Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

Cash is king. With all the places to put money to work right now, cash is offering the best return for the risk. Interest rates have not been this good for nearly 20 years. When the stock market has a good week, like it just did, it makes cash returns of 4-5% look inadequate. This week, I address some critical questions.

- Are we really in a bull market?

- Could we avoid a recession?

- Where should we put money to work besides cash?

- Will the debt ceiling debate cause any problems?

- Where are stocks headed?

(1) Carl Icahn is an infamous American investor and President of Icahn Enterprises, worth nearly $20 billion earlier this year. Like many other investors, Icahn tried to profit from the economic disaster, and he lost almost $9 billion in just a couple of months. Ouch!

Everyone knows the U.S. economy is facing headwinds. Many became more conservative, favoring the higher yields of cash. Others, like Icahn, took massive bets for an immediate crash. I have repeated this frequently in my commentary: When everyone who wants to sell has sold, the market will go up—the short-term flow of money matters like the tide coming in and out.

We are using artificial intelligence to transform our company. It says we should lay off 10,000 workers. This is the statement that has been driving stocks higher this year. Artificial intelligence is going to be great, but it looks a lot like an investment bubble about to burst. Six companies have managed to keep the S&P in positive territory this year and helped the NASDAQ regain half its 2022 losses. This is not what a bull market looks like.

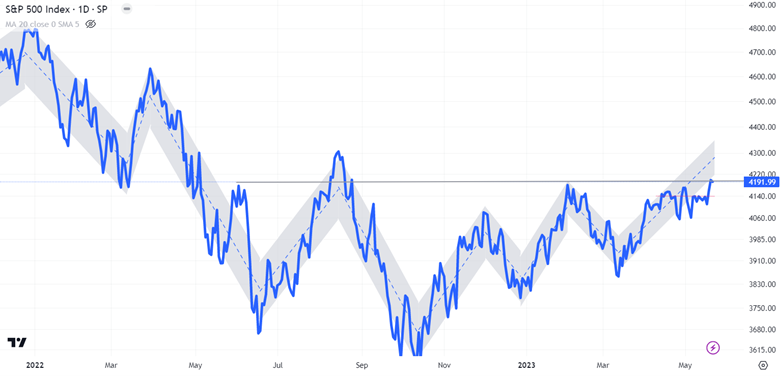

When investors are truly optimistic, they don’t have to hide in a few names. The trend is also weak. It has taken 150 days to make up for what it lost in 41 days last August and September. I expect the positive energy to expand to other areas of the market this week, or else we will see a temporary top.

What are the other areas that look attractive? I would personally rank them as follows (attractive to less attractive):

- Energy

- Healthcare

- Industrials

- Materials

- Consumer Products

- Utilities

- Financials

- Real Estate

- Technology

- Communications

- Consumer Discretionary

(2) Recession is coming. No one knows when. It may be more than a year away. The inverted yield curve will not be wrong, especially this time. Higher interest rates are slowing the economy. The Federal Reserve will not be lowering them any time this year to save the economy unless they believe inflation is falling near zero. (It is currently stuck around 5%.)

(3) Where should we put money to work besides cash? Short-term bonds, like cash, have been great. Long-term bonds have been poor investments in the last few weeks. I believe they are now worth owning. Further declines would make them even more attractive.

(4) The debt ceiling debate is about to heat up. Extremists on both sides of the aisle are unlikely to compromise without an emergency. Republicans have a slim majority in the House and cannot afford to lose many votes.

Does the debt ceiling even matter to investors? It will. Let’s cut some spending and raise this ceiling before disaster hits.

(5) Where Are We Headed? Stocks have been resilient for the reasons mentioned above. Many sectors look attractive. If the market heads north, then they will join the party. If not, they should hold up better than the rest. The graph below shows that the current trend is not strong. It cannot hold itself in the grey-shaded area. I think it will roll over soon.

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.