Keeping your eye and your expectations on the future can be difficult, especially during periods of euphoric speculation. At these times, even intelligent investors can be driven by emotion to make unrealistic decisions regarding money.

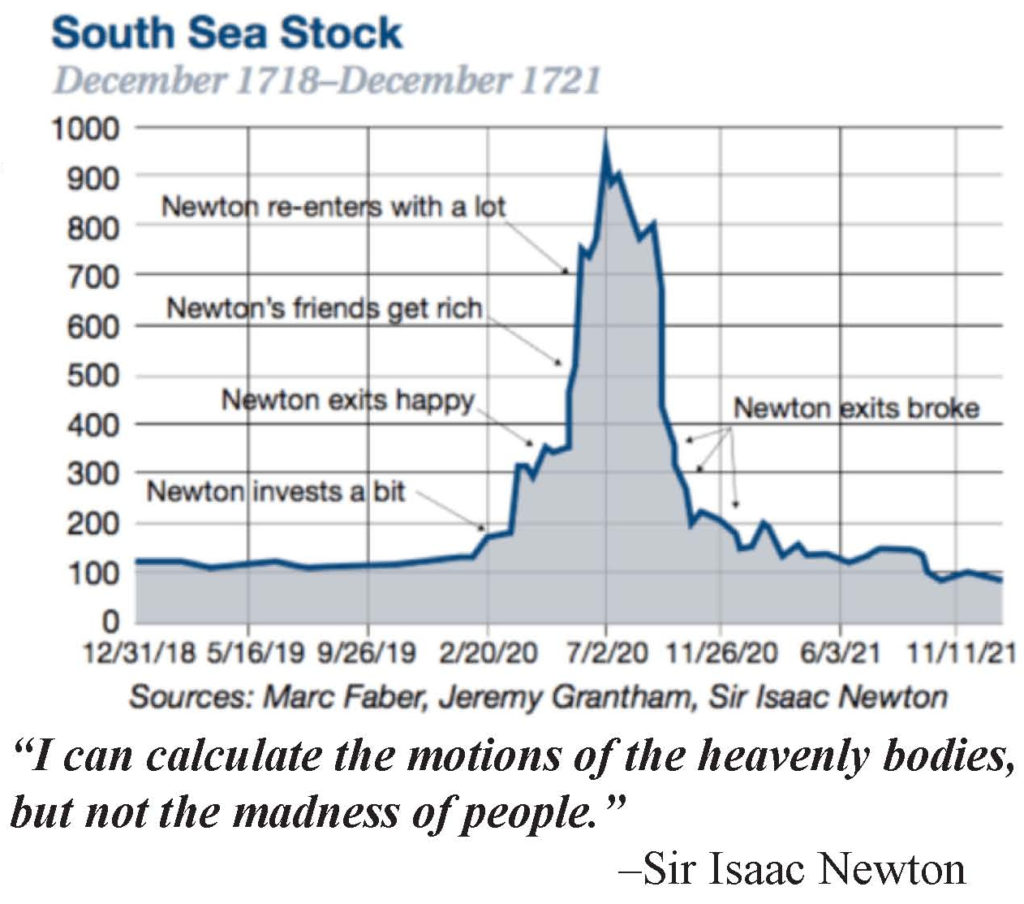

Take, for instance, Sir Isaac Newton, a brilliant mathematician, who in 1720, decided to invest a portion of his wealth in the South Sea Company. In that same year, the House of Lords passed the South Sea Bill, which allowed the South Sea Company a monopoly in trade with South America.

Sir Isaac had made a good return on his investment and, fearing increased speculation in the stock, decided to get out with a hefty profit. As often happens in periods of speculation, the stock continued to skyrocket. He watched his friends’ fortunes continue to grow as they remained invested. Fear of missing out (FOMO) caused Sir Isaac to make an emotional decision. He invested his entire fortune in the South Sea Company just as the stock was nearing its peak. After the stock’s sharp decline, Sir Isaac sold his shares, leaving him financially broke.

Losing one’s fortune is a typical result when making speculative investments. It is not solely reminiscent of the South Sea Bubble. We see the same scenario play out in every market bubble – from the tulips to the financial crisis. The theme is the same “This time is different.” We share this story not to create fear of investing but rather to share the value of diversification and active management.

Diversification reduces market risk over time. Holding several stocks in the same sector, such as only tech companies, is not real diversification. Real diversification is spreading risk across many sectors of the stock market and fixed income investments to smooth out volatility. It means holding stocks that perform differently in the changing economic environment. Some may lose money during periods when others are doing well.

Diversification can be both emotionally difficult and rewarding. Difficult in that FOMO produces the desire to pile into a particular stock or sector when the market is hot. Rewarding because while your investments still fluctuate, you know it is unlikely you will experience an unrecoverable loss.

We understand our clients are better served when employing a well-diversified investment strategy that focuses on values, goals, risk objectives, and time frames. These are paramount to your investment success, and we strive to keep them central to every investment decision we make.