Retirement is on everyone’s radar. Whether you are preparing for a future date or beginning retirement now, you need to know where your money will come from once the paychecks stop rolling in.

One retirement income source that is very confusing is Social Security. It is fraught with complicated options. From understanding how your benefit is calculated to determining the best time to begin receiving your benefit, the process can be painful. I want you to understand the nuances so you can be informed about your options and better prepared to make critical decisions.

To begin, almost everyone reading this article is eligible to receive Social Security benefits in some form. However, eligibility for retirement benefits is based on several factors. If you have worked at least 10 years, you are eligible for benefits based on your own earnings. If you are now or have been married, you may qualify for benefits based on a spouse’s earnings. The challenge is knowing which benefit to claim and how to maximize your income.

Something many women are surprised to know is that Social Security retirement benefits may be available even if you never worked outside of your home. If you are now or have been married, you can claim a benefit based on your spouse’s earnings record. This is in addition to what your spouse or ex-spouse will receive. At your full retirement age (FRA), you can receive 50% of your spouse’s benefit at their FRA. For example, if your spouse’s benefit at FRA is $1,800, you would receive $900 monthly. A spousal benefit does not increase beyond FRA.

If you are divorced and have not remarried, you may be entitled to a spousal benefit. To receive this benefit, you must have been married for at least 10 years. You are entitled to the benefit even if your ex-spouse remarries.

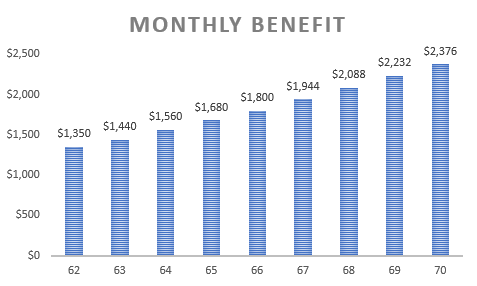

Timing of benefits has a lifelong impact, and you should have a well thought out plan before signing up. For instance, beginning your benefits at the earliest age possible, age 62, will lock you into a reduced benefit for the rest of your life. To receive your full benefit, you must wait until you reach full retirement age. Stop thinking age 65 (that’s for Medicare). When it comes to Social Security, FRA is somewhere between age 66 and 67 – based on the year you were born. But it gets better, for every year you wait beyond your FRA up to age 70, your benefit will increase by 8% – locked in for the rest of your life.

The following chart shows a monthly benefit of $1,800 taken at a full retirement age of 66, and how it would change if taken earlier or later. For example, if taken at age 62, the benefit would be reduced to $1,350, and if taken at age 70, the benefit would increase to $2,376. That’s significant! A $1,026 difference each month – $12,312 annually.

There can be additional downfalls when taking Social Security early. If you take Social Security benefits before your FRA and you continue to work, you may be penalized. If you are under FRA for the entire year, $1 of your benefit will be withheld for every $2 you earn over the annual earnings limit ($17,640 in 2019). The earnings limit is higher in the year you reach FRA ($46,920 in 2019). The bottom line – you may not be getting as much as you think by taking your benefit early.

Understanding Social Security can be difficult and making the wrong decision can be costly. Don’t go it alone. Let us help you analyze your options so you can make the best possible choice regarding your benefit and future income.

If you have not started your Social Security benefit and are over age 55, watch for our Social Security seminar and webinar coming in the fall