Making good decisions and sticking with them for a long time is a recipe for investment success. Short-term indicators discussed in this email may create an illusion that timing the market is simple. It is not. Anything can happen in markets.

Pivot: To turn or swing around from a central point.

The Fed was racing toward recession at 75 MPH and has now made it clear that it will slow to 50 MPH. It has not “pivoted,” as everyone keeps saying. It has the same destination and at a historically quick speed. This is the most critical thing to admit because it means that the bear market is not over.

Economic prosperity is more likely with low inflation. Unfortunately, excess money from 2020/2021 has unleashed demand that has not slowed despite higher prices. The Federal Reserve’s solution is higher borrowing rates, which will eventually slow the economy.

Everyone knows where we are headed, which, ironically, is exactly why this week surprised us

with a positive return.

What Happened Last Week?

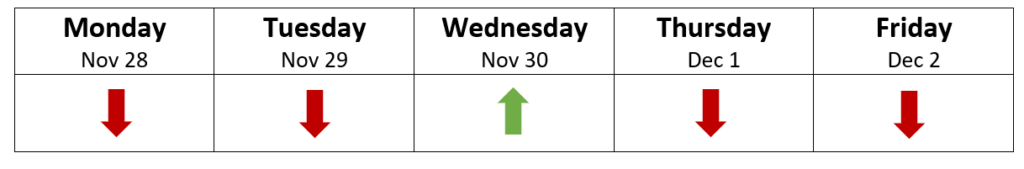

As outlined two weeks ago, investor sentiment is much less bearish, to the point that the market rally should be ending. Many people agree, which explains why 4 of the 5 days were down this past week.

Despite headwinds, the S&P 500 rose 1% for the week. It all happened in the 60 seconds before and the 60 minutes while Fed Chair Jerome Powell spoke at the Brookings Institution. Investors acted as if it was a “victory-over-inflation” speech. Here is how I would summarize it.

- The Fed had aggressively been raising rates, and it no longer needs to act so quickly.

- The battle with inflation is still ongoing, but The Fed wants to avoid overtightening and lowering rates a couple of months later.

- Expect slower raising of rates and that those rates will stay high for a long time.

On Friday, the November jobs report was better than expected, and the market dropped. To figure out why the good news is sometimes bad, we must understand what investors are focused on.

In 2022, anything that will cause the Fed to move rates faster is bad news. The November employment report showed wages had a 0.6% increase in one month when only 0.3% was expected. Higher wages mean more spending, which means higher prices, and the Fed needs to keep hiking rates.

After initially dropping 1.5%, the S&P 500 steadily moved up. It ended down just 0.25%. The good report was bad news to investors, but the recovery is a sign that investors see the glass as half full for now.

Lesson of the week:

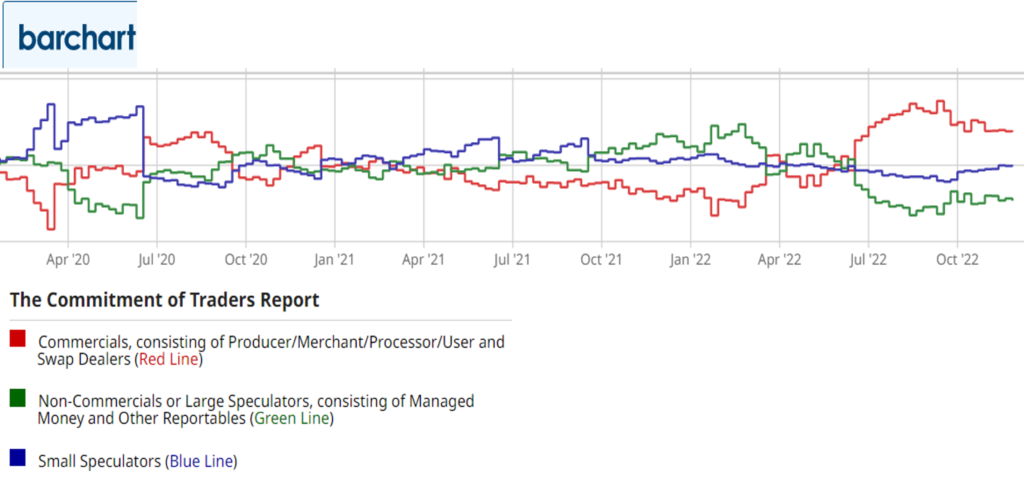

The Commitment of Traders report comes out weekly and may help explain why investors reacted positively to Chair Powell and shook off the bad news on Friday (see graph). The large and small speculators (green and purple) are not heavily invested. The red line is sometimes called the “smart money.” It started selling in 2020 and didn’t start buying until this year. It caught the summer rally and has been slowly moving out since August.

Most tactical traders were likely to have already moved out of the market, and many speculators may have been short. So, those most likely to trade would stay out, which would have little impact, or buy, which would push stock prices up. Speaking of the “smart money,” you can see that it is slow and early—probably too early. This is likely because its trading moves the market. This is the single good reason I see for the market rally to continue upward in the coming weeks. The “smart money” is moving out but has a long way to go before it should be considered a negative sign.

Where are we headed next?

Given that The Fed is tightening at a historical rate, I expect the market to turn lower at some point. I believe the “smart money” will show a quick move, like when it sold in September 2020, December 2020, or January 2022. However, that is just an educated guess. The report does not show that it has happened yet. Perhaps, things are not that bad.

My technical indicators are flashing red, which only happens at extreme levels. Plus, the market is at major resistance. This chart of the S&P 500 will help. I have drawn two scenarios that bounce around in channels. These channels are like those we have been moving in all year.

The red line: This is the market turning this week. This assumption relies on the Fed’s commitment to slow the economy, the overbought market (proprietary signals not discussed here), and the downward-sloping red line that has stopped previous bounces in 2022.

The green line: Bear markets of 2000-2002 and 2008 had moments that moved above trend lines like this, which fooled some into thinking the bad times were over. Then the downtrend continued. This path would give the “smart money” more time to sell. In my opinion, it is unlikely that the market to move higher than this in the next month or two. In the Fed’s next meeting, Powell should do more than raise rates. He needs to manage expectations. Otherwise, spending continues, and prices continue to climb.