Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in markets.

Introduction

It is said that a wise person learns from his mistakes, while a wiser person learns from the mistakes of others. When it comes to the stock market, we all have endless amounts to learn. This commentary is a bold endeavor to guide readers through the unpredictability of the markets and share the lessons of each week.

Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this commentary may create an illusion that timing the market is simple. It is not. Anything can happen in markets, and it does not always make sense.

What Is Happening in the Market?

The S&P 500 fell 0.69% last week as it bounced around between 3,900 and 4,030. It is either refueling for a move towards 4,120 or has already begun the topping process. Most investors are hoping that the recent decline in inflation will cause the Federal Reserve to slow interest rate increases preparatory to a “pivot.” We have seen this narrative play out several times already this year.

A Fed “pivot” was the story behind the July/August and October bounces. Fed Chair Jerome Powell crushed those hopes in August and in October. They are back again, thanks to an inflation reading of 7.7% (7.9% was expected). Last Friday, Susan Collins, the President of the Federal Reserve Bank of Boston, said that she did not see any clear evidence that inflation is coming down and that another 0.75% increase is “still on the table.”

What about the decline in inflation? From my point of view, there is not much difference between 7.7% and 7.9%, especially when the Fed is planning to slow the economy until we get back to 2.0%.

Many investors agree, which is why many investors believe the market will climb until the Fed’s next decision is announced on December 14th. However, that is more than three weeks away, which to me, looks like a long time for markets to move up with such strong headwinds pushing against them.

Educational Section

Correct decision-making will not earn a positive return every day or even every week or month. However, repeated many times, good decision-making should be beneficial. Sometimes poor decisions result in good returns, which can be quite dangerous as investors learn the incorrect lessons. Profits then turn to losses as the mistake is repeated many times over.

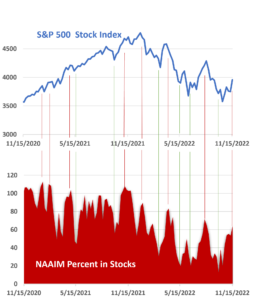

This can be seen in the allocation decisions of other investors. The chart below shows how members of the National Association of Active Investment Managers invest in their portfolios. These are not “buy-and-hold” investors. Most follow momentum strategies, which means they wait until an investment has already gone up and hope that it will keep going. They sell after it has gone down.

I keep track of five different surveys that ask investors how they are invested or how they feel about investing. All produce a result somewhat like this. A peak in stock allocation occurs at approximately the same time as a peak in the stock market. A bottom corresponds to a bottom. The benefit is that recognizing a top in the stock market when it peaks is nearly impossible because there is always a narrative that explains why it has gone up and why it will continue to move higher. However, sentiment is a little easier. For example, in good times, an allocation above 100% signals that the bulls on Wall Street will be taking a break soon. There are a few challenges to turning this into a trading signal.

- High (low) numbers in one year may never be reached in other years.

- A high (low) number can always stay high (low) or go even higher (lower). An important warning, given where we are right now.

- Markets can move fast and often require one to do the opposite of what “feels good.”

- Hindsight is deceiving. In real-time, markets are difficult to predict.

I wrap these allocation and sentiment surveys into one signal. That signal is just one of eight that I am using to make decisions. It is one of the most interesting right now. Could it still go higher? Sure. That is exactly what most people believe will happen. Of course, the whole point of this indicator is to show that the majority could be wrong.

Where Are We Headed?

Most Americans do not feel good about the direction of the economy. However, many investors believe the market will rally for several more weeks before going lower. The sentiment surveys mentioned above indicate this. Television personalities also reflect this idea. They echo how the public feels, and they cautiously wait until it has already happened before they feel comfortable adopting the idea. That is why they are always late.

The most likely scenarios in my mind are either an immediate turndown or perhaps a stretch of the bounce until the end of November. I believe the Santa Clause rally is likely to arrive late this year—perhaps not until 2023. These are only educated guesses that are very short-term in nature. They are meant to provide you with an understanding of what is happening and a vision of what may be coming. When it comes to trading, let’s just say that timing the market is difficult, so be careful.