At times, I have had clients tell me they keep so much money in the bank because they feel it is “safe.” However, any place you put your money has risks. You can bury cash in the backyard and a flood, earthquake, or faulty memory could wipe it out. You can stash some money all over the house, but it can go up in smoke. Just because you think a place is “safe “doesn’t mean it is.

A savings account at the bank can still be wiped out, especially from fraud. I recently had a client lose over $100,000 from their checking account. How did this happen? Wasn’t the bank safe?

I’ve had too many clients impacted by scams like this, so I want to keep raising the warning bell: Watch out for fraud!

In this instance, a warning notice popped up on their computer that there was an issue. The client was instructed to call a phone number that looked legitimate. Since somebody wasn’t calling them from Timbuktu, they felt more secure. The person who answered the phone assured them everything was OK but asked them for personal information and computer sign-in information. With that information, the perpetrator was able to gain access to their computer and lock it down. Then they were able to find banking information. They logged into the bank and wired money to an offshore account. Wires are hard to recover. Even though the bank made efforts to recover the money, they could not get it back.

We have to be even more vigilant in our world. Fraudsters are everywhere: emails, computer hacks, text messages, and phone calls. Even if an email looks legitimate, only click the link or open the attachment if you are expecting the email or you have called the person who sent it to verify. Refrain from trusting the phone number or website link in an email or pop-up window. Do your research to find the actual phone number or website instead. If you get a phone call from your “nephew” who is in jail in Mexico and needs money wired to them, hang up.

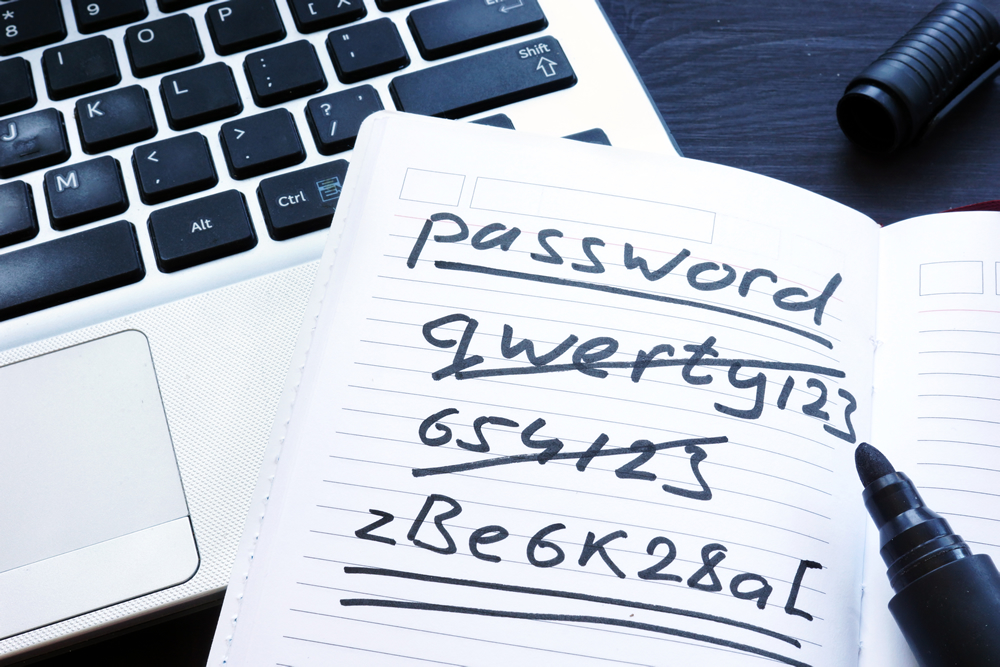

Be smart and protect yourself by using a password manager so you can use a unique complex password for every login. If one password is compromised, the tricksters won’t have access to all your information.

At Smedley Financial, we already have security systems and protocols to help protect your investments from fraud.

- We follow client verification procedures, including personal information and signatures.

- We have a policy not to accept requests via email.

- We use additional verification procedures for high-risk transactions like wire transfers.

We will continue to work hard to protect your hard-earned assets from fraud. If we all do our part, we can prevent fraudsters from tricking another victim.

Listen to a deep dive on how to keep your information secure on the Power Up Wealth podcast.

One Comment