Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in the stock market.

Interest Rates: Higher for Longer

For weeks, I have been writing about the possibility of an economic soft landing, hard landing, or no landing. The first could be good for stocks. The second may be better for bonds. The third is a continuation of the status quo while we wait for the eventual soft or hard landing later in the year.

Last week, we may have eliminated an immediate hard landing. That means interest rates may not be coming down for a while. They will be higher for longer.

What Happened?

On Wednesday, Jerome Powell stepped up to the microphone and delivered his prepared remarks. He was cautious like a hawk. He saw progress, but not enough. Rates would stay higher for longer. Then came the more spontaneous part of the press conference when Powell took questions from reporters. When asked about inflation coming down, Powell could not hide his satisfaction. The Fed was winning.

Earnings came next. Meta (Facebook) informed investors that savings from laying off 12,000 would be spent to buy its stock. It plans to spend $40 billion, which is all the cash it had on December 31st. It’s hard to say what the long-term impact will be of this decision, but it is precisely the kind of short-term thinking that investors like.

Then we received disappointing reports from Apple, Alphabet (Google), Amazon, Ford, Qualcomm, and Starbucks. Apple reported its first revenue decline since 2016. The supply chains are not all fixed, and the economy is slowing. It seemed like stocks were headed for a big drop, but all this took place Thursday after the markets closed.

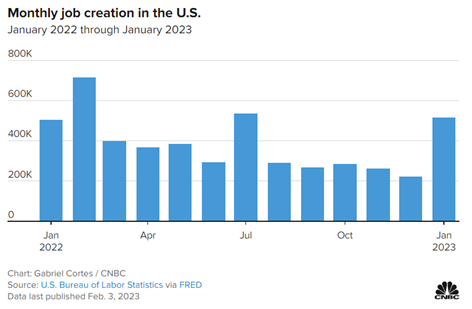

Before the market opened on Friday, January’s employment numbers surprised investors. The report showed 517,000 Americans found jobs, while economists expected just 187,000. The unemployment rate, which was already near an all-time low at 3.5%, fell to 3.4%. Wages increased 4.4% from the prior year as well.

In times like this, it is hard to know if good news will be good for stocks. One thing seemed clear; it was negative for bonds. Their value is sensitive to changes in expectations for inflation and interest rates. A strong economy is less likely to have low inflation, which means the Fed is now even more likely to keep raising rates.

Over the last few weeks, I have explained that bonds had risen on hopes that the Fed would lower rates by half a percent before the end of the year. The only reason to do that would be if inflation is around 2% and the economy is in a recession. This jobs report proved that we are not in a recession yet, and raised the risk that inflation may not come down fast enough.

In reaction to the jobs report, stocks and bonds started negative. Stocks rallied up to positive and then fell again: a sign of strength given the circumstances. However, investors had much less enthusiasm for bonds. By the end of the day, long-term government bonds were down much more than the S&P 500.

Where Are We Headed?

I expect that over the coming weeks I am now more interested in short-term bonds than long-term bonds.

I am still waiting to see if most investors view the recent employment report as positive or negative for stocks. Although stocks fell, I personally found it to be a positive sign. My recent drawings had the S&P 500 moving up to 4,125. It exceeded that level and then fell back towards it. I am watching 4,040 as a key level to stay above for this uptrend to continue.

With the economy holding up better than expected and a slightly positive signal in my short-term indicators, I have broadened the channel in the chart below to allow for the S&P 500 to move in either direction over the next couple of weeks.

I remain skeptical that recession risks are behind us. The Fed has no reason to lower interest rates, and these rates will continue to be a drag on demand for housing and auto loans. Of course, anything can happen in the markets, and I will be watching them carefully.