Be Careful What You Wish For

Lower Rates Sound Nice

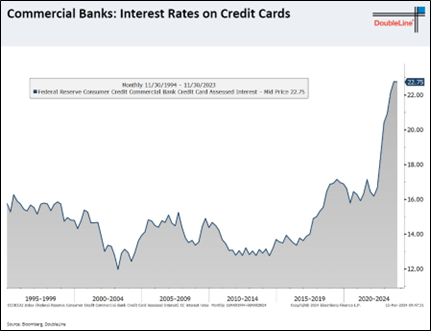

Mortgage rates have been stuck above 6% since September 2022. Auto loans passed that level about the same time. Fall behind on a credit card payment and the current average interest is a punishing 22%. A little reprieve would help this economy to continue moving upward. And if it came now, this would be true. History suggests we have longer to wait and a bumpy road when the time finally arrives.

Over the last two years, investment markets have moved higher even at the suggestion that rates will come down. I have suggested that if Federal Reserve (Fed) Chair Jerome Powell even cracks a smile, markets seem to move higher. After all, his smile communicates optimism about the future, right?

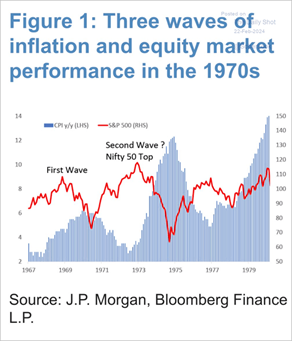

The reality is that the Fed is waiting until inflation comes down more. It does not want to add fuel to the inflation fire and create a second wave of inflation like Americans experienced in the 1970s.

I think they will lower interest rates if inflation drops below 3%. We are almost there, but almost there does not count. As the Fed holds its rate higher for longer, the slowing influence of that rate continues to ripple through the economy. History teaches that by the time the Fed lowers rates, the economy is already slowing.

Why the Fed Rate Matters

People often ask me how the Federal Reserve (Fed) impacts them personally. The day-to-day effect of its actions is low. The Fed changes short-term rates, which alters overnight lending, which is mainly done by banks. Even the economic impact of the Fed is minimal in the short term.

Long-term rates have an immediate impact on investments, mortgage rates, and all kinds of loans. When the bond market moves substantially, that change in rates can really change things right now. For example, if the rate on a 10-year bond falls today, one may be able to get a lower mortgage rate today.

Short-term rates do not have such influence. It takes time for them to change other rates and the overall economy. The rule of thumb is that there is a delay between Fed rate increases and the economy of between 18 and 24 months.

I Am Still Watching These:

- Energy Prices: When I wrote my last article, oil prices (priced per barrel) were stuck in the low $70s. I was concerned that it may rise. It has. We are now around $80 and have been for weeks. Higher prices are like a tax on the economy and have preceded most economic slowdowns. Any sustained level above $85 would be concerning to me.

The silver lining is that higher oil prices could benefit energy investors, a sector unpopular with investors over the last year (except for a big move from July to September 2023). This is one of a few sectors in which SFS has been overweighting since late January. Of course, there is no guarantee where it could be going next. - Inflation and Interest Rates: No changes here. Short-term rates are still higher than long-term rates. Inflation (CPI) is stuck above 3% for now. Any sign that it is climbing above 4% would be incredibly disappointing. A drop into the 2s would be great.

In the chart below, it is easy to see the trend is down, but the current level is still high. It is worth noting that the Fed was raising rates in 2006 to bring down that rate and even it is much lower than our current level. - Employment: Unemployment ticked up from 3.7% to 3.9%. This is not a major concern yet. The current rate is still historically low. However, when the tide starts moving out, even if it is moving slowly, there is a lot of force behind it. Any additional movement higher will be a red flag.

Everywhere one looks, the glass is either half full or half empty.