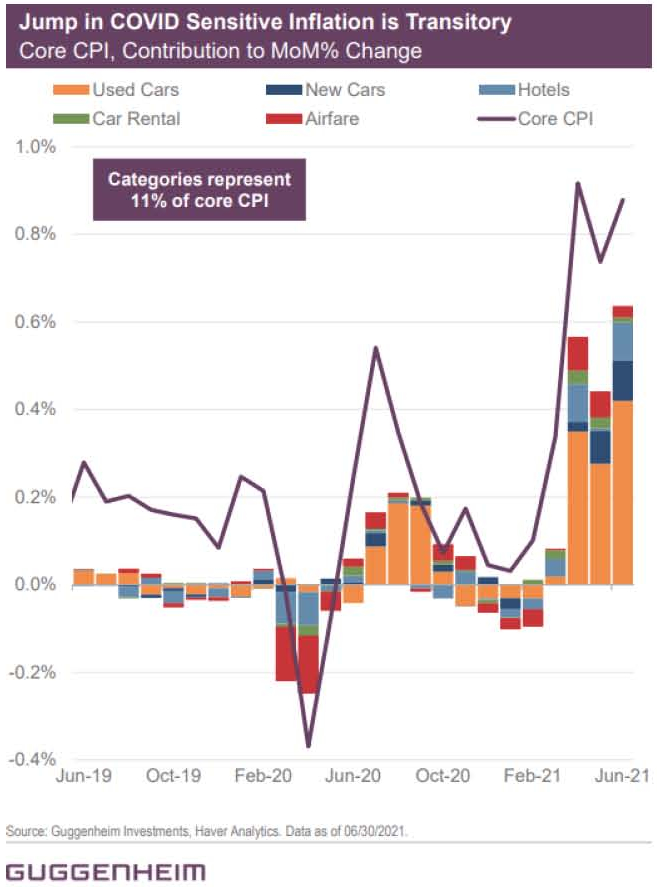

The value of used cars in the United States jumped by over 10% in June. This alone drove a third of all inflation, which has risen to 5.3%. We have not seen numbers much higher than that since the 1980s.

The number one rule of economics is that prices should be determined where supply equals demand. We see this holding true in 2021. Demand is up. Supply is down. And so, prices are rising.

After discussing the frightening details in my last article, I want to present the opposite view: the runaway inflation of 2021 is only temporary.

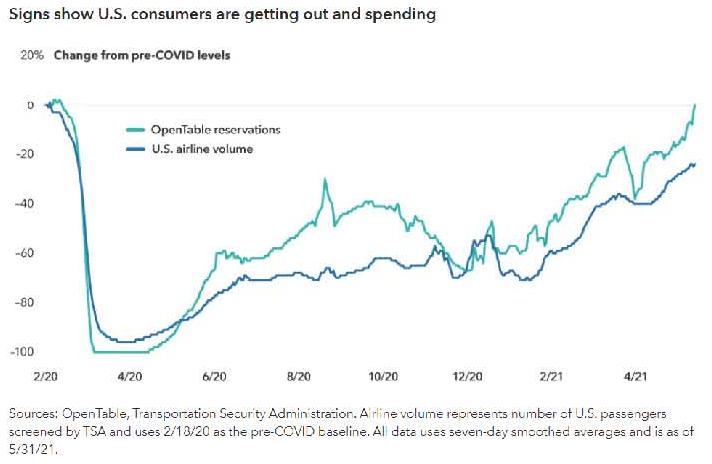

Demand: Thanks to unprecedented government relief, demand for goods is high. Consumer behavior is also beginning to normalize as people eat out and travel more. This can be seen in the graphic below from the Capital Group. However, as stimulus money slows down, any excess demand in pockets of the U.S. economy should return to normal.

Supply: U.S. manufacturers, like the car and truck makers, did not anticipate rising demand. Instead of ramping up production in March of 2020, they cut back. These supply shortages are to blame for inflation. One by one, companies will boost output.

Based on these economic basics of supply and demand, it seems very possible that inflation will return to recent averages of around 2%. Lumber, which rose over 400% earlier, has now fallen, giving up most of those gains. In my opinion, used cars and home prices are unlikely to collapse this year, but they cannot keep going up at the current rates. They will likely level off.

Concerns over rising prices may persist for a few more months, especially as rents finally rise. However, we may also begin to see some signs of stable prices. This would be a welcomed sign for most investors.

Jerome Powell and the Federal Reserve are not worried. They have the tools to deal with inflation, but they still don’t see it as anything but temporary. It’s unusual for the Fed to ignore rising prices. This fact may be the very reason why rising prices persist.

The good news for us as investors is that regardless of where inflation goes, we also have some tools to help us navigate the uncertain future.