Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

We are at a critical juncture. We are no longer just fighting inflation. Economic pain can now be seen in the numbers. From banks to consumers, it is clear that a slowdown has begun.

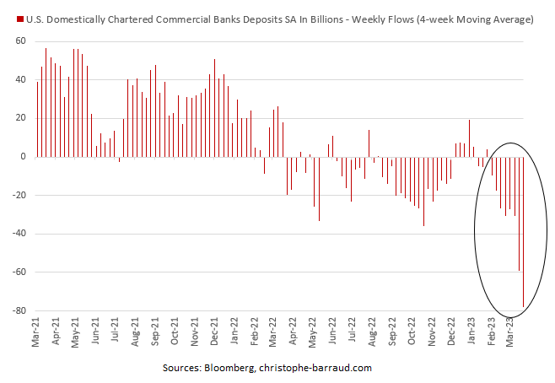

Banks continue to have outflows. I see three explanations for this: (1) Americans are moving savings to “safer” banks, (2) They are spending their saving. (3) Banks are hurting from rising rates and keeping yields too low, pushing savers to look for higher yields elsewhere. Of these explanations, I see the third as having the most significant impact. Regardless, here is what the outflows look like.

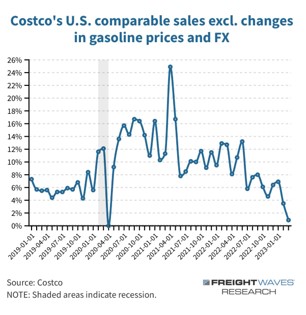

In China, government spending drives the economy. In the United States, government spending is less than 10% of growth, business spending is just over 20%, and consumers are around 70%. Our economy is one where companies pay workers, and workers spend. As discussed a few months ago, even a 2% decline in consumer spending causes a U.S. recession.

Spending on gasoline and food tends to be stable, so it is the change in discretionary goods that makes the difference. Last week, Costco released its revenue, excluding gasoline and FTX (currency fluctuation). Look at the trend. These numbers include food, and they clearly show that consumers are pulling back.

Americans are saving just 3.7% of their income on average. That is one of the lowest savings rates in U.S. history. At the same time, credit card debt is increasing as fast as in 1999. Inflation is still around 5%, and the Fed is raising interest rates at the fastest pace in over four decades. I think it is fair to say that consumers are in the most precarious place they have been since 2008. The bond market is convinced that a recession is coming in the next six months, and the Fed will act quickly to save us. Stock investors seem to anticipate no changes to the status quo. In my opinion, few things in life are as certain as change.

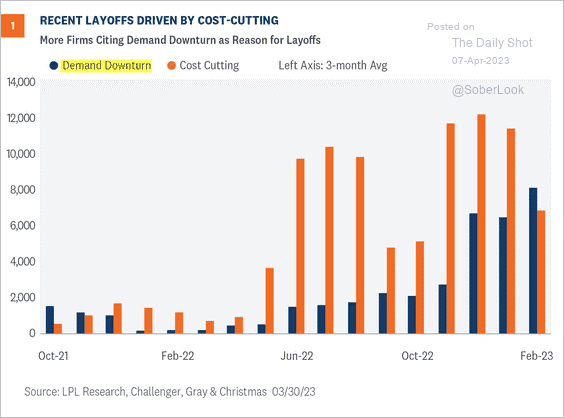

The next domino to fall could be jobs. The good news here is that the latest report stated that the unemployment rate is 3.5%. Another report does not come out until May. Until then, I will be watching weekly unemployment claims, which come out each Thursday. As a rule of thumb, anything under 225,000 is good. A number greater than 250,000 is a sign of deterioration.

Where Are We Headed?

Investors currently believe that the Fed may raise interest rates one more time and will lower them three times before the year’s end. I think this is overly optimistic. The Fed has said it will not pivot this quickly. The only way the Fed changes its mind is if inflation falls quickly AND a recession comes. Last week, the jobs report showed that the economy is slowing, but not that much. This week, we find out if inflation will give the Fed any room to pivot. How investors interpret this inflation report may determine the path forward in the coming weeks. I see the potential upside as limited and the possible downside as much greater. I am heavily favoring less risky investments right now.

- Green Path: A positive surprise will mean that the Fed can pause on rate hikes. I believe this could push the market higher. However, my ultimate view would still be that a recession is coming. (This is based on the yield curve discussed a couple of weeks ago and the slowing consumer demand mentioned above.) I believe this scenario is less likely.

- Red Path: A negative reaction to the inflation report could be dangerous. Investors have ignored many negative signs this year. That could change this week. Of course, anything could happen. I will be watching carefully.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.