With a new year and the passing of SECURE Act 2.0, there are many changes taking place in the world of personal finance, particularly when it comes to retirement planning. The SECURE Act 2.0 was included in a 4,155-page, $1.7 trillion piece of legislation that passed on December 29, 2022. I have studied the Act in detail and outlined here what I believe to be the key points of interest.

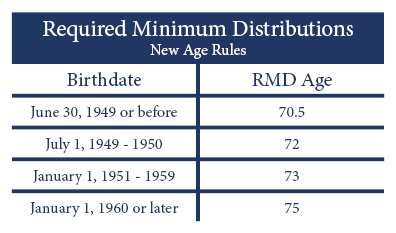

Just like its predecessor, the SECURE Act 2.0 has pushed back the age for required minimum distributions (RMDs) from retirement accounts. We are happy to see this change as it provides greater freedom and flexibility to investors and allows assets to grow tax-deferred for a longer period of time. However, it also adds a greater need for tax and distribution planning as retirement accounts can end up with larger balances and fewer years of required distributions.

In addition to RMD extensions, the penalty for failure to take an RMD has been reduced from 50% to 25%. If a forgotten RMD is taken “within a timely manner,” the penalty will be further reduced to 10%. We applaud this change.

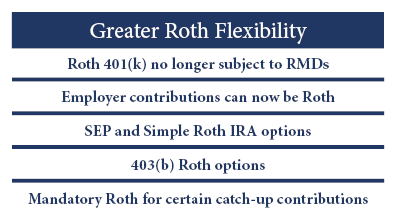

The SECURE Act 2.0 also eliminates the mandatory RMDs from 401(k) Roth accounts starting in 2024. This was a much-needed change as Roth IRA accounts have never had mandatory distributions. Because Roths grow tax-free, the longer we can leave assets in them, the better. The Act also expanded Roth options to include other retirement-type accounts and employer-matching contributions. We are very excited to see this, as the Roth may be the greatest wealth-building vehicle available.

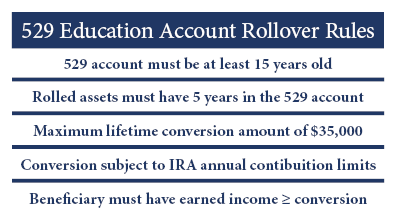

Another welcome change pertains to the 529 education savings account. In years past, there were two options if an account beneficiary did not use all the assets available to them. They could take a taxable cash distribution and pay a 10% penalty, or a new beneficiary could be named. Starting in 2024, account owners will have a third option; they will have the ability to roll 529 assets into a Roth IRA in the name of the beneficiary. This change makes the 529 plan even more attractive for those planning for future qualified education expenses.

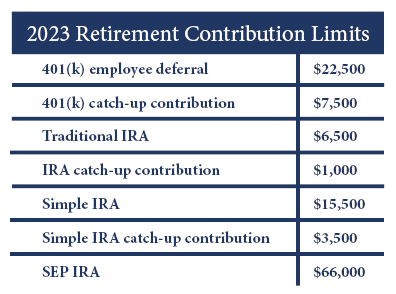

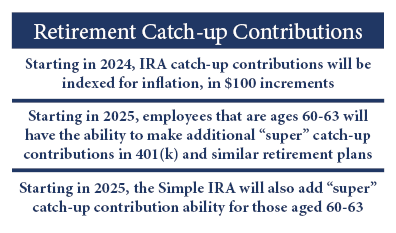

It is now possible to save more money in your tax-advantaged retirement accounts. Although rising contribution limits for 2023 did not come by way of the SECURE Act, the Act did include beneficial changes that will also result in greater savings limits.

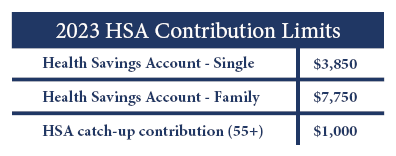

Annual contribution limits have also increased for Health Savings Accounts (HSA). These are fantastic vehicles for tax-advantaged medical savings for those who qualify.

For those over 50, retirement accounts allow for additional catch-up contributions above the standard contribution limits. This has long benefited investors who are nearing retirement. The SECURE Act 2.0 added a “super catch-up” contribution ability for those ages 60, 61, 62, and 63.

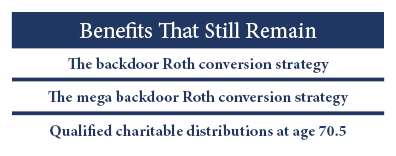

In my opinion, the most exciting part of the SECURE Act 2.0 was not what was in the Act but what was left out. Rumors have swirled for months regarding changes that would prohibit current strategies. We could not be happier seeing that the backdoor Roth options were untouched. This is great news indeed.

The SECURE Act 2.0 adds greater flexibility and many desired saving and investing opportunities. Although many of the benefits are not yet available, we look forward to their implementation. We also look forward to helping our clients adjust their financial plans and strategies to take advantage of what the SECURE Act offers. If you have questions about the SECURE Act 2.0 and what adjustments should be made to better help you reach your financial goals, please reach out to us directly. We look forward to speaking with you.

Listen to a deep dive into in the SECURE Act 2.0 on the Power Up Wealth podcast.

2 Comments