In 2020, the Congressional Budget Office projected that U.S. debt would hit 34 trillion dollars in 2029. Challenge accepted! The government blew through that number in December 2023.

This represents a 50% debt increase in less than four years. Many now claim that America’s financial future is doomed. I believe this is inaccurate and produces unnecessary anger and fear.

What Is Government Debt?

The government does not have credit cards. It borrows by issuing treasury bonds. What we refer to as government debt is an accounting record of outstanding bonds in the world economy.

Treasury bonds are considered a safe and secure investment. In times of economic uncertainty, private investors and world governments run to treasury bonds for financial stability.

Liability or Asset?

If it were possible to magically erase the government debt, I’m confident that most would choose to do so. But what if we magically erase government treasury bonds?

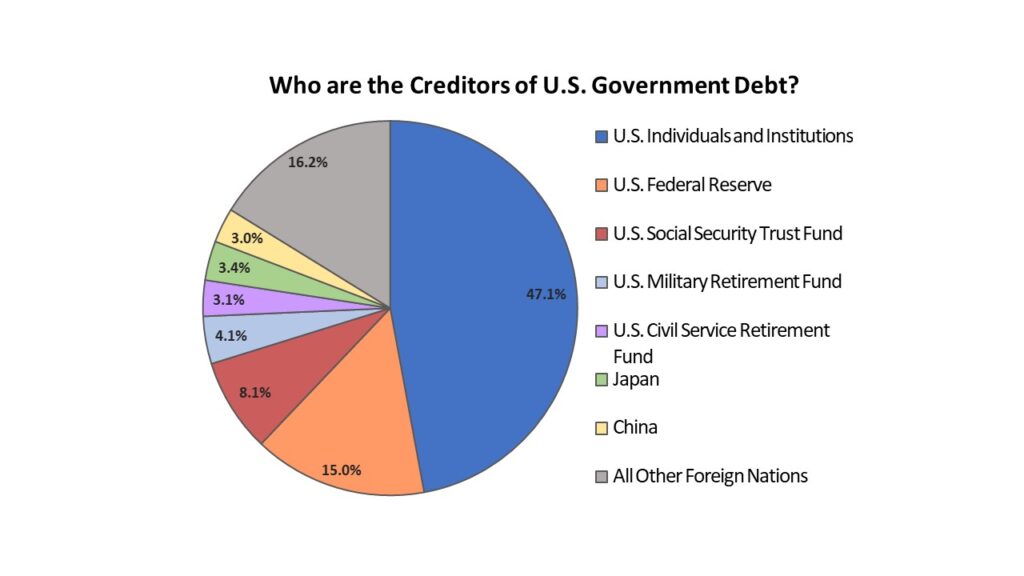

Treasury bonds are a valued asset that support pension funds and provide stability to retirement accounts and investment portfolios. They represent a significant portion of Americans’ savings. To erase treasuries would be a costly mistake. However, the national debt and treasury bonds are two sides of the same coin – to erase one would be to erase them both.

When a liability is counted on one side of the ledger, an asset must be counted on the other. If government debt is an asset to the public, then a government deficit is a public surplus. $34 trillion in government debt is equal to $34 trillion in investment savings.

Government Debt Is Very Different from Other Debt

A significant misunderstanding is that government debt and household debt function similarly. I personally have a budget constraint. I cannot continue to add to my personal debt without eventually defaulting and going bankrupt. Neither can my neighbors nor can businesses. Therefore, it seems reasonable to conclude that government finances work the same way. They do not.

For one, the government issues the currency. The issuer of the currency cannot run out of money. They can never have bills that can’t be paid. They cannot become insolvent. The saying “money doesn’t grow on trees” is true for us, but it is not true for them.

Economic Growth Requires Government Spending

Let’s say that the government wants to invest $1 trillion into infrastructure, and they finance it by way of debt. They will issue $1 trillion worth of bonds. Investors purchase these low-risk bonds and are rewarded with interest. But infrastructure projects also create jobs and require trade, which grows the workforce. With a larger workforce, public income is increased. With higher income comes greater spending, which creates greater demand. This demand stimulates, grows, and strengthens the economy.

So not only does this government debt provide the public with investment bonds, a more robust workforce, and a stronger economy, but it also provides the infrastructure for a better community and greater capacity for future growth. We would not have the economic strength, luxuries, and stability that we enjoy today without government debt.

Government Debt to Gross Domestic Product (GDP)

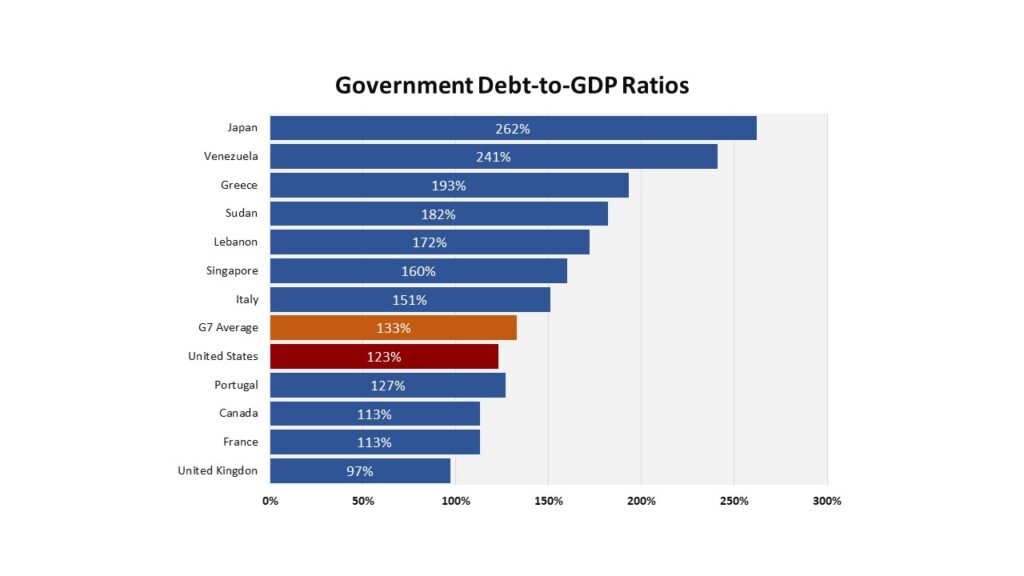

Despite the fact that government debt is essential for a growing economy, there is a balance that should be maintained. However, looking at the value of the debt alone does not provide any meaningful information. A better indicator in determining the sustainability of the national debt is to compare it to the size of economic activity or the Gross Domestic Product (GDP).

The current debt-to-GDP ratio for the U.S. is 123%. There is great debate as to what a healthy debt ratio is. Some economists claim this is a healthy level, while others believe it is high. The conservative consensus is that we should be under 100%.

So, Does the Debt Matter?

It does, but not like most people think. There are many tools available to the government to manage the debt – tools that are not available for you and me. The primary objective is not a balanced budget but a balanced economy.

The result of too much debt is not default. Again, the government can always print money to pay their obligations. Too much debt and money printing can result in inflation and higher interest rates. These are the threats of too much government debt. These are indicators that central banks monitor.

If investors believe the debt is too high, they may see more significant risk in treasuries and demand better rates or invest elsewhere. World investors believe in the U.S. government and are comfortable investing in U.S. bonds.

I believe the nation’s current spending rate is unsustainable in the long term. I would like to see the current debt-to-GDP ratio come down. I advocate for more responsible spending from our federal government. But I would also like to see real conversations about federal spending and less fear-inducing headlines. We are not at crisis levels of debt. $34,108,749,835,069 is a massive number, but in context, it is not a devastating one.