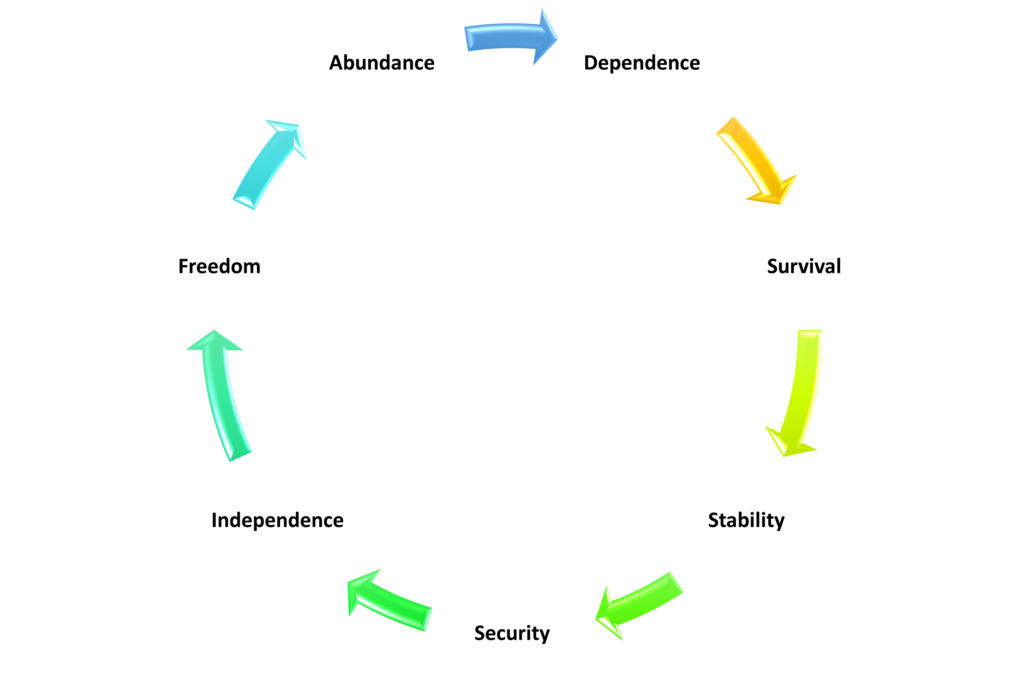

We usually think of wealth generation in a linear fashion, like traveling down a path or going up steps. It has the following levels: dependence, survival, stability, security, independence, freedom, and abundance.1 Many people progress along this path, but it seems like some are trapped in the dependence/survival levels, and some are perpetually in the freedom/abundance levels. Hence the saying, the rich get richer, and the poor get poorer. However, something entirely different is happening. This is the paradox of wealth.

This wealth cycle seems straightforward. You can probably relate to the different levels of wealth: dependence, survival, stability, security, independence, freedom, and abundance. In your formative years, you were dependent on your parents. Then you got your first job, car, house, and bills and were in survival mode. You got a little further into your career, finances were not so tight, and you were able to save a little, creating stability. Once you have been able to save more and finally pay off most of your debt, you find security.

Paying off all your debt and having a good nest egg gives you independence. Then you have the freedom to do what you want when you want. Finally, you feel like you have more than you will need, which is the final phase of abundance. You may see your own progress somewhere along this line.

In our minds, we picture this as a straight line going up to the right. We imagine families just picking up from where the patriarchs left off and continuing the upward march to ever better levels. Hence, the rich get richer, and the poor get poorer.

However, not everyone attains all the levels of wealth. There is a whole segment of society that is trapped in poverty. Relatively few seem to break the cycle to find stability and security. We do see people starting in middle-class security and progressing to where they move to freedom and independence. We see entrepreneurs who create businesses that sell for millions (or billions) of dollars, catapulting them into the abundance category. We often think that once they get to abundance, their family is set. They have reached the pinnacle, and they are never going back.

The paradox of wealth is that for 80% of “rich” families, the wealth will be destroyed within two generations. That means the family “riches” are squandered and the third generation must start all over again. This perpetuates the wealth lifecycle, which paradoxically means the rich get poorer and the poor get richer. Extend it out one more generation to the third generation, and 90% of “rich” families will lose their wealth. Only 10% of families maintain their wealth beyond three generations.

This doesn’t just apply to those in the abundance phase. This also applies to those in the security, independence, and freedom phases. Many times, we see clients that have worked hard their whole lives to build a nest egg of security, only to see it consumed when it gets to the next generation.

What is counterintuitive is that we shouldn’t picture wealth generation in a linear fashion. We need to picture it as a circle that goes around. (See graph) Sometimes, there is a progression from one level to another level. Sometimes, there is a regression back a level or two. Paradoxically, the next step from abundance is dependence, which occurs when a family comes full circle, destroying the wealth that was so carefully cultivated and protected.

In the U.S., this phenomenon of families losing their wealth is referred to as shirtsleeves to shirtsleeves in three generations. However, it isn’t unique to the U.S. In Ireland, it is called clogs to clogs in three generations. In China, it is called rice patty to rice patty in three generations.2

So, if this phenomenon is worldwide, why does it still feel like the rich get richer and the poor get poorer? While this seems counterintuitive, research proves that “The vast majority of affluent clients are New Money, not Old Money. Approximately 80% of…individuals have come to their wealth during their lifetime, not having been born and raised with wealth.”3

Wealth is being generated, but it isn’t from just the rich. Some of the rich stay rich, and some of the poor stay poor. But conversely, some of the rich become poor, and some of the poor become rich.

If you are starting out along the path and are just struggling to make it from survival to security, keep your spirits up. We live in the United States, where the American dream is still alive. You can progress around the circle of wealth and find more security, independence, freedom, and even abundance.

If you have already found independence, freedom, and/or abundance, and you are worried about the next generation, take heart. There are ways to follow the path of the 10% of families that maintain wealth beyond three generations.

The keys to maintaining wealth are found in communication, education, and a change in mindset.

The paradox of wealth is that the rich get poorer, and the poor get richer. It doesn’t need to be that way. If the right principles are implemented, we can help lift the poor out of poverty and also help family wealth be maintained and grow over time.

Click here for a deep dive into the Paradox of Wealth.

- https://www.caminofcu.org/understanding-the-7-stages-of-financial-independence/

- Wealth: Keeping it in the Family.

- US Trust Survey of Affluent Americans, 2007; Phoenix Wealth Survey Executive Summary, 2007; Capgemini/Merrill Lynch World

Wealth Report, 2009.