| Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market. |

Stocks and Bonds Disagree With the Fed and With Each Other

The Federal Reserve is getting close to bringing the economy down from elevated inflation. The hope is to get prices to stop rising without causing a recession. The target is in sight, and the market is moving up in anticipation. However, this is the same hope that fed the market in August and November. Both turned out to be false hope.

Since my last commentary, stocks have patiently waited for any reason to go up. Bonds have risen on both bad and good news. While I welcome positive returns, I don’t anticipate the status quo will continue.

Bonds are moving up as if inflation is over and a major recession is coming. Stocks are moving up as if the Fed has threaded the economic needle. The Fed minutes, released this week, show members are worried about this very thing: investor optimism is negating all the Fed efforts to slow the economy. So, the Fed plans to keep rates high.

When the Federal Reserve struggles to convince markets, it begins repeating a clear message. In recent years, we have heard the following:

- We are not even thinking about thinking about raising rates (2020)

- Transitory inflation (2021)

- Higher for longer (2022-2023)

The first two turned out to be mistakes, so is it any surprise that stock and bond investors do not believe the Fed now? More on this in the education section.

What Happened Last Week?

On Friday, the U.S. government reported that we have roughly 159 million American workers and an unemployment rate of 3.5%. This brings us back to one of the lowest national rates we have ever recorded. We also learned that wage increases slowed to a 4.6% average increase in December. This mixed data sent stocks up and then back down again.

Shortly after, we learned that the services industry contracted in December—a signal that the economy is already slowing. The stock market took this bad news as good news. It moved up and did not look back.

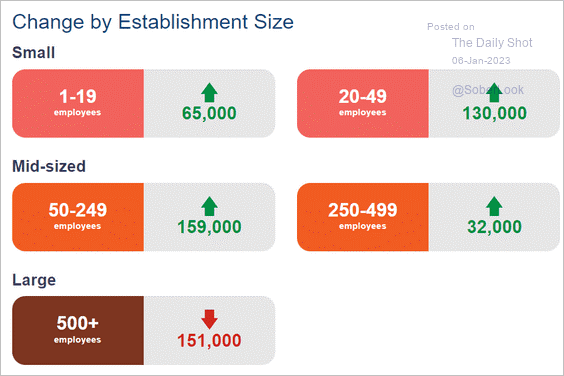

In the last two years, major U.S. companies have reduced workers. The following graphic shows that smaller companies have been making up the difference.

Education Section

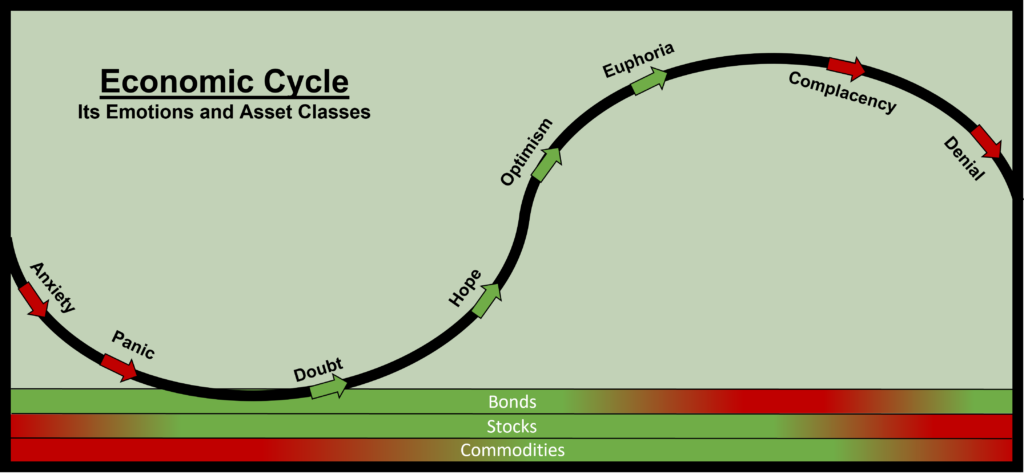

In my last Market ViewPoint, I explained how the economic cycle relates to bonds, stocks, and commodities. Over short periods (days and weeks), these assets do not usually move perfectly in sync with the graphic. For example, over the last three weeks, I have seen the following:

- Bond prices are rising

- Stock prices are flat

- Commodity prices are falling

These might behave this way if we were coming out of a recession. You can see that I labeled such a time with emotions of panic and then doubt. Perhaps it is ironic, then, that I doubt them. Why? I never saw Americans panic. I will have to keep an eye on things, just in case the economy does somehow manage to skip that step.

Currently, the Fed has rates at 4.25%-4.5%. Let’s call it 4.5%. It says rates will likely go to 5.25% and stay there until at least 2024. Not a single member of the Fed projected a lowering of rates in 2023!

Bond prices are rising because investors are planning on the Fed lowering rates by at least 1.5%, beginning in 2023. This is the opposite of what the Fed is saying publicly. In fact, the only way I see it happening is if we get a significant recession.

Stocks, however, are refusing to accept that this recession is coming. They have moved sideways for three weeks. I expect this will mean a big move is coming, which could be up or down.

The smart money is not trading much right now, which means the traders and speculators have been moving the markets.

Where are we headed?

The recent market bounce was exactly what I expected at the end of 2022. It came late, which has pushed it beyond the lines I have drawn as guides to our current trend. If you study the image below, you will see that this is not unusual.

In many ways, the current movement resembles that of last April. The initial drop in April had a long pause that was followed by an upward move outside the trend. Then came the big surprise—a quick move down. I believe something similar could happen this week, and I have marked the path with red arrows.

I added a second scenario in green arrows that show the market revisiting its November highs. I do not expect this, but I will watch the S&P 500 for a move above 3980. This will be my indicator that we are on a different path than I have been projecting for months. Markets move fast, and we will manage the risk according to our understanding of the current situation.