Making good decisions and sticking with them for a long time is a recipe for investment success.

Short-term indicators discussed in this email may create an illusion that timing the market is simple.

It is not. Anything can happen in the stock market.

Markets will take from the impatient and give to the patient.

Inflation continues to be a problem. The average rent in the United States is $1,999 per month. The average car payment is $800. The average credit card payment is $430. These add up to $3,229 per month for what I will call basic living expenses. Fall behind on payments, and there is little hope because interest on those credit cards is 25% on average1. Those living paycheck to paycheck are approaching a day of reckoning. They simply cannot afford to keep going down this path.

The Federal government is helping to keep this economy going. The budget deficit is currently $240 billion. One year ago, it was just $66 billion. We are essentially increasing our national debt by 7% of GDP; in return, our economy is getting 1% in real growth.

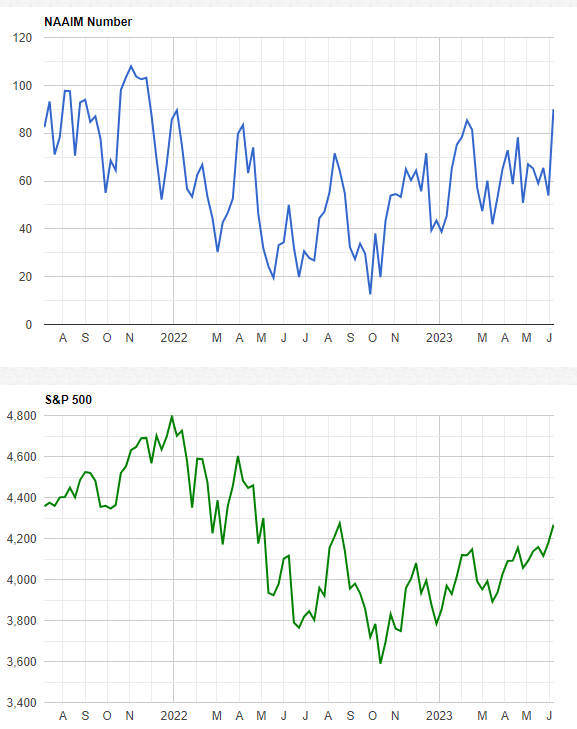

Consumer debt and slow growth make this a dangerous time to make aggressive changes for investors. The S&P 500 is a bit above where it peaked three months ago. It is about the same level as August 2022 and March 2022. For some reason, investors are much more optimistic than they were at those pivotal points.

Investors are overconfident. The AAII sentiment indicator is sending warning signals with its highest reading since January 2022.2 The NAAIM allocation is warning that it is also at January 2022 levels.3 The Fear/Greed index is coming in at its highest level since the first week of April in 2022.4

Anything can happen, especially over short periods of time. Wednesday, we will hear from the Fed. Its decision on interest rates will likely depend on the latest inflation. Economists believe the probabilities of a Fed hike are 24%. I see it as more of a 50/50 chance. It will likely hinge on the inflation number that will be released Tuesday morning. Regardless of what the Fed does, this is a time for investors to be patient.

- The Kobeissi Letter

- AAII.com

- NAIM.com

- CNN Fear/Greed

This newsletter is for educational purposes. The opinions may or may not come to pass. Timing the market successfully is extremely difficult. All investing involves risk, including possible loss of principal. The S&P 500 is used here to represent the U.S. stock market. One cannot invest directly in an index. Diversification does not guarantee positive outcomes. This is not a solicitation to buy or sell any security.