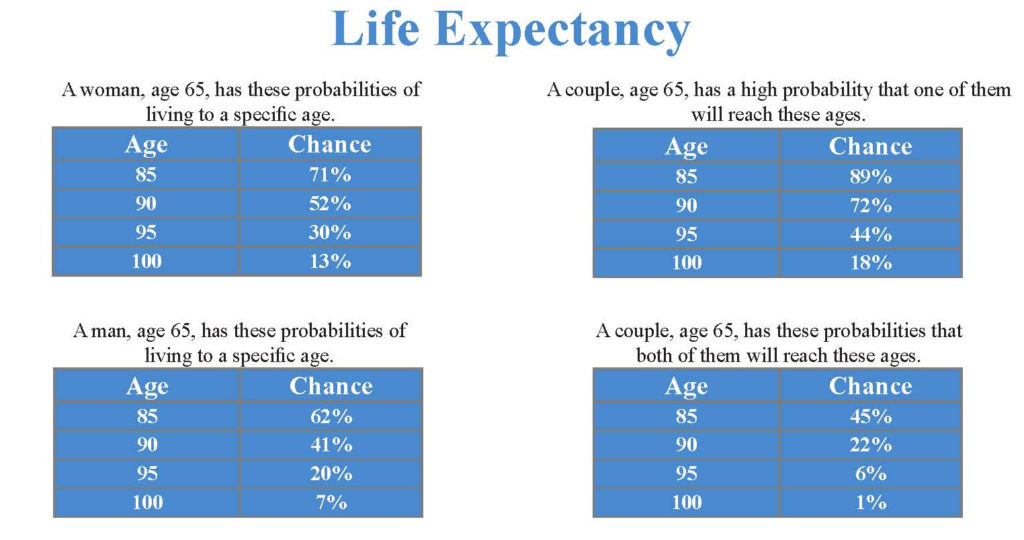

Retirement is the time to enjoy the fruits of years of hard work and saving. But longer life spans are changing the financial picture for many retirees – living longer requires more money.

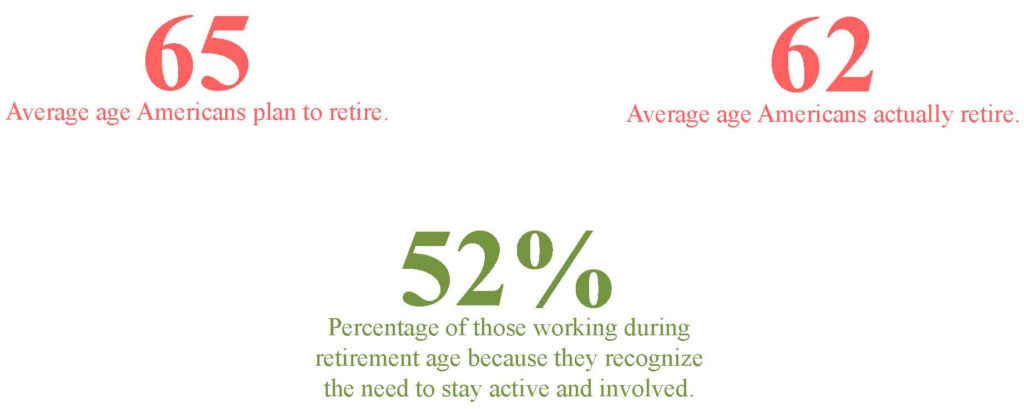

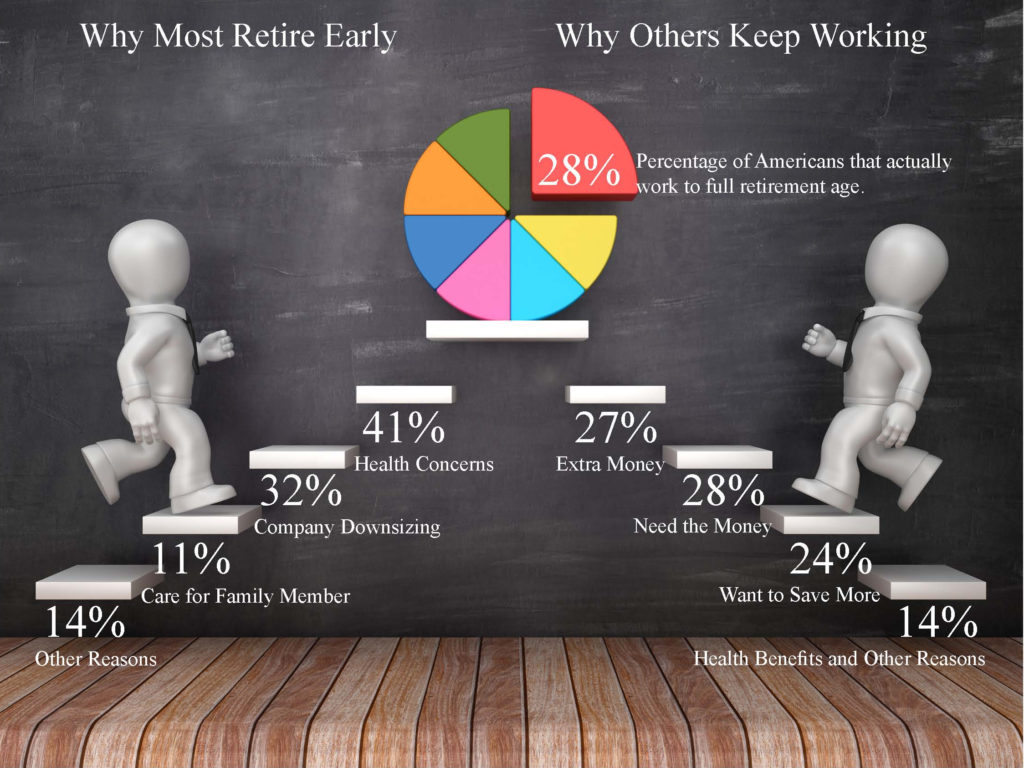

You may not have complete control over when you retire. Some people plan to work beyond age 65, so they have money to travel, buy extras, or postpone dipping into their nest egg.

Unfortunately, many people are forced to retire before they had planned due to poor health, company downsizing, or to help care for family.

Longer life spans are only part of the concern. Pensions are no longer mainstream for most workers. Where 51% of Americans over age 77 have a pension, only 16% of millennials will have pensions. This makes saving for retirement early and saving more very important.

A consistent annual savings of 10% to 15% of gross income is recommended when planning for retirement.

Unfortunately, the average annual savings rate among Americans is 8%, far below the recommended level and changes from year to year. It’s been as low as 3% and as high as 15% – which occurred in 2020 when U.S. government stimulus increased household income.

To hedge against the cost of living longer, it is crucial that Americans tap into all available savings opportunities and set aside as much as possible.

Source: JP Morgan Guide To Retirement

Listen to a deep dive about the retirement numbers on the Power Up Wealth podcast.

One Comment