The loss of lives and freedoms that will result from the Russian invasion is a human tragedy. While investors certainly understand this, the stock market reaction could be surprising.

My bullish attitude was renewed on Jan 21, 2022, when I started adding risk to accounts. Since then, I have made a few changes but have been cautious with additional modifications. Overall, my views can be summarized by stating that the U.S. economy is doing well and the stock markets are oversold.

Sentiment: A Contrarian Indicator

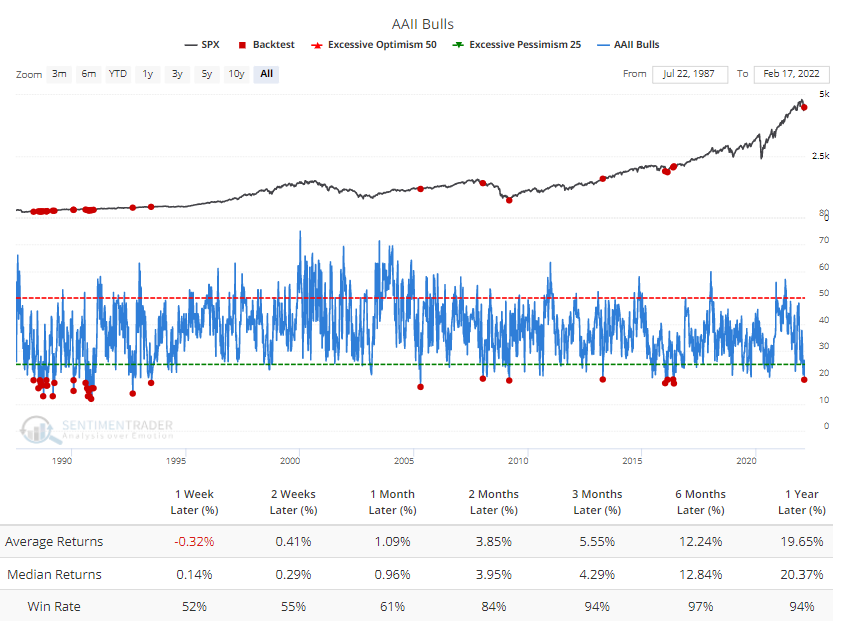

The AAII sentiment index shows that only 19% of investors feel bullish right now. That is one of the lowest numbers you will ever see and is actually a positive sign for the markets.

Why are investors so bearish? Looking at the indexes, losses have been pretty mild, but a near-majority of the stocks many investors are concentrated in have been cut in half. This “stealth bear market” began 12 months ago.

Investors are feeling extremely nervous, and as they feel better, they will move money back to stocks. When bullish percentages have fallen below 20% in the past, the market has been higher 3 months later 94% of the time. The average return in that 3-month period has been over 5%

Fed Hikes: Priced In

Markets are now pricing in 7 rate hikes of 0.25% each. There are likely to be 4 this year and 3 next year, which would get us to a rate of 1.75%. That is massively accommodative given that inflation is running at more than 4 times that number. Could the Fed surprise us? In light of recent turmoil, any surprise would be a less aggressive Fed, which would be welcomed by most stock investors. Plus, inflation could very likely top around 8% and begin a decline towards 4%, which would allow for a more accommodative Fed.

Russian Invasion: Concerning

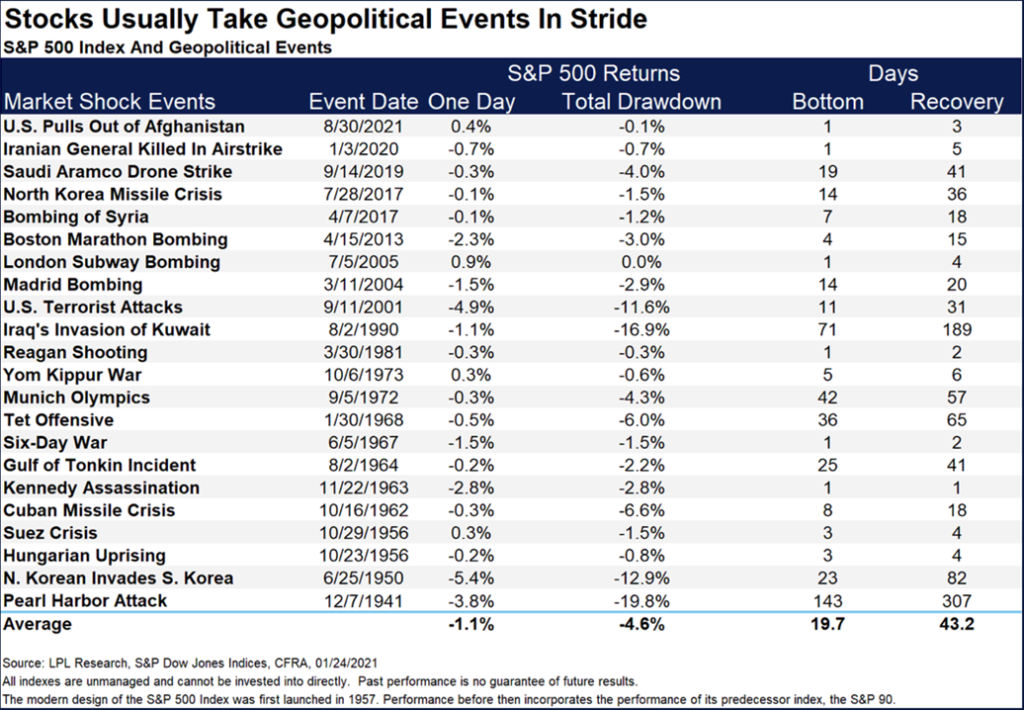

Russia’s invasion of Ukraine is a major geopolitical event that is reshaping the world. As investors, it is our job to look at the financial impact, especially here in the United States. If war does not spread, then I believe the impact on the U.S. economy will not be as bad as many fear.

Does this mean investors should buy the invasion? There is no way to know, but this is exactly what history would suggest. Volatility will be higher, and investors will have ups and downs, but the overall impact of war is low as long as there is little damage to productivity centers.

The greatest factor right now is that markets hate uncertainty. And as time goes on, regardless of what happens, the uncertainty should decrease, and many sitting on the sidelines are likely to move in.

The S&P 500 index is often considered to represent the U.S. stock market. One cannot invest directly in an index. Historical performance does not guarantee future results. An investor should carefully consider the investment objectives, risks, charges, and expenses before investing.