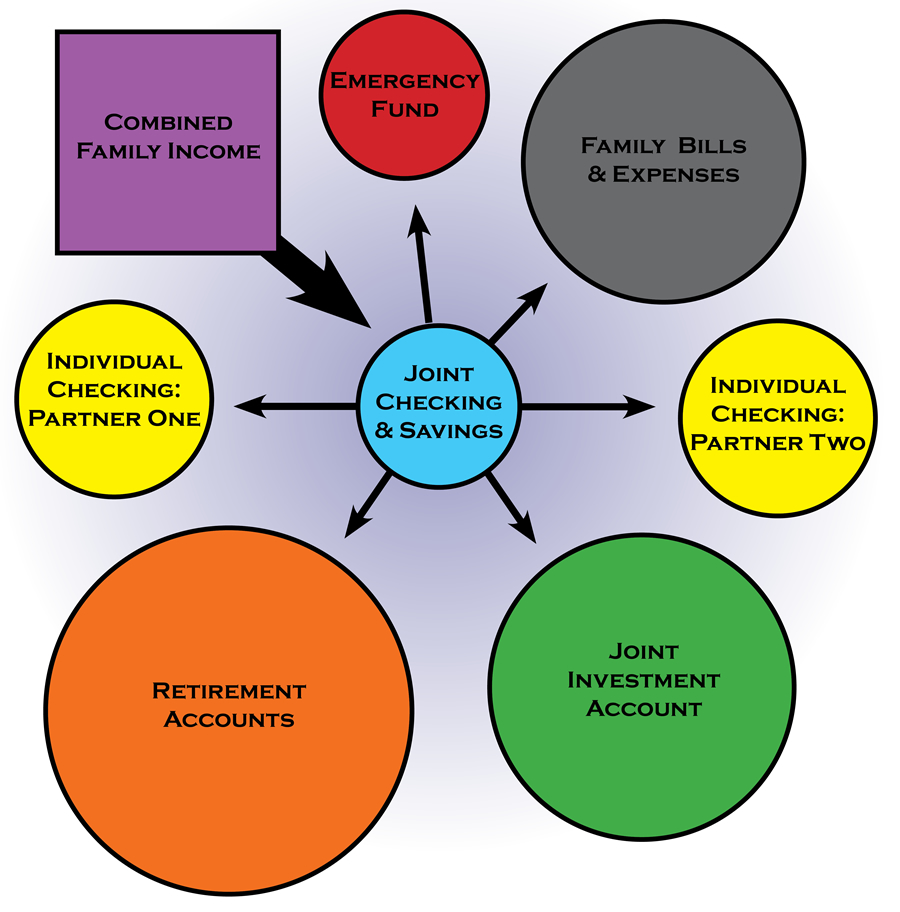

A well-organized and effective account structure can help couples create wealth and financial security. Although there are many ways to manage family finances, the presented diagram here offers several benefits. It provides each individual with some financial independence while maintaining centralization and efficiency. The model can be modified to accomplish the specific needs of each family, but the concepts should be implemented. Ultimately, the keys to success in any family financial arrangement are communication and unity.

Joint Checking & Savings

These accounts should be registered in the names of both individuals. The purpose of the checking account is to receive all income, cover monthly expenses, and distribute what remains. The savings account is for short-term goals (< 12 months) and provides a cushion for occasional excess spending. You should not hold a large amount of money in either of these accounts for long periods as neither account will keep pace with inflation.

Emergency Fund

It is common for an emergency fund to be separate and distinct from other financial accounts. The purpose of this account is to cover unexpected emergencies. I recommend utilizing a money market, hi-yield savings, or implementing a CD ladder for slightly better interest rates while maintaining liquidity. Generally, the account should hold no less, or more, than 3-6 months of non-discretionary spending. Although an overfunded emergency account is better than an underfunded one, this is not the ideal place for savings. Once you have accomplished your emergency fund goal, allocate money elsewhere.

Family Bills and Expenses

Monthly family bills and expenses (i.e., mortgage, car loans, and medical) should be paid from the joint checking account before assets are distributed to other accounts. Total monthly debts should not exceed 43% of gross monthly income, with no more than 28% of gross income going towards mortgage or rent. The couple should have individual credit cards which are paid in full from their respective checking accounts.

Individual Checking Accounts

These satellite checking accounts receive a monthly allocation for each individual. These accounts cover discretionary spending and give everyone the freedom and flexibility to spend, or save, as they wish. The individual account owners should be responsible for their budget and respect the other by not overspending. Any purchases larger than an individual can afford should be discussed and agreed to by the couple beforehand.

Joint Investment Account

The purpose of this account is wealth building. This is the savings account for everything over 12 months. Assets should be invested according to your risk tolerance and time horizon. This account does not have the tax benefits, contribution limits, or access restrictions of retirement accounts. Contributing and withdrawing from this account is quick and easy.

Retirement Accounts

In many situations, retirement contributions will be made before income is deposited into the joint checking account. Employer-sponsored retirement plans that offer payroll deduction and a company match should be utilized (and maximized). Contributions to retirement accounts outside of employer plans should be made from the joint checking. In most situations, the annual retirement savings goal should be 15% of gross income.