One of the most absurd and fascinating financial stories of the pandemic was Hertz. Yes, the Hertz that pre-Covid was the second-largest rental car company. Last April, it had 700,000 vehicles sitting idle and $19 billion in debt! On May 22, 2020, Hertz filed for bankruptcy protection. Then, just a few days later, the stock began a miraculous rise.

Between May 26th and June 8th, Hertz stock rose nearly 1,000%. A savvy investor might think that after all creditors are paid, there may be something left over for stockholders. In reality, Hertz had become one of the first social media stocks of the pandemic.

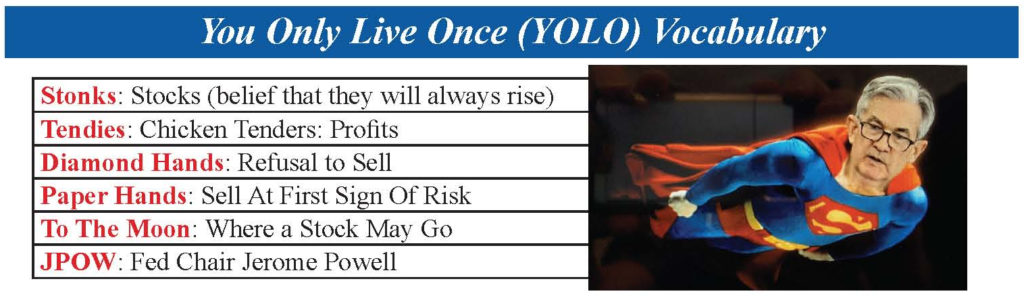

Individual investors encouraged each other to buy Hertz because it was “going to the moon” and “You Only Live Once,” also known as just YOLO.

Hertz recently announced it might be purchased for just under $5 billion—a number far below the $19 billion in debt. Eventually, investors realized this would happen because the stock could not stay above its June 2020 high. In reality, it is now worth approximately zero.

We have seen the manic rise and fall of many stocks, most of them in January and February of this year and most of them unprofitable. The reasons are complicated, but we will summarize them below:

(1) Gamification of investing with free phone apps

(2) People stuck at home with more free time

(3) Free money from Uncle Sam

(4) Leverage through the use of options

(5) Market makers hedging their risks

(6) Short sellers forced to cover

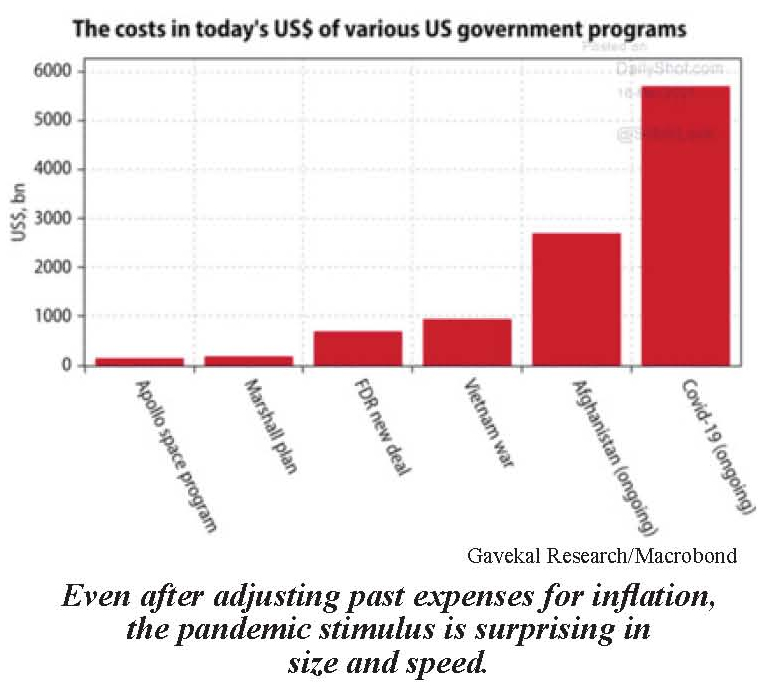

Let’s focus on the one that impacts all of us as investors: “free money.” The U.S. government has now approved three rounds of stimulus, totaling around $6 trillion. (An additional $4 trillion from the Federal Reserve went into financial markets over the last year.)

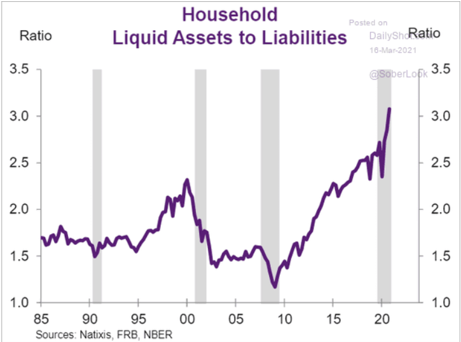

As described in the graphic below, the majority of Americans are not planning to spend the stimulus immediately. It has led Americans to save more money in the past year than any other time recorded in U.S. history!

Combine all these savings with reduced household debt, and we get a very flexible consumer. Remember, consumer spending is 69% of the U.S. economy.

Much of these savings will eventually get spent or find their way into investments, which is why some have called the rise in the stock market a “Rational Bubble.”

The health situation has drastically improved since January. While the United States continues to face even more contagious variants of Covid-19, vaccine distribution has substantially expanded. As of March 15th, over 90 million doses had been administered. Plus, approximately 2 million more Americans receive a dose each day.

Nationally, the best-case scenario may be happening. High economic growth (likely to top 6% this year) and low inflation (rising to possibly 3%) make it easier to handle the heavy level of debt. Many states, from New York to California, are easing restrictions. Other, less densely populated states are already way ahead in reopening.

In Utah, the governor thought we would have a massive deficit when shutdowns began last spring. Instead, the state ended up with a $1.5 billion surplus, and in February 2021, Utah had an unemployment rate of just 3.1%.

A year ago, many debated what the financial recovery would look like. Would we have a sharp rebound or a V-shaped bounce, or would it be a slower U-shaped or volatile W-shaped recovery?

The reality has been a letter not previously used to describe economics, but one that I think we will see again in the future. Our current progress has been called a K-shaped recovery because while it has been good for some, it has been difficult for others. As we emerge in Spring 2021, we hope to see more joyful and prosperous times for all.

*Research by SFS. Data from the Federal Reserve Bank of St. Louis. Investing involves risk, including the potential loss of principal. The S&P 500 index is widely considered to represent the overall U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive results. Past performance does not guarantee future results. The opinions and forecasts expressed are those of the author and may not actually come to pass. This information is subject to change at any time, based upon changing conditions. This is not a recommendation to purchase any type of investment.