Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

I started in the financial industry on the day that Yahoo! became the most valuable company in the world. It was the same month that Time Warner purchased America Online (AOL). The internet was going to change the world, and these were the companies leading the charge. It didn’t have to make perfect sense. The internet was going to make anything possible. This was both right and wrong. It took a few years to sort out the chaos.

The NASDAQ topped in February 2000. The other major indices followed one at a time. By June 2000, Federal Reserve Chairman Alan Greenspan announced the Fed’s final rate increase. Stocks bounced. Then they fell again. Some areas of the market did well. They were not immune from the volatility. They were a better value when investors were looking for value.

I see a couple of scenarios in the year 2023. Unemployment could rise, and recession could come. I have been watching for signs of this all year. The cycle into recession is a normal part of economic growth and can be helpful for teaching lessons about finance and life. Things get tough, and then they get better. The slowdown will come, but it has not arrived yet.

Another possibility is that we are living in something similar to the year 2000. We have incredible technology and seemingly endless opportunities. We have a Federal Reserve that is almost done raising interest rates. And we have a stock market that has shifted favoritism from one area to another over the last year. If we continue on the current path, we should take a lesson from history.

Last fall, energy stocks were all the rage. Technology struggled and did not participate in the growth. In January, emerging market stocks were favored. Then in March, it was Technology stocks. In June, these slowed down, and other cyclical stocks started making money.

Chasing each sector would have been painful. Energy had a terrible start to the year. Emerging market stocks have been beaten down heavily since the start of February. Only time will tell if this happens in other sectors of the market.

If this economy continues to grow in 2023, then there will continue to be opportunities. Like in the year 2000, I am looking for small-cap and value companies to lead the way. These are two common terms in the industry that define many companies that are looking increasingly attractive. There are already some signs in the Commitment of Traders report that things are headed in this direction. I will be watching to see if they continue.

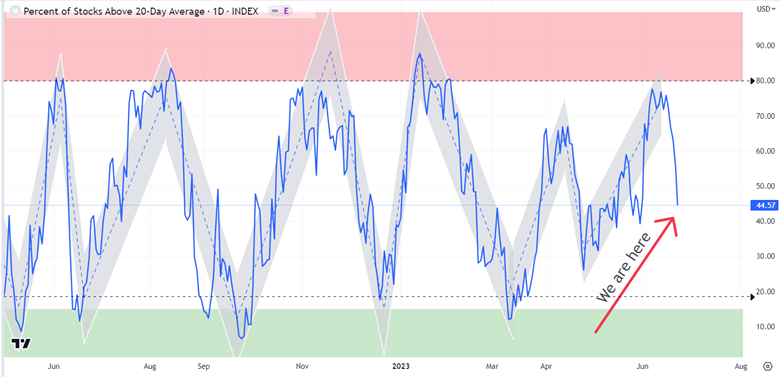

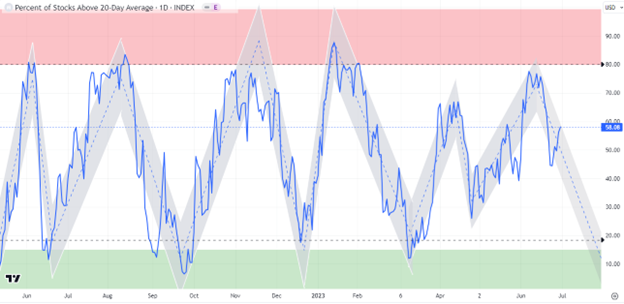

Last week, I showed this chart of the percentage of stocks trending up. Here it is again. The blue line is the percentage of stocks trending up. I added the grey areas to help simplify the image. The red and green areas are important levels where it is difficult for the market not to turn. Last week, we were in a free fall. The average stock was not doing well. Large companies were holding things up. In this graph, they all receive equal weight. Now, I am including the update below.

I am happy to see the bounce over the last week. It means stocks moved up, including small and mid-sized company stocks. I also see some reason for concern remains, but only if the blue line continues lower. It could go higher. Anything can happen.

I have become increasingly concerned with longer-term bonds. They bounced in the last couple of months but look risky in an economy that is still growing with elevated inflation. Short-term bonds look even better than the last time I mentioned them.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.