heard us say that when it comes to money the pain of losing is greater than the thrill of winning. As such, a 40 percent loss has a much greater impact on a portfolio than a 40 percent gain. Assuming an investor suffered a loss equivalent to the S&P 500 during the 2008 bear market, he or she would have to gain 131.35 percent, and it would have taken four years to break even. Let’s say that again. For over four years their investments were still below the high point of October 2007.

Timing the market

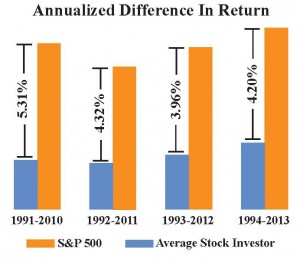

When left to their reactive behaviors, investors often sabotage their investment performance. Dalbar has long studied the results experienced by investors. Year after year, we see the same information reported. Investors are not able to outperform, let alone keep up with, market returns. This is believed to be the result of chasing returns, becoming overly cautious during periods of increased volatility, and consequently making poor decisions at inopportune times. Outperforming the market every year is an unrealistic goal. If an investor is consistently changing strategies or investments in an effort to get the best return, he or she is missing the value of average returns over longer periods of time. The chart illustrates how investors are falling short of the market. To put it in perspective, a 3 percent increase in return, over 24 years, will double your money.

Embracing average returns

It’s not exciting or flashy, but consistent returns are important in reaching financial goals. This can be accomplished through diversification. As an example, a portfolio with 60 percent allocated to the S&P 500 and 40 percent allocated to fixed-income has a greater chance of smoothing out big market swings. Generally you will not have the hottest returns nor will you suffer the greatest losses. When compared to the same 2008 bear market, the hypothetical 60/40 portfolio would have lost only 35 percent compared to the S&P 500’s 56.78 percent loss. The break-even point comes at just shy of two years as compared to over four. This type of diversified portfolio does not prevent losses but it does help reduce market risk. The result is average returns.

When it comes to investing, the most important factor should be reaching your financial goals with a reasonable amount of risk based on your objectives and risk-tolerance. We believe that if investors avoid the emotions that push them to chase high returns and remember that consistency pays in the long run, they will be better positioned to meet their investment expectations and concurrently their goals.

If it has been awhile since you have reviewed your portfolio, investment strategy, and financial goals, we encourage you to meet with one of our wealth management consultants. Call us to schedule an appointment to meet in person or speak over the phone (800) 748-4788.