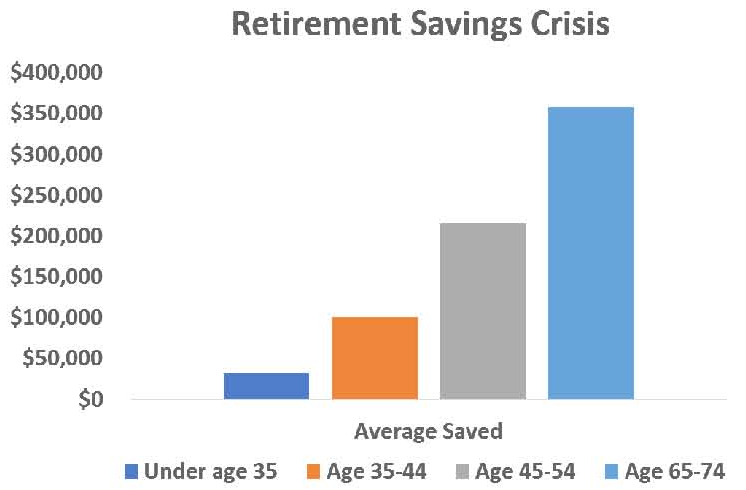

It is no secret that Americans need to save more for retirement. The amount of money an individual or couple will need to carry them through their retirement years varies based on numerous factors, including age, standard of living, location, expected fixed income sources – like a pension and Social Security – and more. Everyone needs to know where they stand based on their specific needs. Have they saved enough, or do they need to save more? Here are some shocking statistics that illustrate that Americans are falling short.

This chart shows the average retirement savings account balance of active savers. Averages can be deceiving as there are many balances far above the number shown. The issue lies in the realization that there are a significant number of accounts with balances far below the average. This creates a future financial crisis for these savers. Living today on the income they receive is doable. However, it will be almost impossible for these savers to maintain their standard of living in their elder years if they continue at the same rate of saving.

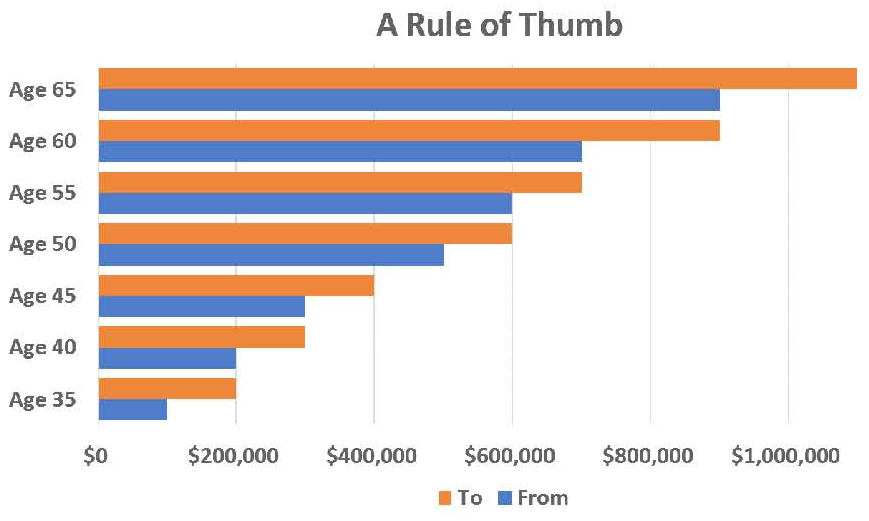

We are not proponents of Rule of Thumb planning. We prefer planning using actual key information specific to each client’s situation. But, in this situation, it helps us illustrate a reality. This chart shows how much someone should have in their retirement savings based on age. The amount shown is a multiple based on a $100,000 income.

Rule of thumb would say, based on the desired income amount you want in retirement, you should have saved a multiple of your current income. The amounts illustrated are multiples of a $100,000 income. For example, if you are age 45, you should have already saved 3 to 4 times your income. If you are 65, you should have saved 9 to 11 times your income. How are you doing?

The good news is there is always hope. If you are not on track, regardless of your age or situation, we can help create a roadmap to get you back on track, one step at a time. Contact one of our Wealth Advisors for more information.