and a Few Financial Reasons To Give Thanks

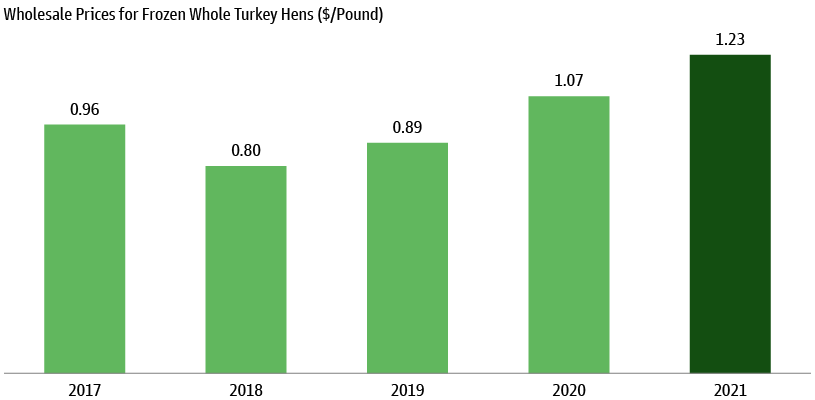

Thanksgiving food demand converged with supply disruptions, resulting in the most expensive November holiday ever.

The average price of a frozen turkey was approximately 40% higher than just 2 years ago.

The total cost of turkey, stuffing, sweet potatoes, and pumpkin pie was 14% higher than last year.1

This inflation is the result of higher costs of fertilizer, animal feed, and fuel. Add to that the shortage of workers in meat packing plants, the trucking industry, and grocery stores. Another adjustment among those that could manage the higher expenses: fewer leftovers.

Nevertheless, we have plenty to be grateful for in our country. Americans can celebrate an abundance of jobs, a silver lining in the latest pandemic news, and a stock market near all-time highs.

During the last week of November, initial claims for unemployment dropped to 199,000—its lowest level since 1969. The unemployment rate is at 4.2%. In the state of Utah, where SFS is located, the unemployment rate is at its lowest level ever at 1.4%.

There are currently 10.4 million U.S. jobs available and only 7.4 million Americans looking for work. So, there are currently more jobs available than there are potential workers.

Where have all the workers gone? According to Pew Research, more than twice as many Americans retired in 2020 as in 2019. That explains the whereabouts of over one million workers.2

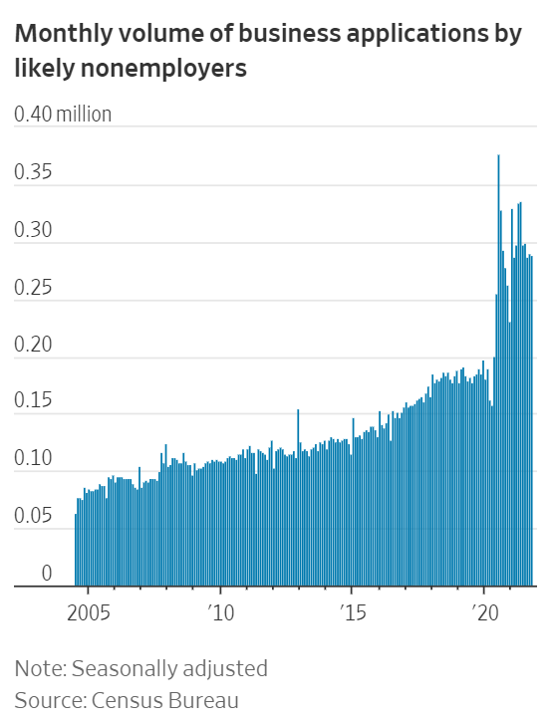

The Wall Street Journal reports that in the first ten months of 2021, American entrepreneurs registered over 4.5 million new businesses for federal tax identification numbers. The Labor Department estimates that nearly 10 million Americans are now self-employed.3

The demand for workers, especially in entry-level work, is lifting wages significantly. This is something the economy has missed over the last 20 years of income stagnation. Unfortunately, it is not all good news. Historically, higher wages have led to longer-lasting inflation.

It seems that the current battle with inflation is mostly a temporary problem with supply chains. Suppliers have a big incentive to solve these problems through hiring and automation. So the shortages seem unlikely to last beyond 2022. However, the impact of wages on inflation is likely to be more permanent. This is attracting the attention of the Federal Reserve and may mean less stimulus for the economy.

Regardless of the duration, higher prices are eliminating the benefit of higher wages, and shortages are having an impact on consumer confidence. American consumers are extremely resilient. I once heard it said,

When Americans are feeling down, they

go shopping.

Consumer spending represents around 70% of all economic growth, and despite concerns over shortages and higher prices, consumer spending is up. According to JP Morgan, consumer spending rose almost 14% in November. Take out food, which is less variable, and spending increased over 20% from last year.

What about Black Friday? Adobe reported that online shopping decreased for the first time ever on Black Friday. This is coming after last year’s pandemic shopping season. In 2021, in-person sales are estimated to have increased by 47% over last year.4

Adobe also reported that Americans have done more shopping early, motivated by fear of shortages and rising prices. The entire month of November is likely to show an overall increase from previous years. Companies are going to be busy trying to restock their shelves for some time.

News broke on Thanksgiving night that the Omicron variant of COVID-19 was identified in South Africa. At this point, it appears that it may be significantly more contagious than the Delta variant. This caused a commotion in the stock market, which endured a brief sell-off on an unusually volatile Black Friday. However, there have been no reported deaths yet, so it seems investors may have overreacted. We will see.

It is too soon to know for sure, but I see a possible silver lining to a fast-spreading, mild variant. It could circulate through the globe quickly and help increase immunity to more severe variations of the virus.

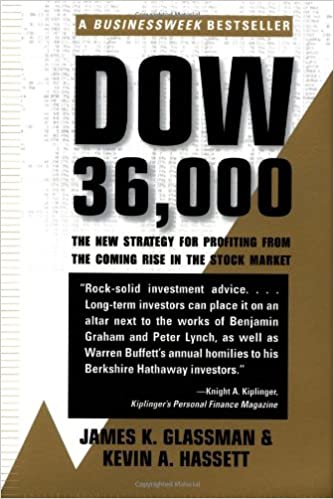

Back in 1999, columnist James Glassman and economist Kevin Hasset wrote a book titled Dow 36,000 where they predicted that the stock index would reach that level by 2004 or maybe even 2002. They were wrong about the timing, but investors should not be surprised at all that we eventually did reach these levels in 2021.

As high as these prices may seem to some, I see a lot of things still helping investors: Interest rates are low, economic growth is exceeding expectations, and consumer debt is looking good. There are no guarantees, but I believe stocks are still the best place to be for long-term investors.

- Leslie Patton and Amelia Pollard, “Thanksgiving’s Price Tag Packs on the Pounds,” Bloomberg, 11/12/2021

- Richard Fry, “The Pace Of Boomer Retirements Has Accelerated In the Past Year,” Pew Research.org, 11/9/2020

- Josh Mitchell and Kathryn Dill, “Workers Quit Jobs in Droves to Become Their Own Bosses,” The Wall Street Journal, 11/29/21

- Art Raymond, Black Friday Online Sales Dipped for the First Time in History This Year, KSL.com 11/30/2021

All other data from the Federal Reserve Bank of St Louis

The Dow index includes 30 large U.S. companies. One cannot invest directly in an index. Past performance does not guarantee future results.