Social Security cost of living adjustment (COLA) for 2023 is expected to be a big one. In fact, it will likely be the largest increase in more than 40 years. This is welcome news for anyone who is relying on Social Security benefits.

Although the large COLA sounds like a boon, it will merely cover the increased cost experienced by seniors. Inflation is impacting everyone, but those living on fixed incomes, such as Social Security, are hit especially hard. Food alone has increased 11% (eating at home). If you are eating out, prices have increased 13%. The cost of medical care, which is used more as we age, has increased by 6%. Unlike someone who is working and will get pay increases over time, seniors receive incomes that are locked in and do not always increase. As the costs to cover life’s necessities edge up, it becomes more challenging to maintain a comfortable standard of living.

Fortunately, Social Security is designed to keep pace with inflation. As inflation goes up, so will benefits. Increases are determined based on an average of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a subset of the Consumer Price Index (CPI).

While the official COLA, announced by the Social Security Administration, will be released in October, it is anticipated to be upwards of 8%. The exact amount is based on a calculation that includes the 3rd quarter CPI-W – not available until October 13th.

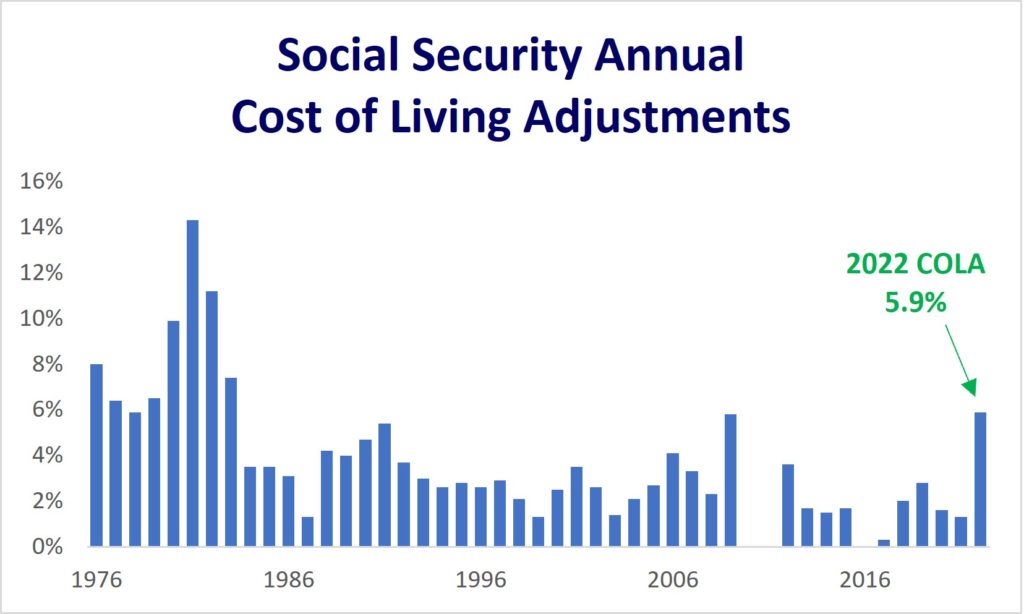

The chart above shows the annual Social Security COLA over the past 46 years. While the anticipated 2023 increase seems huge, during the early 1980s, when inflation was high, there were years when the Social Security COLA exceeded 11%. Conversely, there were years following the Great Recession when we were facing no inflation, and there was no increase in benefits.

Workers looking to retire are contemplating the best time to begin their Social Security benefits. The answer is complex and determined by many factors specific to their financial situation. The upcoming COLA is so large that it introduces a new variable for those about to reach full retirement age. Once the benefit stream begins, it is locked in and cannot be changed. You want to get this right. For this reason, it is vital to understand your options. Our wealth management advisors can assess your situation and create a plan to help you maximize your Social Security benefit.

Listen to a deep dive into Social Security and the COLA on the Power Up Wealth podcast.

One Comment