Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in markets.

Down on Good News?

Stocks bottomed on bad news (inflation) in October and topped on good news (inflation) in December. How ironic is that? In October, inflation showed little improvement when it was reported to be 8.2%. Markets initially fell and then exploded higher. Last Tuesday, inflation was reported to be 7.1%, which was better than the expected 7.3%–good news because it gives the Fed flexibility to slow hikes. Stocks initially rose almost 3% and then lost nearly all the gains within hours. These are classic examples of the Wall Street mantra, “Buy the rumor and sell the news.”

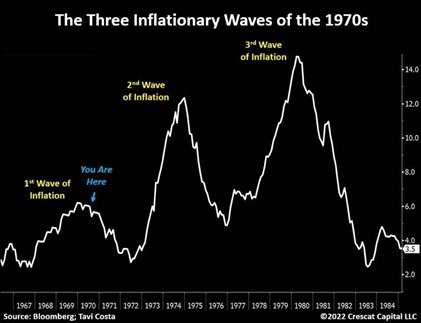

The Fed repeatedly stated that it did not want to make the same mistakes as it did in the 1970s. Here is a graph of inflation at that time. The Fed did its job, and inflation still returned. The 2022 Fed has shown us that it doesn’t want three waves of higher inflation. If that continues to be the path, then I expect there will be more economic pain coming. The next domino to fall might be employment, which is currently looking strong.

What Happened? The Fed Did What It Said It Would Do.

Last week, I projected a bounce for stocks, followed by a more significant move down, which is exactly what happened. The move-up was larger than I expected but lasted just a couple of hours. In 72 hours (Tuesday morning to Friday morning), the S&P 500 dropped 7%, and the market only made 14% from its October lows. So, we are in the downward channel described in my previous commentary.

If you think most people saw this coming, think again. I don’t have space to get into all the indicators I track daily/weekly, but one comes from the National Association of Active Investment Managers (NAAIM). It shows that its members were buying right at the top. Ouch!

Those who missed my commentary on why this happens repeatedly can read the 11-19-2022 commentary on our website. The timing is sometimes unclear, but the signal is good.

Not everything went down as the Fed raised interest rates. Most bonds rose in value. This may mean that investors have moved from inflation fears to recession fears. That makes bonds more attractive than they have been in a long time.

Education Section: The Economic Cycle Signals Opportunity

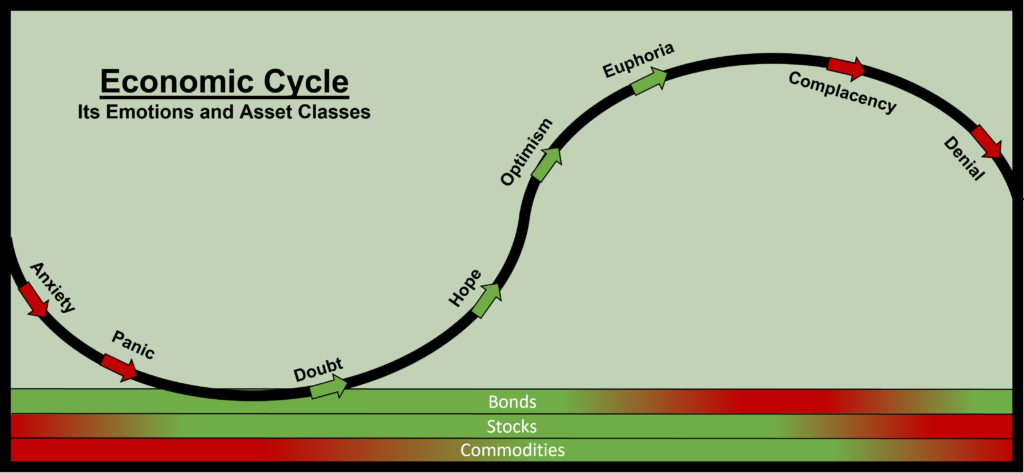

The economy cycles up and down, leading other investments to move up and down. In a normal cycle, I expect bonds to start moving up, then stocks, then commodities. They would all move upwards together for a time until inflation becomes a concern. Then bonds would start moving lower, followed by stocks and commodities. While these assets do not always behave as expected, they seem to be moving according to script in 2022—more so than any time I can recall in my professional career. The key to understanding economic and investment cycles is recognizing that they are normal and bring opportunities. In good times, there is growth and innovation. Bad times are a reckoning for those who have taken too much risk or even broken the law. It is no coincidence that Bernie Madoff was caught in 2008, and FTX failed in 2022.

Look for “Denial” on the chart. This is where I think the U.S. economy is right now. In my opinion, most Americans do not believe we are in a recession and think one can still be avoided. Maybe they are right. The key for me is that the Fed is committed to bringing inflation down, even if that means slowing the economy. If that stays true, I believe a normal cycle will continue. Move your eyes down to the row titled Bonds. It turns red when the economy is hot because inflation makes the interest less attractive. As the economic cycle turns down, bonds should turn green. This is when they should become a good investment again. Just like all other investments, they will not move in a straight line. Ups and downs along the way are healthy. And just as with the other investments, they can go in any direction at any time. They don’t need our permission or our understanding.

Where Are We Headed?

The market has given up a month of gains in just a few days. Probabilities favor a bounce going into year-end, but surprises usually occur in the direction of the trend. The graph below shows my expectation on approximate targets and duration. I want to emphasize again that this is an educated guess. Anything can happen, especially in periods as short as a few days/weeks. One key is not to feel too excited about moves up or down. Financial advisors help plan for long periods of time, like 10 to 40 years. That is the correct perspective for investing. It will allow you to make better decisions and help you focus on living your life.

I will be following the markets over the coming weeks. However, my next Market ViewPoint will not be published until after the New Year.

One Comment