First base was my position. I quit playing baseball in high school to pursue other opportunities, but a piece of my heart remains at first base even today. Knowing how to catch is probably the most important of the many skills required to play the sport.

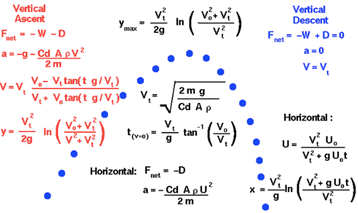

To position yourself correctly to catch a pop fly, you must consider several variables, such as the speed of the ball, its height, and wind resistance. The formula required to calculate where the ball will land looks like this:

I have completed the process of catching pop flies thousands of times. Yet not once did I ever solve this complex equation. My coaches never taught quadratic functions at practice, and I have never purchased an algebra book at a sporting goods store.

Through experience and some common sense, catching pop flies becomes routine. One instinctively reacts to the situation in the way that gives them the best chance to succeed.

Recessions and bear markets are like pop flies in some important ways. They are inseparable elements in their respective worlds, and reacting properly is paramount to success.

Here are five winning reactions to recessions and bear markets. Like reacting to pop flies, these behaviors should be procedural. Excessive deliberation at each encounter would be similar to doing math on the ball field.

Reduce Excess Spending

A struggling economy can create problems on an individual level. Reducing excess and unnecessary spending is an important step to fortifying yourself financially. Review your budget and allocate funds to places that better serve you.

Minimize High-Interest Rate Debt

High-interest debt, such as credit cards, can chip away at your financial structure. Although there is never a good time to carry high-interest debt, heading into a market downturn could be the worst time. Minimize and pay off bad debt.

Evaluate your Emergency Fund

A distressed economy leads to higher unemployment. An emergency fund is designed to get you through those kinds of tough periods. Make sure you have a healthy emergency fund of 3-6 months of expenses; more if you feel necessary.

Continue to Invest

With great volatility comes great opportunity. More money is made after a down market than at any other time. Don’t stop investing! A down market means a market on sale. It may be the best time to invest if you have extra cash, even though it’s emotionally difficult.

Focus on the Big Picture

Don’t get caught up in the bad investment news of the day. Markets have always had periods of volatility, and they have always recovered. New market highs are continually around the corner. Be patient and keep a long-term perspective.

Listen to a deep dive about Winning Reactions on the Power Up Wealth podcast.

One Comment