Your decision to retire may be one of the hardest you will make. A lifetime of preparation comes down to a single day when you leave the familiar day-to-day routine – not to mention the regular paycheck – and embark on a new adventure.

That nest egg you have been accumulating will need to provide a large portion of your monthly income along with Social Security and your pension, assuming you have one.

Imagine that you planned to retire in 2020. Should you retire in a year when markets are experiencing extreme volatility, and there seems to be an abundance of uncertainty when looking at the economic picture? What will happen to your retirement income if your nest egg balance drops?

Your fear is based on sequence risk. You are concerned that the market will continue to drop right at the point when you are hoping it will increase. Sequence-of-returns risk, or sequence risk, is the risk that an investor will experience negative portfolio returns very late in their working years, or early in the retirement years. The fear of losing money can cause an investor to become risk-averse in the short-term, discounting future opportunities for growth.

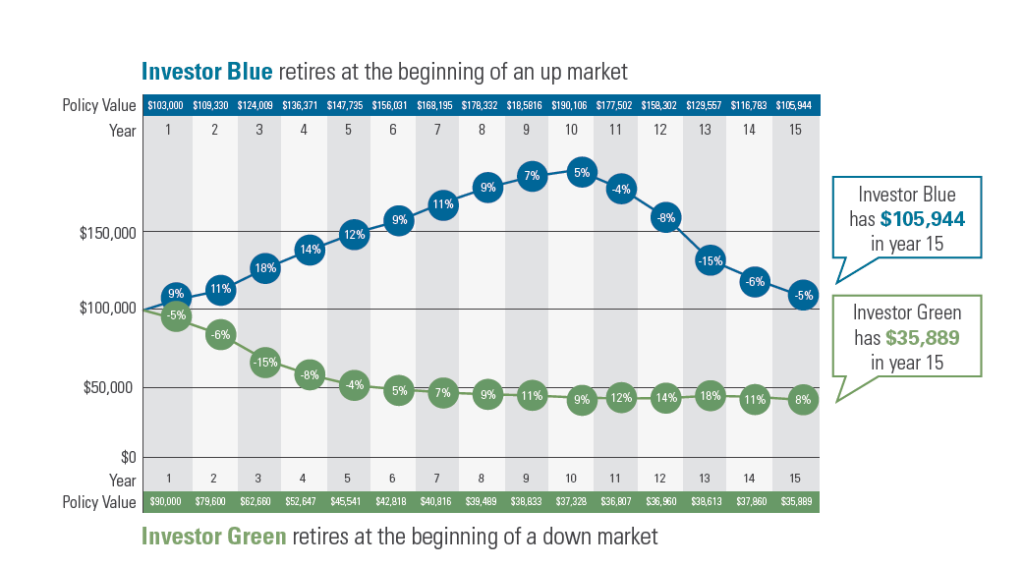

This chart illustrates the impact market returns can have on an investment portfolio. One illustrates negative returns early in retirement and the other positive returns early in retirement. Consequently, the average return in both cases is 4%.

Sequence risk is a real threat but can be managed in a retirement portfolio. Our Lifetime Income Plan diminishes sequence risk without locking investors into illiquid products with high fees and minimal flexibility.

The key is managing risk throughout retirement. Determining how much money you will need at different intervals is the backbone of the Lifetime Income Plan. Knowing these key points helps us to ascertain how much risk should be taken with an investment.

Let’s say you need $42,000 each year to supplement Social Security and other income. We would invest enough money to cover the income for five years in a very conservative investment. In this case, we are more interested in the security of the money than potential return.

This continues in segments through retirement, generally in 5-year increments. With each segment, we determine how much money will be needed and increase risk accordingly. The assets that will be used ten or more years out typically have a greater amount of risk.

The Lifetime Income Plan helps diminish the impact of volatility on your income and emotions. This helps you stay invested and gives you a greater opportunity to participate in market growth over time.

One thing is certain; risk is inherent to investing. If managed correctly, it can help you outpace inflation and maintain your lifestyle in retirement. For more information on how a Lifetime Income Plan can benefit you, contact an SFS Wealth Management consultant.

Graphic from RetireOne: hypothetical illustration does not represent the results of an actual investment. It does not reflect any investment fees, expenses, or taxes associated with investments. An average annual return of 4% is reflected for both investors. Annual withdrawals of $5,000 are taken at the end of each year.