In today’s environment, inflation is a common topic. Whether you are at the grocery store, shocked at the increased price of groceries, or the pump, watching the dollars ratchet up as you fill your vehicle with gas, you are experiencing inflation.

Inflation, as measured by the Consumer Price Index (CPI), has been reported since 1914. Looking back, inflation has averaged 3.23% from 1914 through 2021. This isn’t a steady number. It fluctuates from year to year and has been as high as 23.7% and as low as -15.8%. More recently, year-over-year inflation as of July 2021 was measured at 5.4%.

While you may find this information fascinating, I want to focus on what this means to you and how to prepare for the future. Inflation can deliver a severe blow to your retirement nest egg if not addressed in your financial and retirement income plans.

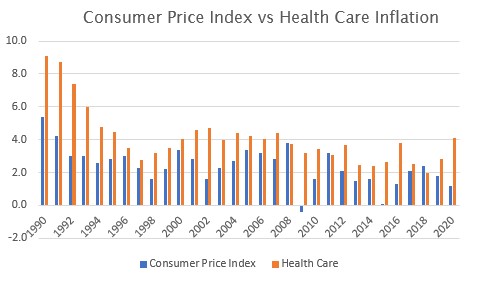

Consider your personal situation. Over the past 20 years, you have experienced increases in food prices, housing costs, vehicle prices, and energy costs. The list is limitless. What if, during that same 20-year period, your income did not increase? How would you stretch your dollar? What would you go without? This is a perfect example of what might happen if you omit inflation from a financial plan. Seniors experience even greater inflation. Healthcare inflation has outpaced CPI significantly over the past 30 years, as illustrated in the chart below.

Seniors experience even greater inflation. Healthcare inflation has outpaced CPI significantly over the past 30 years, as illustrated in the chart below.

While we can trim back on our standard of living if required, one thing we cannot trim back on is healthcare. American’s today are living longer, and as we age, we need more healthcare services. Over the past 30 years, as shown in the chart, CPI averaged 2.4%. Over the same period, healthcare inflation averaged 4.1%. Nearly double!

A solid financial plan incorporates key assumptions. One of which is inflation. Back of the envelope planning leaves inflation out of the picture. For example, you may think if you have $750,000 saved and you take 4% or $30,000 out each year to supplement your income, you should be set. Watch out! If inflation averages 3.23% by the end of 20 years, you will need $54,000 to maintain the equivalent standard of living.

We want you to enjoy the lifestyle you are accustomed to. This means your plan will incorporate increasing your income each year by a certain percentage to offset the impact of inflation. If you have questions about your plan and how it addresses inflation, please reach out to our Wealth Management team.