For those following along, this is the third installment answering the question, “Will my retirement last?” We have discussed risks that retirees face in retirement, like bear markets, the sequence of return risk, retirement timing, losses, and inflation. Here, we will go over how to plan to combat these risks.

All the risks we have laid out come into play during retirement. The fact that we are living longer as humans means that we must plan so that we do not run out of money too soon. How do we balance all these risks? How can we look at our plan and know that we are going to be okay?

We have solutions at Smedley Financial. Some are fundamentals that anyone can deploy, and others are strategies that we use to combat these things so that retirees live the lifestyle they want during retirement.

Mitigating Standard Deviation

The primary tactic that many ignore is mitigating standard deviation. If that sentence went over your head, that is fine. We are going to explain.

Standard deviation is the fluctuation of your money. In other words, it is volatility. It is one way investors measure risk. The standard deviation for the stock market is large, whereas the standard deviation for bonds, especially short-term bonds, is lower.

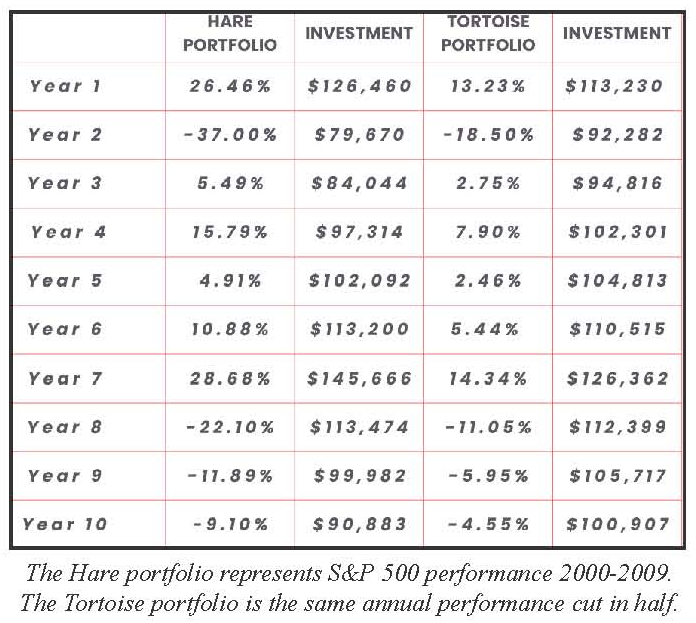

Let’s see why standard deviation plays such a big role. Take two portfolios, the Hare portfolio, and the Tortoise portfolio, during a 10-year period. Each starts at $100,000. The Hare represents the S&P 500 performance, and the Tortoise would simply be that same performance but cut in half. The results will surprise you.

By the end of 10 years, the Tortoise wound up with more money. It did not have near the gains in the market as the Hare did, but it did not have near the losses either. Losses are powerful.

You can mitigate standard deviation in a few ways.

Basket of Holdings

One could comprise a list of holdings in a portfolio of funds that do not deviate as much as the market but continue to grow. This is how most do it, and even here at Smedley Financial, we use this to analyze the investments we select.

Lifetime Income Plan Buckets

Another tool we use is the Lifetime Income Plan. We split assets up into different accounts. Some of those accounts may have higher than desired standard deviation, and some may be too low. Overall, they create the desired standard deviation. This is a strategy that we use in conjunction with others.

Active Management

We can also proactively trade based on opportunities and risk in the markets. Using a host of indicators and information, we can make judgment calls that can potentially help reduce market risk.

The overall goal is to protect not only the accounts but the lifestyles of those retirees who own them. By deploying these efforts, we are better able to weather the storms of retirement timing, sequence of returns risk, and the power of losses, making it through the barrage of bear markets and inflation. We do this so we can look across the table at our clients and say, “Yes, you are going to be okay.” We are happy to partner with you and ensure your retirement will last.