Emotions are a dominating force that impacts every aspect of our lives. The decisions we make, the interpretation of our experience, even our very personalities are all primarily influenced by our emotions. We are neurobiologically wired to create, feel, and think by emotion. In so many ways, our perceived realities are governed not by facts, but by feelings.

Psychologists believe that emotions drive 80% of the choices we make, while practicality and objectivity only represent 20% of our decision-making. This is because our brain has two sides, the thinking side, and the feeling side. The thinking brain is slow, rational, and objective. It deliberately, methodically, and logically reasons through information. The feeling brain is much faster. It is impulsive, emotional, and unconscious. It is also our default decision-making system.

How often do we describe the reason for a decision by saying, “It feels right?” Yet strangely, the mechanism we rely on most when making decisions is so fickle that it can be greatly altered even by what we ate (or did not eat).

This is why Dave Ramsey said that personal finance is not a math problem, but a behavior problem. Investors are emotional. Thus, they judge investment decisions mainly by emotion. This can have expensive consequences.

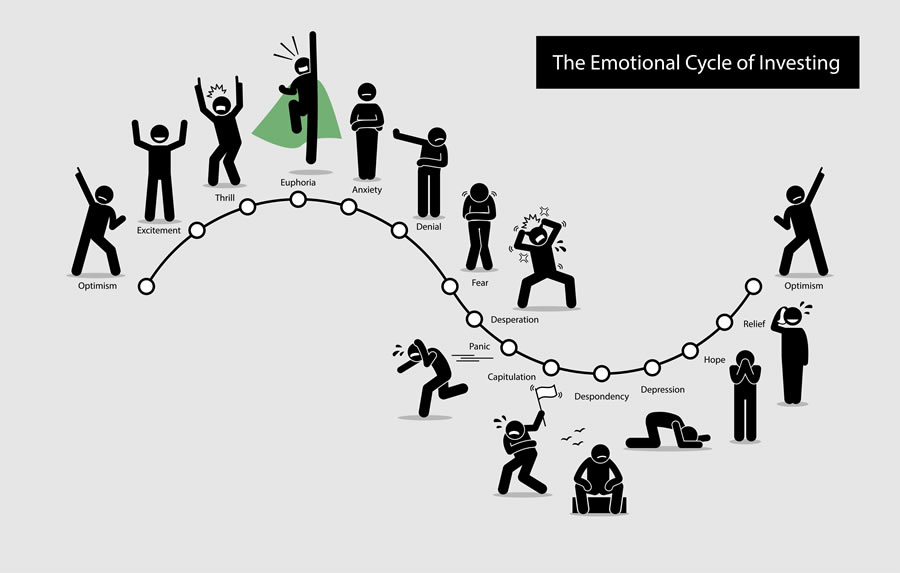

Most investors go through a recurring cycle that follows the market. This emotional cycle often leads an investor to make the wrong decision at the wrong time. You have heard the saying, “Buy low and sell high.” Logically, this means buying when everyone is feeling despondent (selling) and selling when everyone is feeling euphoric (buying). This is so much easier said than done.

One of many examples: In 2018, when the S&P 500 lost 4.38%, the financial analytics firm found that the average investor lost more than double that, at 9.42%. Investors lost money because they acted on emotion when markets declined. A study that same year published in the Journal of Financial Planning found that investors who implemented strategies to remove emotion saw returns up to 23% higher over a 10-year period.

As accredited Behavior Financial Advisors and Certified Financial Planners, we can help remove emotion from the equation and make wise financial decisions. Whether it is investments, estate planning, or a large purchase, we can provide the expertise that can make a positive difference in your financial future.