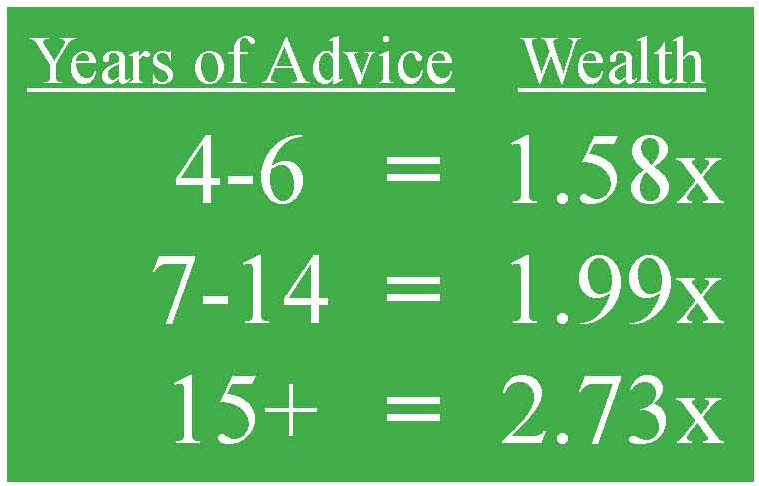

Companies like Vanguard, Morningstar, and Financial Engines have long shown that receiving financial advice is worth a great deal. Vanguard, which is famously fee sensitive, puts the value of advice at about 3% per year. However, what caught my eye recently is a statistic that showed the impact of financial advice over time. It showed that people who received advice for 15 or more years “clocked in at an overwhelming 2.73x multiple” of wealth vs. their no-advice peers. Let’s explain what this means and how it can benefit you.

The Investment Funds Institute of Canada did a study to quantify the value of financial advice. They found a significant wealth disparity between Do It Yourself (DIY) investors and people who pay for advice. That disparity was directly impacted by the length of time people worked with a financial advisor. Those receiving advice for 4-6 years had 1.58 times the wealth of DIY investors. After 7-14 years, almost double, or 1.99 times. And those receiving advice for 15 or more years had an impressive 2.73 times the wealth vs. their DIY peers.

To put it in perspective, if a DIY person saved $1,000,000 towards retirement, the person receiving financial advice for more than 15 years had $2,730,000.

In addition to dollar-and-cents differences, there is also the quality of life differences. Fifty-four percent of those receiving advice replied affirmatively to the question, “I have peace of mind,” compared to only 36% of their DIY peers. In addition, 51% of respondents receiving advice felt prepared for retirement compared to only 18% of their “no advice” peers. “Receiving good financial advice pays a dividend that builds both wealth and confidence.”

The main catalysts for increased wealth and confidence are goals-based advice and behavioral coaching. The study found that families who received advice ended up creating a financial blueprint for their future. This may not sound significant, but in creating a financial blueprint, they materialized their goals and created avenues to reach those goals. Those families also had a good behavioral coach to help them stick to their plan, especially during times of profound fear and greed.

In addition, a good financial advisor might improve your situation through asset allocation, rebalancing, withdrawal strategies, tax efficiency, and product allocation. These benefits are significant by themselves but are most powerful when coupled with behavioral coaching and goals-based advice.

The numbers speak for themselves. Everyone would like to be wealthier. Using a comprehensive financial advisor, like SFS, may help you improve both your means and your quality of life.

Source: Behavioral Alpha: The True Power of Financial Advice. Dr. Daniel Crosby. Oct 17, 2016.