Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

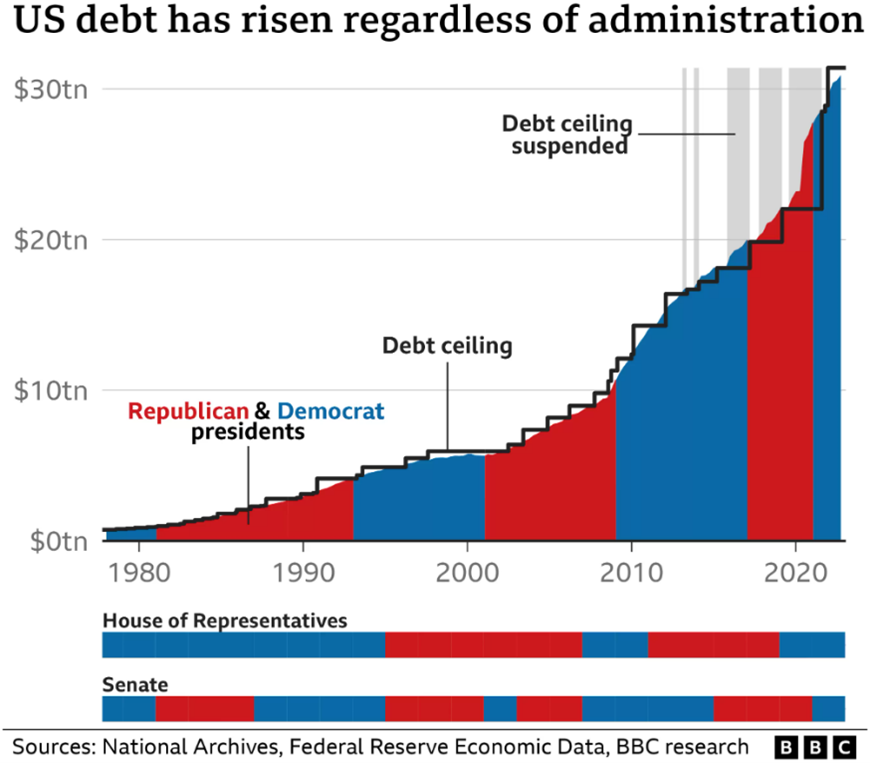

The United States is spending more than it can afford and has no plan to slow down. It is entirely reliant on borrowing. In January, it reached $31.4 trillion in debt and has been drawing down “savings” and using “extraordinary measures” since. The debt ceiling has been raised over one hundred times and will be raised again. Timing is critical.

Janet Yellen, the U.S. Secretary of the Treasury, has repeatedly told Americans that Congress must raise the debt ceiling by June 1st. Even a temporary lapse could have severe consequences. It is possible they have more time, but not much.

The United States Government spends roughly $3.6 billion daily, according to Treasury.gov. As I write this, only 88 billion dollars remain (Bloomberg). By my rough calculations, it has enough money for 24 more days, running out around June 7th. If that is true, that gives Congress another week. However, it would be dangerous to assume Secretary Yellen is exaggerating. The fact that we are counting down the day is a major concern, and a default on making a payment on U.S. debt would be unprecedented.

Education Section: Our National Debt

Our national debt is an important tool. It allows investment in American infrastructure, and it finances wars if necessary. When we, as Americans, find ourselves in a recessionary spiral, government spending can help. However, we cannot grow it faster than our economy without someday paying a hefty price.

The last time the United States spent less than it received was 1957. It has become increasingly difficult, thanks to entitlement programs. If we added up the incomes of every American for an entire year, we would have $24 trillion. Even that is not equal to the U.S. national debt.

Andrew Jackson was the only President of the United States to pay off all national debt (TheBalanceMoney.com). Here are some other important facts about our public debt:

- The United States owes $31.4 trillion.

- Debt is expected to rise by $1.5 trillion in 2023.

- Interest on this debt is nearly $400 billion—roughly 7% of the national budget.

- The debt ceiling began 106 years ago to prevent excessive government spending year after year.

- Debt has come down only five times in the last 100 years. (We came close in 2000, adding just $8 billion.)

- Our debt is 123% of the size of our economy. This is a good way to think about the debt levels.

- Japan has the highest debt-to-GDP for a developed nation: 266%. It has not been a significant problem yet—the next highest on this list: Greece, Italy, Portugal, and then the United States.

The debt cannot continue to rise without consequence. Managing it is the job of Congress when it passes the annual budget. Depending on your view, the debt ceiling is a political tool to force negotiations or an unnecessary financial risk. Regardless, it is a reality.

The debt ceiling will be raised. It always has. Choosing not to increase it is similar to choosing not to pay your bills for the money you have already spent. The most likely outcome is that the Democrats and the Republicans will compromise. Debt will go up if spending comes down a little. This predictable outcome is why I have chosen not to let it influence my investment decisions until now.

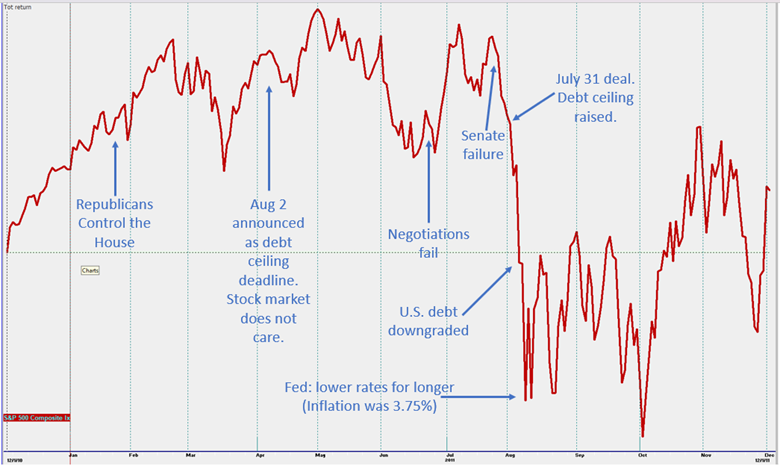

The closest we ever came to default was in 2011 when Congress passed a bill during a special weekend session on the last night before the U.S. government ran out of money. Investors did not care until a week before the deadline. Where did they invest when they feared the United States might miss a payment on its debt? Ironically, they bought U.S. government debt. It was riskier assets that suffered the most.

I do not believe 2023 will be just like 2011. I am counting on a deal, even if it comes one minute before midnight on May 31st. Another possibility is a temporary bump to give lawmakers a few more months.

Where Are We Headed?

Last year, big companies, especially those in the energy sector, tried to hold markets up. This year, large technology companies are doing their best, and small companies have yet to do well in either year.

For the second week in a row, both long-term bonds and stocks were down a little. Short-term bonds, which I still favor, were flat. Overall, stocks are stuck. The S&P 500 has bounced around 4,125 for over five weeks. It will not last until the end of May. We will move up or down.

My outlook is for a move lower in the coming weeks. If the economy holds up, it is possible the stock market will also. If the economy enters a recession, the stock market may not be able to maintain its state of denial.

I do not favor taking a lot of risk. Short-term bonds have some of the best yields in decades. In addition, I am watching defensive sectors like consumer products, utilities, and healthcare. These are not recommendations for buying. They may make money or lose money—just like any other investment. They are areas I am watching.

Here is my educated guess on two paths forward for U.S. stocks. Both the red and green have short-term drops, and both include an eventual U.S. recession. Why? I do not believe banks are in the clear yet. We have the debt ceiling debate. Higher interest rates are taking their toll on consumer spending, especially big-ticket items like homes.

Finally, unemployment claims are rising. They moved above 250,000 for the first time in a year. This is a critical level that I keep on a sticky note by my desk. The next red flag will be if it averages above that level for four weeks. More on this indicator in the weeks to come.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.