Fighting the pandemic financially required more money than the government has ever created before. It was placed in the hands of Americans and invested in to the bond markets. U.S. households ended up with record low debt and a desire to spend.

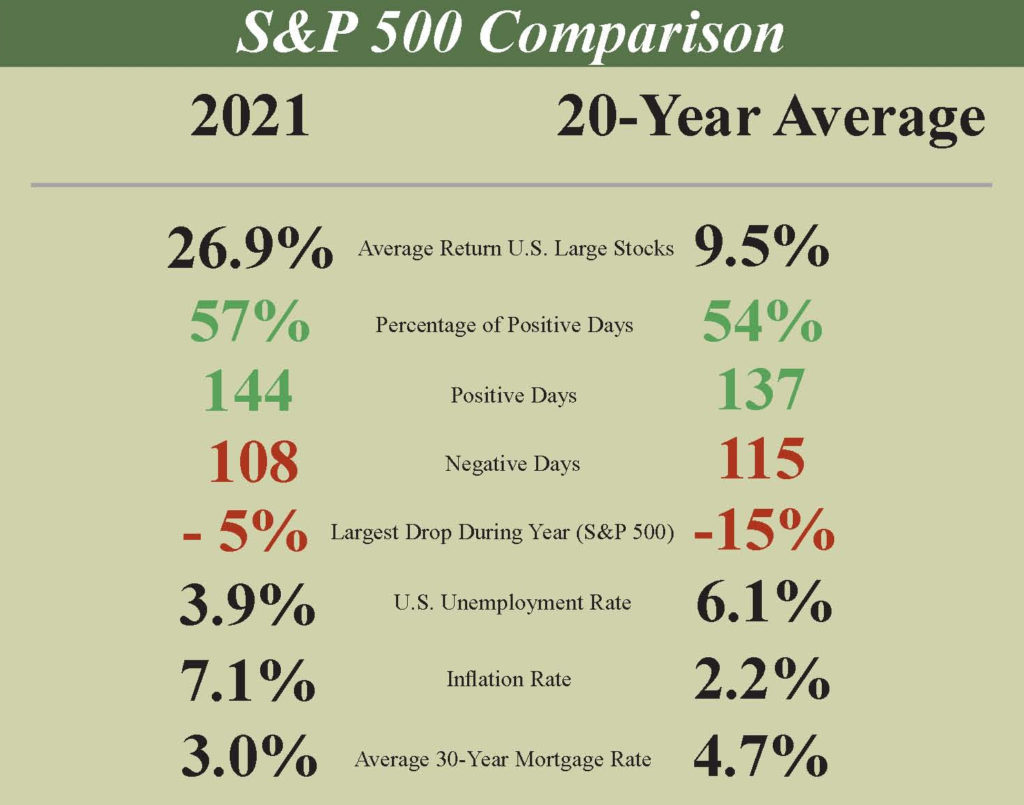

Demand for goods increased beyond what could be supplied. This increased prices as shortages continued COVID-19 shutdowns. Then, high transportation costs became a worldwide challenge. Despite these setbacks, the stock market found a way to deliver again.

The Federal Reserve is responsible for almost half the $9 trillion in stimulus. By the end of the year, it had to abandon its insistence that inflation was transitory, which investors have found alarming. Ironically, I believe there is a good chance that by the end of 2022, we may find that the Fed’s initial theory was correct, and inflation comes down from the 7% level.

A falling inflation rate would likely be welcomed by bond and stock investors in 2022, but there is no guarantee that we will see it. Inflation may be the most important economic measurement to watch this year.

Past performance does not guarantee future results. S&P 500 index is often used to represent the U.S. stock market. One cannot invest directly in an index.