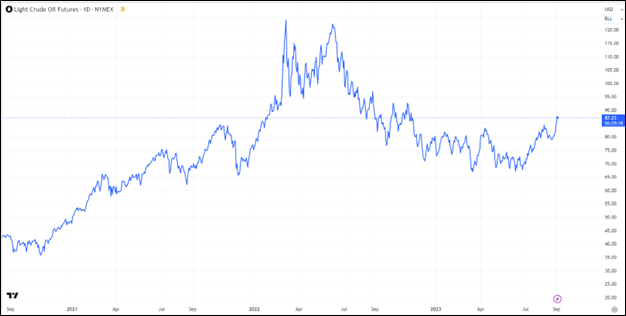

In my July commentary, I wrote that demand is up with the U.S. purchasing oil, and the economy is doing fine. Combining that with OPEC+ cutting supply, we have high demand and low supply. Unsurprisingly, oil prices are currently sitting around $80 per barrel and looking strong. This is an opportunity to invest in a sector of the stock market that was shunned earlier this year: Energy. It seems other investors are beginning to come around. It has been volatile and will likely continue, but I find the sector attractive.

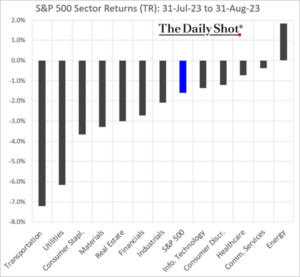

Energy has been the top-performing sector in the S&P 500 over the last one, two, and three months. This surprises most investors who think the Federal Reserve has beaten inflation. On the contrary, inflationary pressures are still with us. This is typical for the late stages of the economic cycle. It is premature to assume a “soft landing.” There are still so many things that have to happen before we get back to the beginning. Think of the economic cycle as a play with several acts. Some acts will be quick, while others last a while. Each has an important role to play, and there will be no skipping. Try to skip an essential step, and you will find that instead of moving forward, you may have just lengthened the duration of the current act.

Economic Cycle

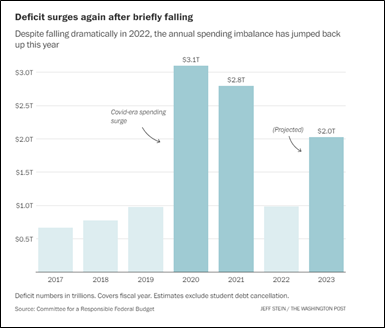

In our modern world, we work tirelessly to control natural cycles. The U.S. government is trying to keep us from moving forward without completing a typical cycle. My evidence is the large amount of deficit spending even though we are in a high-inflation environment.

I believe progress will eventually become inevitable and invite us all to embrace the positives that come from the ups and downs. The remainder of this article will lay out a path for the current cycle. Here are a few assumptions used in this analysis:

- Each step in the economic cycle is critical.

- Skipping steps is not an option, as each plays an important role.

- The process will take time—much more than we expect. It is not until we accept our reality that we can allow all the necessary elements to take place.

- Each change comes as a surprise for most people.

Act One: Everything is Awesome.

The government creates too much money. People are happy, but later surprised when the price of everything goes up. (Examples: 1997, 2005, 2020.)

Act Two: Can’t Have Your Cake and Eat It Too.

Everyone, including the government, should pay down debt. They do not. The only responsible party is the U.S. Federal Reserve. It remembers price stability is its main mandate, and it raises short-term interest rates. The cost of borrowing just increased. This reduces demand in the economy and financial markets. Investors run from all risky assets, including bonds. As losses mount, more selling occurs. Inflation declines. Fear of a recession sends investors back to bonds. This pushes interest rates down, which makes borrowing less expensive. Investors are surprised by how far asset values fall. (Examples: 1998, 2006, 2022.)

Act Three: Uh Oh!

Something breaks. The Fed blinks. It assumes that it may have done enough. With or without announcing it, the Fed takes its foot off the brake to see what will happen next. (Examples: August 1998, March 2008, March 2023.)

Act Four: Party On! (We are still here.)

Inflation has improved, and there is no recession. Higher interest rates are not a problem. Whatever broke is now in the past. Stage 3 was not so bad, so why not start the cycle again with a large amount of spending? The government spends, and the economy rises. Investors are surprised by the strength of the economy. Some prices begin to rise again. This could last a long time. (Examples: 1999, April to September 2008, Summer to the end of 2023?)

Act Five: Oops! We Did It Again. (On deck.)

Prices are rising for consumers again, but it’s not as bad as before. The Fed prefers to move slowly now. This makes short-term rates relatively stable, but the strong economic narrative pushes long-term rates up again. Borrowing becomes a bit more expensive. This is the tipping point. (Examples: 2000, 2008, Start of 2024?)

Act Six: Inevitable Slowdown Finally Arrives.

Tight lending standards mean many consumers can no longer live on credit cards. Their spending diminishes. The slowdown has become a reality. Some workers lose their jobs. Then comes the forced selling of assets like cars and even homes. Prices fall. (2001, late-2008, 2024?)

Act Seven: Here comes the Sun.

Lower inflation gives the Fed flexibility. Higher unemployment gives them a reason. The Fed lowers interest rates. The excess government spending in Act 3 government was a mistake. Now, it is different. It is time to increase spending to break the downward spiral and return the economy to its growing ways. (2002, end of 2008, 2024?)

Controlling the Cycle

- Federal Reserve Chair Jerome Powell quietly stopped Quantitative Tightening at the end of 2022. Markets believe he may be done raising interest rates as well.

- Following the Silicon Valley Bank failure, the Fed began accepting bonds from banks. The Fed would accept them at full value even though their market value was much lower. Jerome Powell has maintained that this is not economic stimulus. It is not a coincidence that the stock market bottomed out when the Fed rolled out the program.

- Secretary of the Treasury Janet Yellen has done her best to avoid issuing new bonds. She knows it pulls cash from other investments. First, she did it because the debt ceiling forced her to. Then, she avoided it to keep markets high. In August, the government announced it would issue bonds. (This costs taxpayers more when the yield curve is inverted, which is why no Secretary of the Treasury has done this before to this extent.)

- Without a debt ceiling, the Federal Government quietly boosted the percentage of spending by double digits.

- The Federal Government has drained half of the Strategic Petroleum Reserve to bring down oil prices. This temporary benefit is now behind us. We need to refill it. (See Market ViewPoint from July 31, 2023.)

What I am Watching

Each stage hits as a surprise and then continues until the narrative has been sufficiently convincing. Then comes the next. These are the two necessary elements I am watching.

- Inflation could rise again in the coming months—but nothing like 2022. Oil has quietly already begun. If it manages to reach $90 per barrel, it will no longer be ignored. (See the graph from TradingView.)

- Long-term interest rates rise next. This is when the market finishes the work of the Fed. This would be significant. Short-term rates are around 5.25%. Long-term rates are closer to 4.2%. This gap needs to be closed. As it does, further tightening in the economy is likely, and higher unemployment is possible.

As far as timing goes, no one knows. They happen when they happen.

Thanks to Andy Constan for inspiring the acts of the economic play. This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.