Taking advantage of financial opportunities requires action and, in some cases, even inaction. Doing a few things early in the year can have a significant impact on your financial success. While there are many things that can help improve financial success, in this issue of Money Matters, we are going to focus on three.

Set yourself up for retirement success. If you are still working, this is a good time to reevaluate your retirement savings. When possible, increase the amount you save. Every dollar counts! If you have been maximizing your contribution, here’s your opportunity to save more. The employee contribution limit for 401(k), 403(b), and 457 plans increased to $20,500 for 2022. The SIMPLE plan employee contribution increased to $14,000. If you are age 50 or older, you can add an additional $6,000 to 401(k), 403(b), and 457 plans, and $3,000 to SIMPLE IRAs.

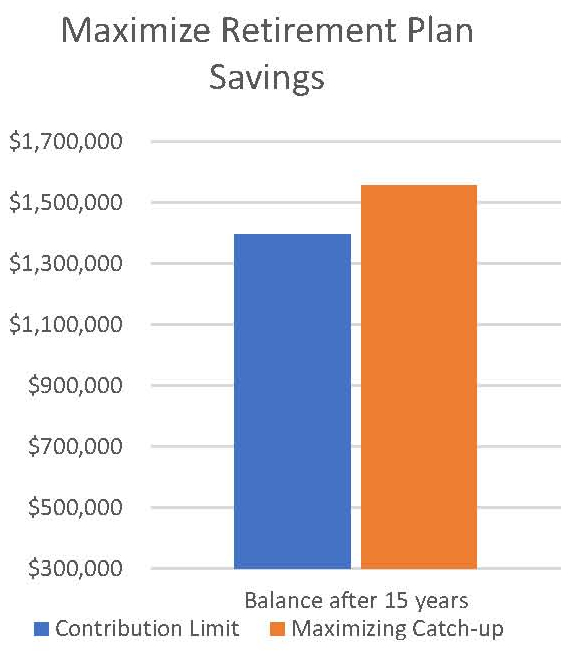

The chart reflects the benefit of maximizing your savings by taking advantage of the catch-up provision. It illustrates an account balance of $300,000 at age 50 growing at an annual 7% return. In one case, the employee is saving the contribution limit of $20,500 compared to saving an additional $6,000 annually through the catch-up provision, for a total annual contribution of $26,500. Maximizing the catch-up would increase the balance after 15 years by $158,481. This does not include any matching contributions made by an employer. Of course, this is hypothetical and for illustrative purposes only. It does not represent an actual investment result. However, you can see how the extra savings can really add up.

Stick to your plan. How will you react if the market drops 30 percent? How will you react if the market gains 30 percent? Hopefully, your answer will be – I will not react because I am following my plan. Having a financial plan in place helps reduce the feeling to act or change something when market volatility increases or when the market has a correction – which at some point, it will. It also protects you from making an emotional decision to increase risk when the market is shooting straight up, and you feel like you are missing out. A plan is designed to take in all market scenarios over time. That does not mean your account will grow at a steady rate. Some years you will surely experience negative market returns. On the flip side, you will also have years where your returns exceed the plan. The secret is creating a plan that incorporates your individual tolerance for risk, diversification among market and fixed income investments, and a structure that reduces risk on money that you will need in the next five years. Having a plan and sticking to it is instrumental in your long-term financial success.

Understand your tax reduction strategies. There are many ways to reduce taxes now and in the future. Regarding retirement accounts, here are a few things to consider. If you are in a high tax bracket, make contributions to your employer retirement plan or IRA before tax. This allows you to save money today before paying taxes and defer those taxes until you access the money during retirement. If you are currently in a low tax bracket or believe you will be in a higher tax bracket when you retire, use the Roth option within your employer plan or IRA. This allows you to pay taxes now at your lower tax bracket. The money grows tax-free, and when you use it at retirement, there will be no tax to report.

If you are retired and make donations to your favorite qualified charity, consider making a qualified charitable distribution avoiding any tax on that amount donated. This can only be done from an IRA at age 70 ½ or older. The money comes out of your account and goes directly to the qualified charity. You pay no tax on the distribution, and there is no increase on the taxes you pay on Social Security benefits and no increase in Medicare Part B premiums. This is a win, win for retirees.

Now you have a few ideas to help you make a smart start in 2022.