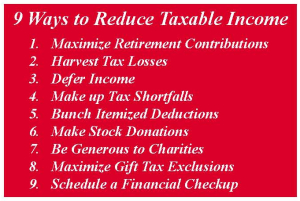

It is hard to believe 2014 is swiftly drawing to a close. At this point, what can you do to better manage your taxes? Here are several ideas you can consider:

Maximize retirement contributions.

All contributions to your traditional 401(k) or other tax deferred retirement accounts are made before taxes are calculated. This means that if you make a maximum $17,500 contribution to a 401(k) your taxable income is reduced by $17,500. So, why not pay yourself rather than Uncle Sam? Generally speaking, you can modify your contributions at any time during the year, but check with your benefits office to be sure of your plan’s rules.

Harvest tax losses.

After several years of market growth you may want to lock in some of your investment gains. The downside is you will also trigger a tax on any growth over your initial investment. Consider dumping some of your portfolio losers. This will allow you to offset your taxable gains with losses resulting in a zero tax bill if the numbers are the same. Keep in mind you can only offset long-term gains with long-term losses. The same applies to short-term gains and losses. We can help you identify any tax harvesting opportunities in your portfolio.

Defer income.

If you have control over when you will receive income, consider deferring some of your income until next year. This generally applies to those earning commissions, bonuses, consulting fees, or self-employment income. A quick exercise to determine where you are tax-wise and how much income should be deferred to prevent you from hitting the next marginal tax bracket is recommended. This can be done by consulting with your tax professional. Some programs such as Turbo Tax allow you to run a pro-forma tax filing to get an idea of where you stand.

Make up tax shortfalls.

If you have not paid enough withholding or estimated tax throughout the year, there is still time make up the difference before the year ends. Increasing your tax withholding or making an estimated tax payment will help avoid any underpayment penalties.

Bunch itemized deductions.

Retirement brings with it some unexpected tax situations. For many there are not enough deductions each year to itemize on Schedule A of the tax return, in effect minimizing any tax advantages. By bunching deductions every other year, you can itemize one year and take the standard deduction the next year. This could be applied by prepaying state taxes every other year, making charitable donations every other year, moving up or pushing back a non-urgent medical procedure, and much more. Your tax professional can share ideas that fit your specific situation.

Make stock donations.

If you have held taxable investments for more than a year and they have increased in value, you can donate the stock directly to a qualifying charity. This avoids any capital gains you may owe on the growth of your investment. Nevertheless, you can still itemize the full value of the donation. Even better, the receiving charity pays no tax on the gift. You are then free to invest the cash you would have donated, creating the opportunity for future stock donations.

Be generous to charities.

Gifting cash to a qualified charitable organization also has tax perks. You can deduct the cash donation on Schedule A when you file your return. (Be sure to keep receipts for all cash donations.) You also get the benefit of helping others, while this may be a completely intangible outcome; the good feeling of making a difference in the world goes well beyond any tax advantages.

Maximize gift tax exclusions.

If your estate is growing considerably, you may want to gift something to your children and grandchildren while you can watch them enjoy the gift. You can give $14,000 annually to as many people as you wish. Neither you nor the happy recipients will pay gift taxes or estate taxes. If you are married your spouse can gift the same amount. Get double tax benefits by gifting appreciated stock and avoiding the capital gains taxes. The capital gains basis will transfer to the recipient, who is most likely in a lower tax bracket.

Schedule a financial checkup.

Throughout the year there may have been changes to your personal situation. This is a good time to review beneficiary designations, retirement plan contributions, estate planning options, and investment strategies. Your advisor can make you aware of and help you take full advantage of a wide range of planning opportunities.

For more information and ideas on how to maximize year-end planning opportunities, contact one of our wealth management consultants or your tax professional. Don’t wait too long; there is a deadline for getting everything finalized and some of our suggestions take time.