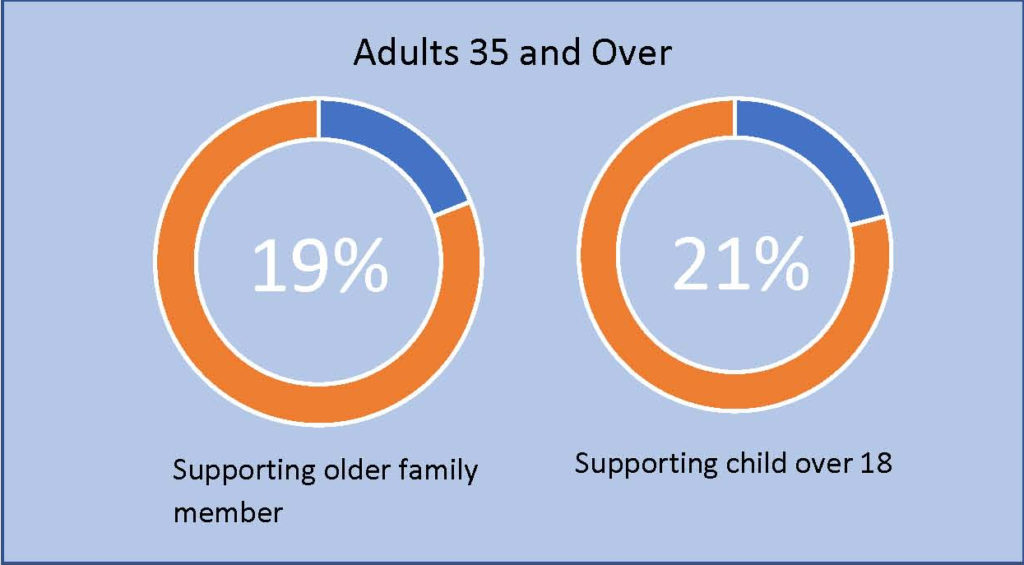

Living in the Sandwich Generation describes more Americans today than it did in the past. The Sandwich Generation used to describe women in their 30s and 40s who are caring for children and their aging parents.

Now that life expectancies have increased, and more adult children are taking longer to reach independence, the definition has expanded to include women and men in their 50s and 60s who are supporting aging parents and adult children.

In many cases, members of the sandwich generation are busy holding down their own full-time job. Being squeezed by dual responsibilities can cause financial and emotional stress for those caught in the middle.

Here are some strategies that can help as you prepare for this phase of life.

Whether you are allowing a family member to live in your home or helping to cover some of their expenses, there will be a financial impact on you. These additional expenses may come as you are preparing to retire or have just retired. It is crucial to set boundaries and share the expenses where possible.

It is imperative that you know your limits. Create a personal budget that outlines your expenses. This will provide a clear picture of what you can chip in financially to help when needed. Be careful not to jeopardize your financial security in the process of helping your family.

For older family members, review their expenses and help them establish a budget. As we age, it can be difficult to remember how we have spent money throughout the month or what future commitments we may have. Make sure the proper legal documents are in order, so you can assist in the management of their finances. Check with aging services to see if financial assistance is available to help your older family members. Get others involved and give them an opportunity to help when possible.

For adult children, setting limits from the beginning will help you manage this difficult financial situation. Have an open discussion with your adult child and let them know you have financial limits and what will be expected from them. The goal is to help them become financially successful adults.

Finally, remember to think about your needs. Caring for others can take a toll financially and emotionally. Getting adequate sleep, eating a nutritious diet, and exercising will increase your ability to cope. Most importantly, do not feel guilty about taking time for yourself. Taking time away from the demands will help you recharge and be in a better position to care for those around you. Let us help you. We have an abundance of resources available to help you through this challenging phase of life. Please reach out to us. We would love to share our expertise and support.