My wife had a university course where the professor often repeated, “If you fear, then fear not. If you fear not, then fear.” This was not an investment class, but I find it as valuable as anything I learned in working for my bachelor’s degree, master’s degree, or Chartered Financial Analyst designation. Fear is a strong word, but the lesson is clear. Its application is critical, especially for investors, as markets cycle up, down, and back up again.

Most investors only casually follow the investment markets. They place their time and energy in other pursuits, like relationships with friends and family, as well as their work, hobbies, etc. When markets really begin to move in either direction, they take notice.

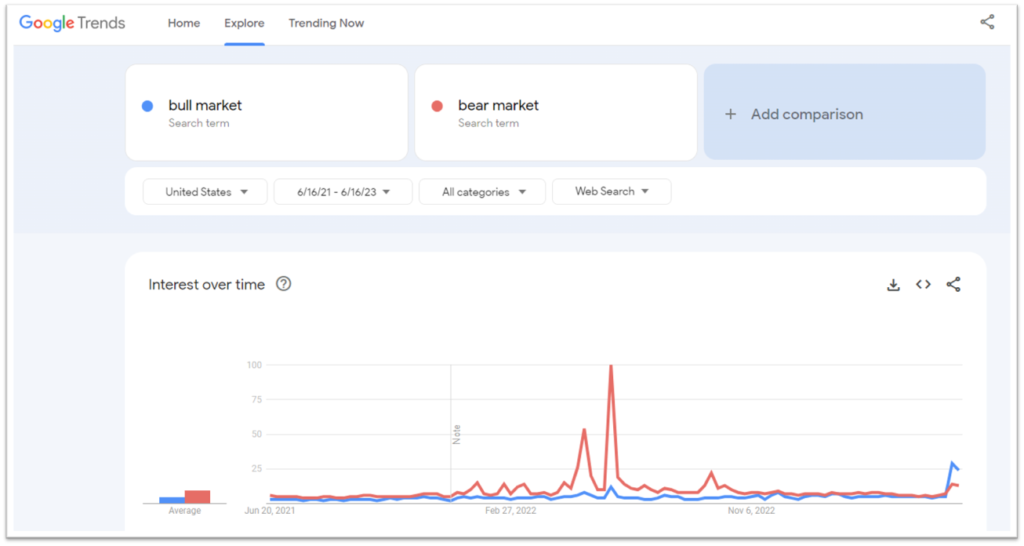

Google Trends is a fun website where anyone can type in a word or phrase to find out how popular it is. Last Friday, I entered the terms “bull market” and “bear market.” As you can see in red, interest in “bear markets” peaked in June 2022. I will call this peak fear. It is no coincidence that a major bottom in the U.S. stock market came the same week. Now, we find fear has diminished. The blue line is higher than the red, and that does not happen often.

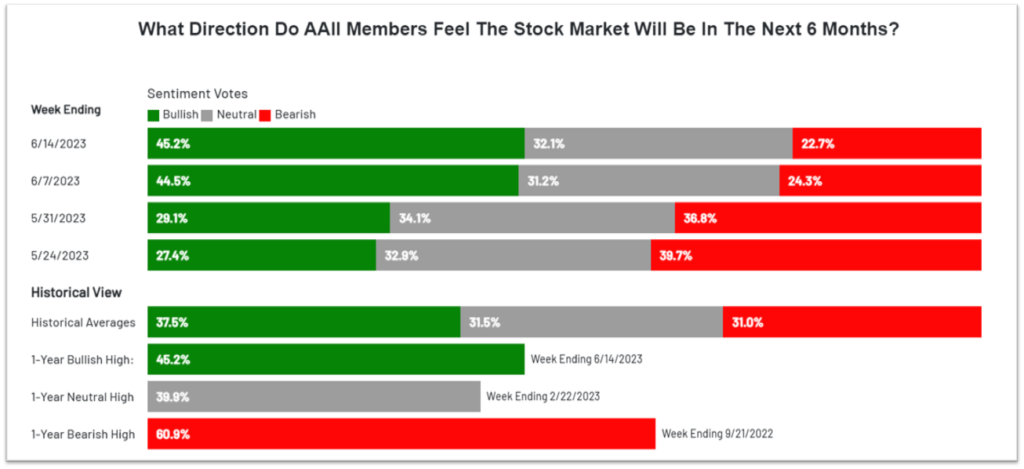

Something similar can be seen in weekly polls given to investors. The AAII Sentiment Survey shows that 45% of its investors feel bullish about the stock market. That may not sound like a big number. Given the uncertainty right now, it is significant. This is the highest percentage since November 2021, when cracks began to appear in market growth.

The application of this signal can be tricky. The timing is rarely perfect. To help, I combine the results of sentiment surveys with other fundamental and technical signals. They are nearly unanimous in flashing a warning: Other investors are showing little fear.

These emotions are a cycle. They are not new. Knowing what may be coming helps preparations. I currently favor a diversified portfolio, including defensive stocks (utility, healthcare, energy, and consumer products) and bonds, especially short-term bonds. Short-term bonds continue to pay some of the best interest rates I have seen in the last 15 years.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.