Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not.

Anything can happen in the stock market.

Coke and Pepsi Economics. Last week, Coke stated that product sales were down by 6%. Its profits still managed to rise. How? Well, they continue to raise prices—the current figure reflects a price hike of 9%. Pepsi had a similar situation: their unit sales decreased by 5%, but they compensated by raising prices by 8%. As investors, this situation seems acceptable for now. As American workers, we will adapt. And as U.S. consumers, it stinks—we are paying more and receiving less.

Last week, retail sales surprised us. They revealed that U.S. consumers reduced spending by 0.8% in January. This is unusual, as Americans rarely cut back on spending. It might be the first significant sign of an economic slowdown in months.

Stagflation, characterized by high inflation and a sluggish economy, is becoming more evident. Just look around—from Coke to McDonald’s, prices are rising. And these corporate price increases are a major factor in our current economic growth.

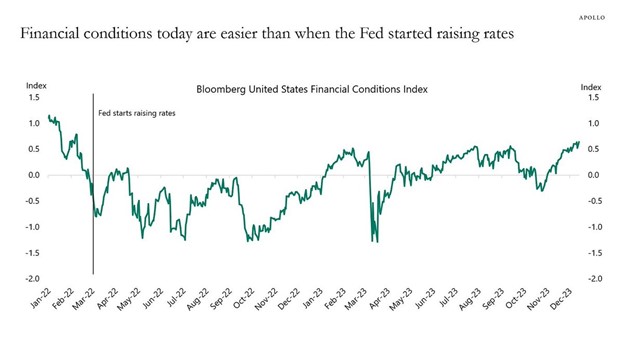

Who should we hold responsible for inflation? The answer lies with all of us. Corporations are doing what they can to maximize profits, and consumers end up footing the bill. While we could cut back, society remains in a consumption mood. Public opinion also influences government spending (fiscal policy). Additionally, the Federal Reserve’s leniency in financial conditions supports the status quo. These factors contribute to the persistence of sticky inflation.

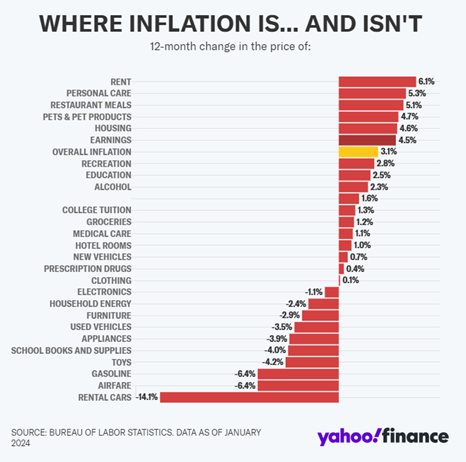

In my previous Market ViewPoint, I highlighted that while some goods experienced price fluctuations, finished products haven’t been as forgiving on our wallets. Inflation affects different areas in varying ways—this truth remains constant—even when inflation is around 3.1%.

What I am Watching

Energy Prices: If the economy is doing alright, then I would expect energy pricing to hold up. Oil prices dropped below $70 a barrel a few times last year. Given all the geopolitical conflict and uncertainty, I think this was a gift to consumers. I will be watching to see which way it goes from here. A pushback above $85 a barrel would likely raise gasoline prices and potentially end those “easy financial conditions” I mentioned earlier. It would feel like a repeat of the summer of 2008. On the other hand, if the prices remain stable in the low $70s, it makes a good economy more likely.

Inflation and Interest Rates: Short-term interest rates are still higher than longer-term rates. This inversion has persisted for a couple of years. The “soft economic landing” is not a reality until we get these rates back to something more normal. Eventually, either longer rates will rise above the short ones, or the short rates will drop below the longer ones. The Fed is responsible for the short-term rates. It will not lower them until it is convinced that lower rates will not reignite inflation.

Employment: Unemployment is at 3.7%, which is incredibly good. The economy looks good to me if the number stays below 4%. However, consumer spending has shown some cracks in recent weeks. Spending slowed, and loan defaults rose. Credit card debt is at record highs, and so are the interest rates banks charge. Falling behind—how can one catch back up?

Everywhere one looks, the glass is either half full or half empty.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.