The Economy and the Salt Lake International Airport

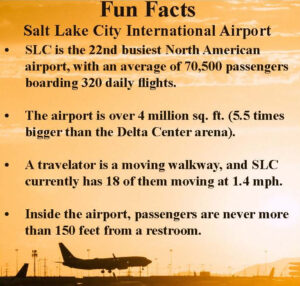

The new Salt Lake City International Airport has expanded gradually to over 4 million square feet since it opened in 2020. Walking to the end of Concourse B is roughly 2/3 of a mile. Movement has improved with the addition of 18 moving walkways. This easier movement has been similar to our economic landscape until recently.

Over the last 40 years, inflation has been falling, allowing interest rates to drop as well. This has helped the economy, especially since 2008 when the Federal Reserve (Fed) dropped rates near zero.

Low rates equal low borrowing costs. Their impact has been felt for centuries. As Adam Smith noted in his book, The Wealth of Nations, published in 1776, “Land prices had risen in recent decades, as interest rates declined.”

Low rates meant lower returns unless one took more risk. As the saying goes, “The worst loans are made at the best of times.”

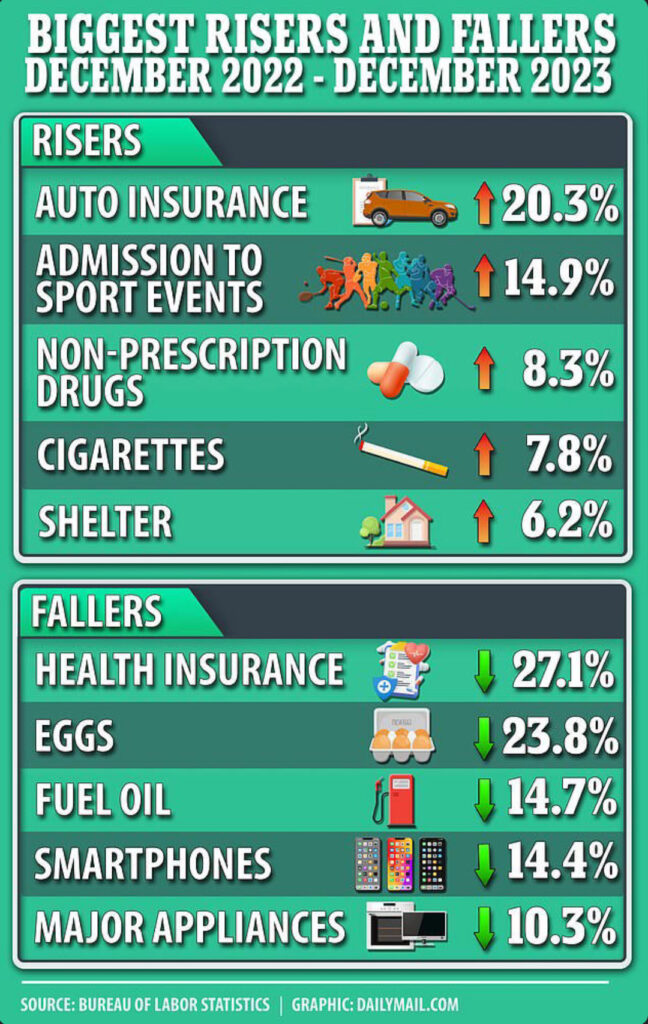

In 2021, inflation surged due to higher demand and pandemic-related supply issues. Blaming it all on supply, the Federal Reserve called it “transitory inflation.”

Inflation was not all temporary. Prices for commodities like lumber and gasoline may have returned to prior levels. Finished products like homes and vehicles have not.

In response, interest rates rose significantly in 2022 and have stayed higher. This was the moment when the economy stepped off the moving walkway. It felt abrupt. Some may have lost their balance.

If prices turn lower, it would give the Federal Reserve flexibility to turn the moving walkway back on.

If inflation resurfaces as it did in the late-1970s and early-1980s, we will continue to walk without Fed help.

There are no guarantees what the future will bring. One benefit of higher rates is that savers and investors can now get paid more interest than they have in two decades.