Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

One-dollar cheeseburgers are not coming back to McDonald’s. Some prices rise and fall. Others just seem to rise. Lumber costs skyrocketed in 2021 and have now come back down. Housing prices have not dropped to old levels. Gasoline prices moved up significantly in 2022 and have now come down. Vehicle prices have not. I do not think they will.

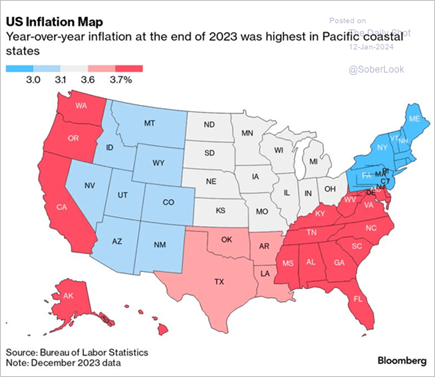

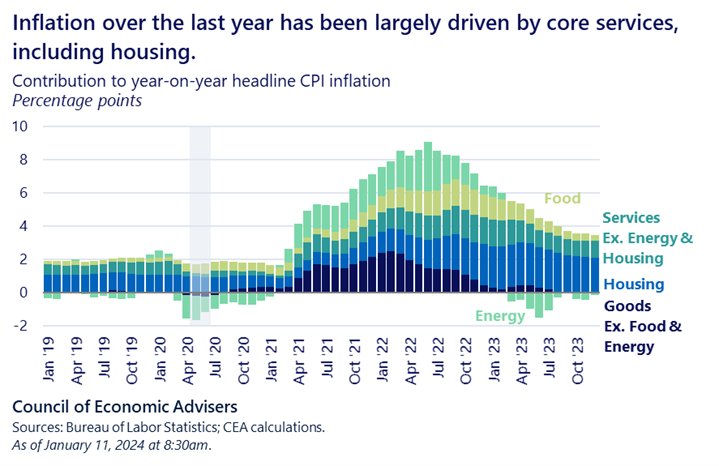

It takes economic force to get from 9.1% inflation (2022 CPI high) to 3.4% (current). Pushback from consumers who are less willing to pay higher and higher prices helps. The next goal is to thread the needle of keeping that rate low without allowing it to turn negative. We are at that pivotal moment when it appears that the mission has been accomplished. The next question is, “Where do we go from here?”

Background

Inflation is the silent killer of money. It degrades the purchasing power of our income and savings. After decades of incredibly low inflation, it has exploded higher and become the number one concern for investors over the last few years.

Good inflation is when we believe that a new refrigerator will cost more a year from now, which incentivizes us to buy one now. Many businesses are fine with higher prices as well if they are charging them. If revenue rises faster than costs (many are fixed), then profits also increase.

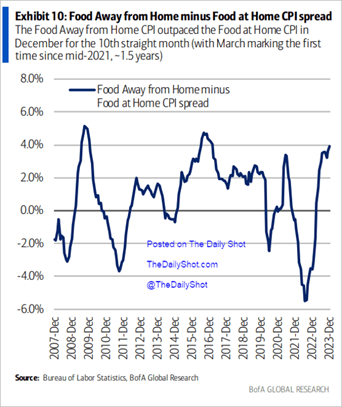

Bad inflation is when excessive price increases force consumers to pull back on spending. Changing our behavior is much easier said than done. The following chart displays the cost of eating out versus eating at home.

Ugly inflation is deflation, which is falling prices. It seems good, but it is not. Deflation is dangerous. The last real struggle with deflation was during the Great Depression.

Expectations matter. The average U.S. home fell 20% in value from 2006 to 2010. The national scope and magnitude of change were shocking. Banks were failing. Construction ground to a halt. Now, imagine if we all knew that home prices would fall. Few people would buy in 2006 and 2007. The financial disaster would be self-fulfilling and likely even deeper.

This brings us to the Federal Reserve. Its mandates are (1) stable prices and (2) full employment. Historically, it has been a balancing act as full employment can lead to more spending, which could turn into higher prices.

In the 1990s and 2000s, the Fed found that keeping investment values up would help accomplish both mandates. During this time, another challenge grew that was outside the scope of what the Fed does. The gap between the rich and poor has increased, and social pressure has been building for the government to get more involved.

Higher inflation in recent years was the result of many factors. Some, like the supply disruptions of the pandemic and government handouts of money, were temporary. Other factors appear to be part of a trend: (1) Populist attitude in favor of more government spending, (2) Higher manufacturing costs with less globalization, (3) Greater shipping expense as geopolitical risk rises.

What I am Watching

Investors are excited about the possibility of the Fed lowering interest rates in 2024. They are pricing bond markets for six or seven cuts of 0.25% each. I only see this happening if the economy slips into a recession. If the economy stays positive for the next 24 months, then some repricing may occur, especially in the bond market. Inflation and interest rates will have an incredible impact on how the Fed and investors react.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.