Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in markets.

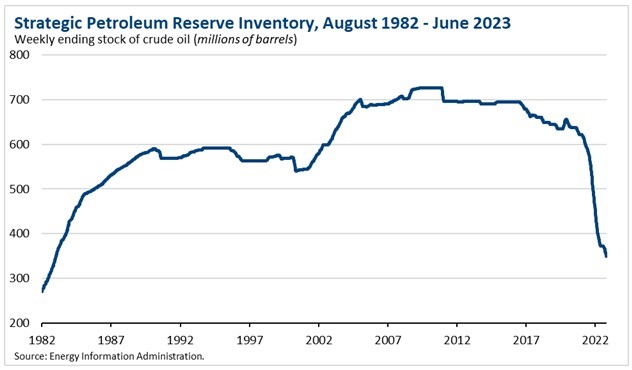

The Department of Energy (DOE) has been storing oil for decades in the Strategic Petroleum Reserve (SPR), and it released half of it in the past year. It couldn’t wait for an emergency. It sold over 250 million barrels to bring down prices. This would be a catastrophe if a supply shock hits, but it has been good for the economy. Now, the DOE is struggling to fill the reserve back up at a reasonable price.

After the oil shocks of 1973/1974, the SPR was established to counter any disruption in oil supplies. It held over 700 million barrels of oil at its peak in 2011. (U.S. consumes around 20 million barrels a day in fuel and manufacturing. We supply about 75% of the oil domestically. Another 20% comes from Canada.)

The SPR is made up of a series of large caverns deep underground in Texas and Louisiana. Last year, the Biden administration began draining the emergency reserves because oil prices were deemed too high.

In June, the SPR had only 348 million barrels. The DOE announced it would buy six million barrels of oil in the coming months to begin refilling the SPR. Adding the six million barrels in the next few months still leaves us extremely low.

– The challenge is adding oil back to the reserves at a reasonable price, which the DOE has determined is anything under $70 per barrel. Each time oil has dipped below that level this year, OPEC+ (OPEC and Russia) has lowered their supply to increase the price. This can be seen in the chart below. (I don’t know why we announced our intentions rather than quietly getting the job done.)

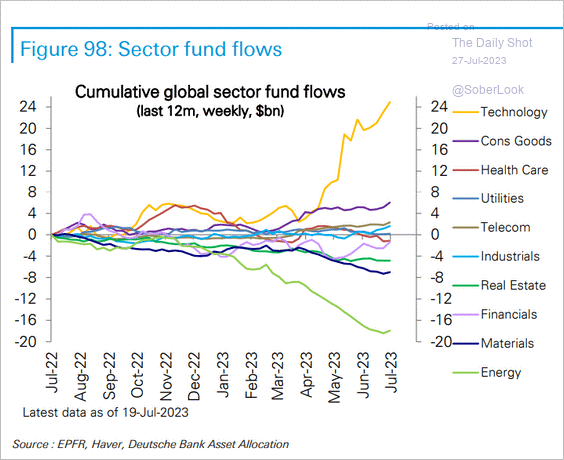

With the U.S. purchasing oil, demand is up, and the economy is doing fine. Combining that with OPEC+ cutting supply, we have high demand and low supply. It is not surprising that oil prices are currently sitting around $80 per barrel and looking strong. This is an opportunity to invest in a sector of the stock market that was shunned earlier this year: Energy. It seems other investors are beginning to come around. It has been volatile and will likely continue to be, but I find the sector attractive, especially when considering oil’s supply/demand dynamics.

Most investors have yet to see the opportunity. There is no guarantee it will be positive. The energy sector has quietly come back alive. Warren Buffett added to this area recently as well. As Wayne Gretzky said, “I skate to where the puck is going, not where it has been.” I will be watching energy closely in the coming months.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.